Use Signature Notifications For Legal Minnesota Personal Loans Forms For Free

How it works

-

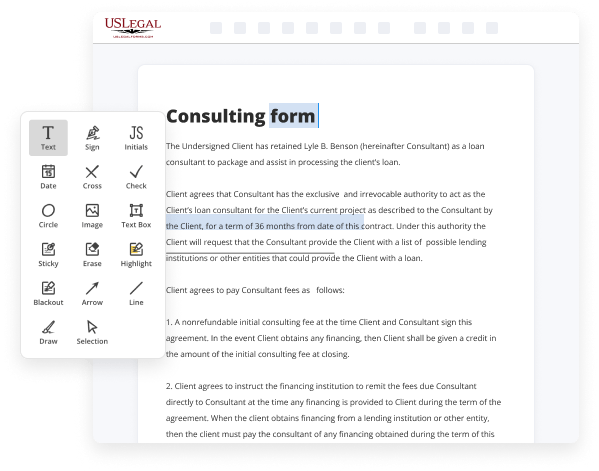

Import your Minnesota Personal Loans Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Minnesota Personal Loans Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Use Signature Notifications For Legal Minnesota Personal Loans Forms For Free

Online PDF editors have demonstrated their trustworthiness and effectiveness for legal paperwork execution. Use our secure, fast, and straightforward service to Use Signature Notifications For Legal Minnesota Personal Loans Forms For Free your documents any time you need them, with minimum effort and highest precision.

Make these quick steps to Use Signature Notifications For Legal Minnesota Personal Loans Forms For Free online:

- Import a file to the editor. You can select from a couple of options - add it from your device or the cloud or import it from a template catalog, external URL, or email attachment.

- Complete the blank fields. Put the cursor on the first empty area and use our editor’s navigation to move step-by-step to prevent missing anything on your template. Use Text, Initials, Cross, and Check tools.

- Make your necessary modifications. Update the form with inserted images, draw lines and signs, highlight important elements, or remove any unnecessary ones.

- Create additional fillable fields. Adjust the template with a new area for fill-out if required. Utilize the right-side toolbar for this, drop each field where you want others to leave their data, and make the rest of the fields required, optional, or conditional.

- Organize your pages. Remove sheets you don’t need anymore or create new ones making use of the appropriate key, rotate them, or change their order.

- Generate eSignatures. Click on the Sign option and choose how you’d insert your signature to the form - by typing your name, drawing it, uploading its picture, or using a QR code.

- Share and send for eSigning. End your editing using the Done button and send your copy to other parties for signing through an email request, with a Link to Fill option, in an SMS or fax message. Request a quick online notarization if required.

- Save the file in the format you need. Download your paperwork, save it to cloud storage in its current format, or convert it as you need.

And that’s how you can complete and share any individual or business legal documentation in minutes. Give it a try today!

Benefits of Editing Minnesota Personal Loans Forms Online

Top Questions and Answers

Examples of Signature Loans Let's say a borrower gets a signature loan with a 7% interest rate for an amount equal to the total of balances that they are carrying on credit cards, with rates ranging from 12% to 20%. The borrower then uses the signature loan to pay off the credit cards in full.

Video Guide to Use Signature Notifications For Legal Minnesota Personal Loans Forms For Free

Another question that came up about the Navy Federal personal loan was can you have two ongoing personal loans with Navy Federal and the answer is yes you can and our community member here actually just confirmed that that he also asked the same question the only thing

Is that it cannot be more than 50k and if or your first personal loan with Navy Federal is in good standing and you have no late payments on your other credit cards with Navy Federal and that your account with Navy Federal is in good standing

Tips to Use Signature Notifications For Legal Minnesota Personal Loans Forms For Free

- Ensure the signature notifications are clearly visible in the loan forms

- Clearly explain the purpose of the signature notifications to borrowers

- Include instructions on how to sign and where to sign on the forms

- Use a reliable electronic signature platform for secure and legally binding signatures

- Regularly update and review the signature notifications to meet legal requirements

The editing feature for Use Signature Notifications For Legal Minnesota Personal Loans Forms may be needed when borrowers need to review or make changes to the terms of the loan agreement before signing. It allows for easy modifications to ensure all parties involved are in agreement with the terms.

Related Searches

Generate electronic signatures. Click on the Sign option and choose how you'd insert your signature to the form - by typing your name, drawing it, uploading its ... This Agreement shall be construed and governed by the laws located in the state of [GOVERNING LAW] (?Governing Law?). IN WITNESS WHEREOF, Borrower and Lender ... Sign the Agreement. borrower signing loan agreement. Depending on the loan that was selected a legal contract will need to be drafted stating the terms of the ... A consumer small loan is a short-term, unsecured loan to be repaid in a ... The form of the notice must be approved by the commissioner prior to its use. 24-Jul-2023 ? Consumers have new protections involving debt collection and payday lending that affect thousands of Minnesotans. The new laws were passed ... Accept loan applications online with a free Personal Loan Application Form. Embed in your bank or credit union's website. Customize in seconds! The notary may sign documents using their normal signature if different then what is listed on their commission certificate. A notary that fails to affix ... Promissory notes are common documents in any financial service. You've likely signed one if you have taken out any type of loan in the past. The Short Form contains the loan-specific information (e.g., borrower name, lender name, loan amount, description of property, etc.) and identifies the ... Whatever you're dreaming of, get the money to make it happen with a personal loan from BMO. View personal loan rates, terms, and apply today.

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.