Use Signature Notifications For Legal Indiana Financial Statements Forms For Free

How it works

-

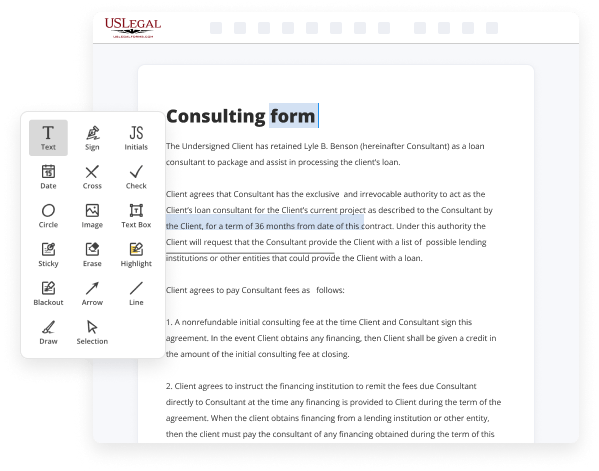

Import your Indiana Financial Statements Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Indiana Financial Statements Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Use Signature Notifications For Legal Indiana Financial Statements Forms For Free

Legal paperwork requires maximum precision and timely execution. While printing and filling forms out usually takes plenty of time, online document editors prove their practicality and effectiveness. Our service is at your disposal if you’re searching for a reputable and easy-to-use tool to Use Signature Notifications For Legal Indiana Financial Statements Forms For Free quickly and securely. Once you try it, you will be surprised how easy working with formal paperwork can be.

Follow the guidelines below to Use Signature Notifications For Legal Indiana Financial Statements Forms For Free:

- Add your template through one of the available options - from your device, cloud, or PDF catalog. You can also obtain it from an email or direct URL or using a request from another person.

- Make use of the upper toolbar to fill out your document: start typing in text areas and click on the box fields to mark appropriate options.

- Make other essential adjustments: add images, lines, or icons, highlight or remove some details, etc.

- Use our side tools to make page arrangements - add new sheets, change their order, remove unnecessary ones, add page numbers if missing, etc.

- Add additional fields to your document requesting different types of data and place watermarks to protect the contents from unauthorized copying.

- Check if things are correct and sign your paperwork - generate a legally-binding electronic signature the way you prefer and place the current date next to it.

- Click Done when you are ready and decide where to save your form - download it to your device or export it to the cloud in whatever file format you need.

- Share a copy with others or send it to them for signature through email, a signing link, SMS, or fax. Request online notarization and obtain your form quickly witnessed.

Imagine doing all of that manually in writing when even one error forces you to reprint and refill all the data from the beginning! With online solutions like ours, things become much more manageable. Give it a try now!

Benefits of Editing Indiana Financial Statements Forms Online

Top Questions and Answers

Indiana has a 7.00 percent state sales tax rate and does not levy any local sales taxes. Indiana's tax system ranks 9th overall on our 2023 State Business Tax Climate Index.

Video Guide to Use Signature Notifications For Legal Indiana Financial Statements Forms For Free

How to Fill Out IRS Form 8832 Hi, I'm Priyanka Prakash, senior staff writer at Fundera. Today, I'll show you how to fill out IRS Form 8832: Entity Classification Election. This form is used whenever a business wants to opt out of default tax treatment for federal tax purposes. A common example is when a limited liability company (LLC) wants

To be taxed as a C-corp. By default, a single-member LLC is taxed as a disregarded entity, and a multi-member LLC is taxed as a partnership. This means that business profits and losses passed through to the owners’ personal income tax returns. However, if you correctly fill out and submit Form 8832, you can elect for the LLC to be

Tips to Use Signature Notifications For Legal Indiana Financial Statements Forms For Free

- Ensure all necessary fields are completed before sending for signature

- Set up automated email reminders for signers to increase efficiency

- Review the document carefully before finalizing the signature process

- Use encryption to protect sensitive information during the signature process

- Keep track of the signing status to stay organized

Using signature notifications for legal Indiana financial statements forms can help streamline the signing process and ensure all parties involved are aware of the status of the document. This editing feature may be needed when multiple signatures are required and tracking the progress of each signer is essential.

Related Searches

We agree to and will notify you immediately in writing of any materially unfavorable change in our financial condition. Officials and employees are required to use State Board of Accounts prescribed or approved forms in the manner prescribed. Pre-Signing Documents. Checks and ... For programs with approved non-Fifth Third bank accounts, the Accounting Coordinator will initiate a new signature card and corporate resolution (if required). A financial institution may use different wording so long as the substance of the notice remains the same, may delete inapplicable provisions (for example, the. 10-Feb-2022 ? WALMART INC. ANNUAL REPORT ON FORM 10-K. FOR THE FISCAL YEAR ENDED JANUARY 31, 2022. All references in this Annual Report on Form ... 09-Aug-2021 ? In this editorial, Author shall discuss about concept of Signing of Financial Statement of Company (OPC, Small, Private, Public, ... Therefore, the migration to electronic signatures will enable the Bank to capture all signed documents in a timely manner for inclusion in quarterly financial ... Indiana law (IC 21-40-5) requires students on residential campuses to provide proof of their immunization status. All incoming IU Bloomington and IUPUI ... Signatures in Global and National Commerce Act (E-Sign). 3. The Dodd-Frank Act granted rule-making authority under RESPA to the Consumer Financial. Signatures in Global and National Commerce Act (E-Sign). 3. The Dodd-Frank Act granted rule-making authority under RESPA to the Consumer Financial.

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.