- US Legal Forms

- Agreements - Agreement Forms

-

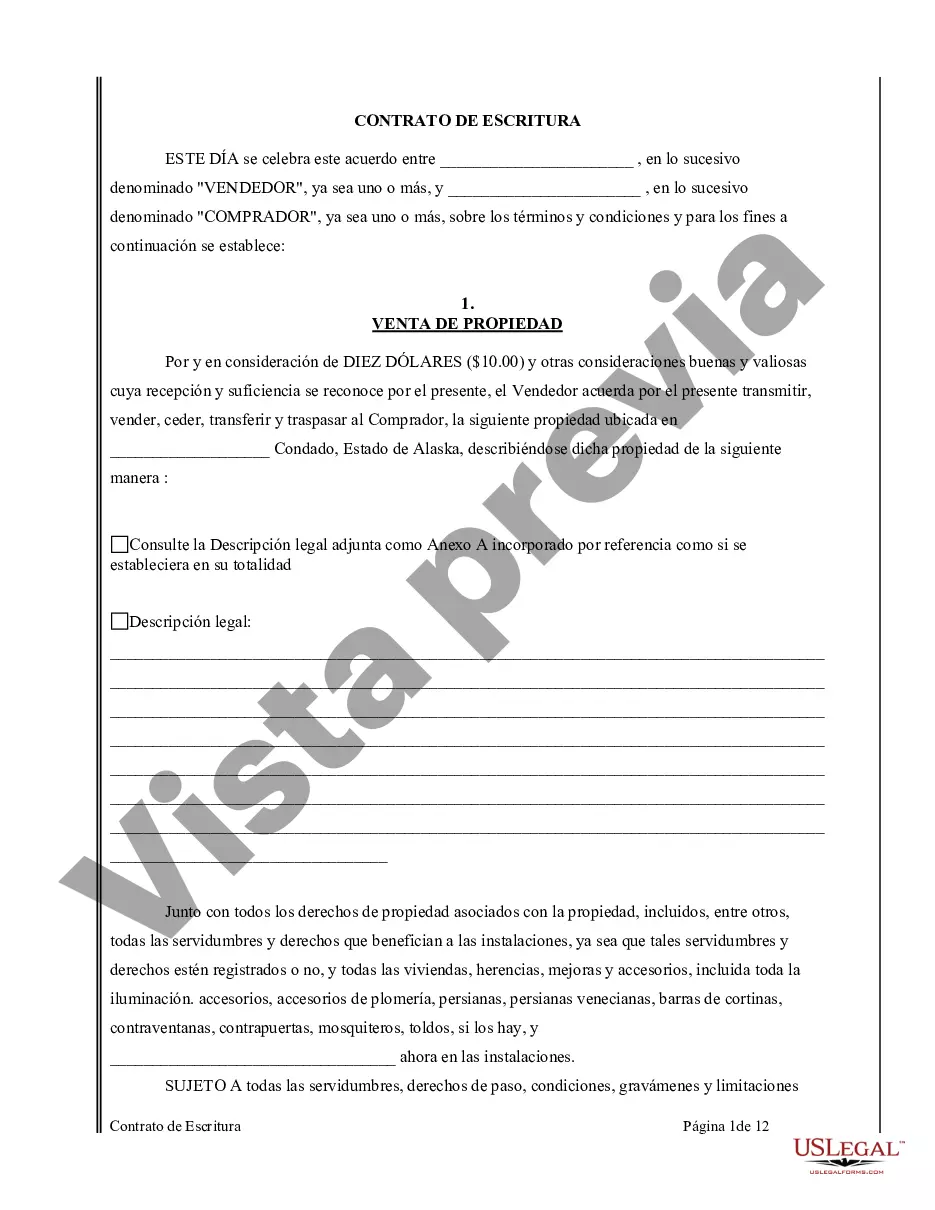

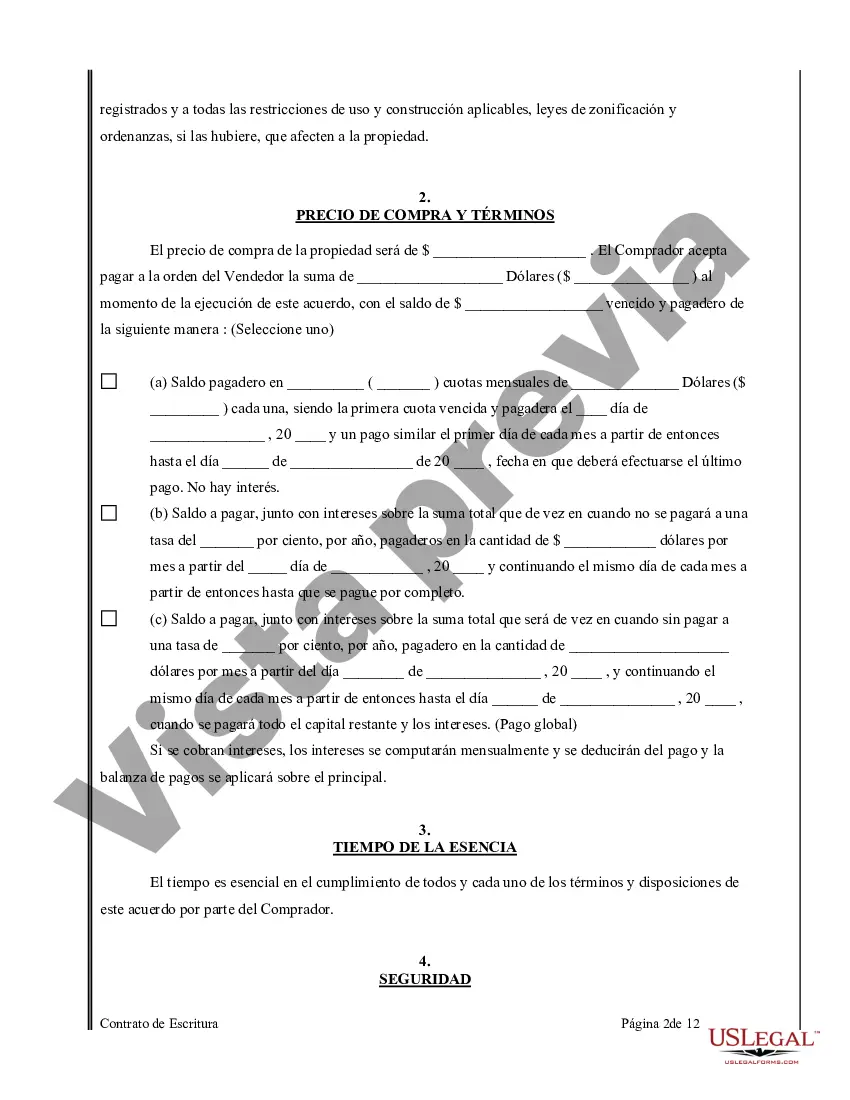

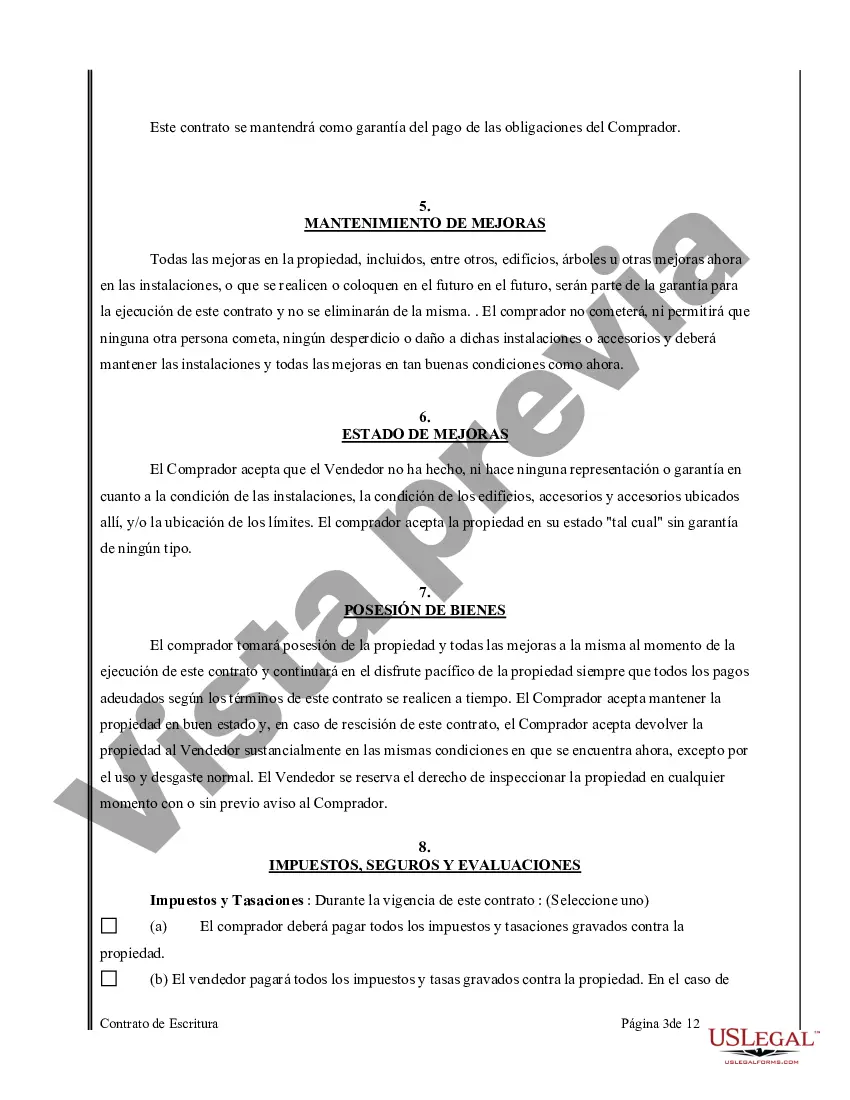

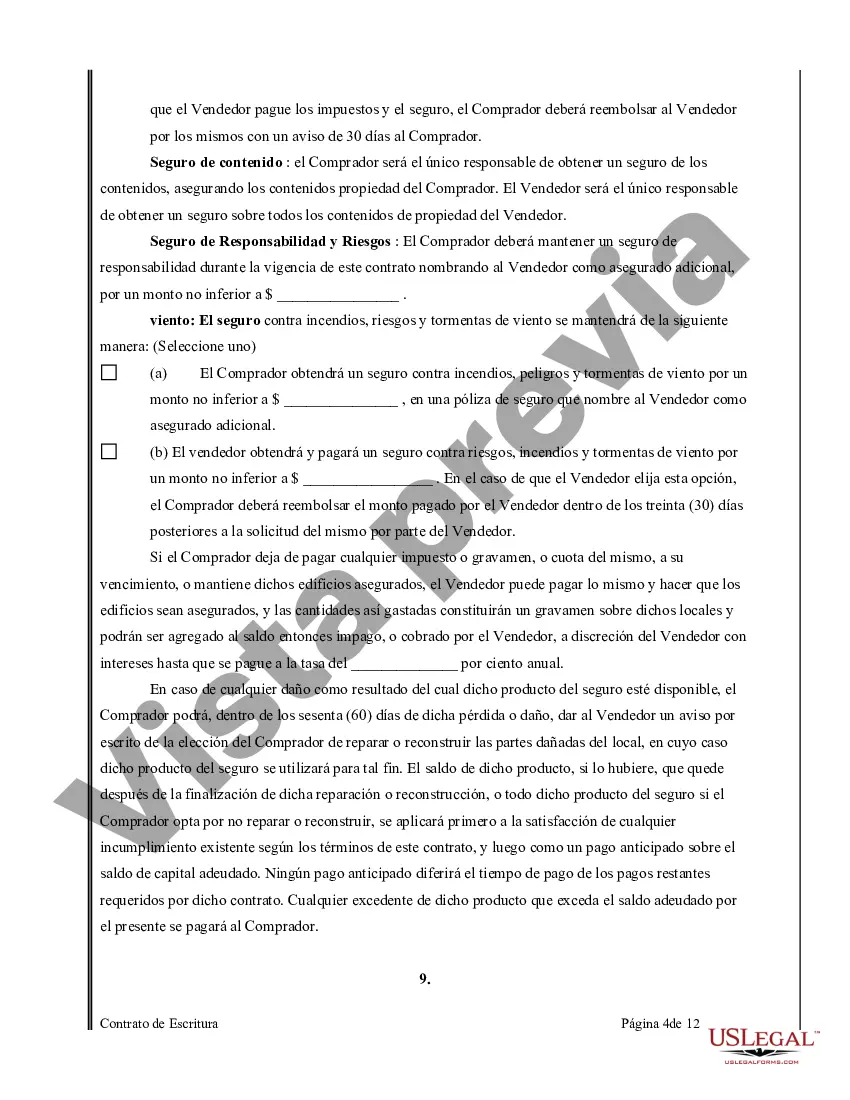

Alaska Acuerdo o Contrato de Escritura de Venta y Compra de Bienes...

Agreement Purchase Land With Construction Loan - Alaska Agreement or Contract for Deed for Sale and Purchase of Real Estate a/k/a Land or Executory Contract

Description Acuerdo Venta Compra Bienes K Terreno

Contrato Escritura Venta Compra Related forms

View Guardianship for medical

View Guardianship medical report form

View Medical guardianship of minor

View Guardianship in medical terms

View Temporary medical guardianship form

Related legal definitions

Viewed forms

How to fill out Agreement Purchase Land With Construction Loan?

There's no more need to waste hours browsing for legal papers to comply with your local state regulations. US Legal Forms has accumulated all of them in one place and streamlined their accessibility. Our website provides more than 85k templates for any business and personal legal scenarios grouped by state and area of use All forms are professionally drafted and verified for validity, so you can rest assured in getting an up-to-date Agreement Purchase Land With Construction Loan.

If you are familiar with our platform and already have an account, you need to ensure your subscription is valid prior to getting any templates. Log in to your account, choose the document, and click Download. You can also return to all saved paperwork any time needed by opening the My Forms tab in your profile.

If you've never used our platform before, the process will take a few more actions to complete. Here's how new users can obtain the Agreement Purchase Land With Construction Loan in our library:

- Look at the page content carefully to make sure it contains the sample you need.

- To do so, use the form description and preview options if any.

- Use the Seach bar above to browser for another sample if the previous one didn't suit you.

- Click Buy Now next to the template title once you find the proper one.

- Pick the preferable pricing plan and register for an account or sign in.

- Make payment for your subscription with a credit card or via PayPal to proceed.

- Pick the file format for your Agreement Purchase Land With Construction Loan and download it to your device.

- Print out your form to fill it out manually or upload the sample if you prefer to do it in an online editor.

Preparing official paperwork under federal and state regulations is fast and easy with our library. Try out US Legal Forms today to keep your documentation in order!

Contrato Venta K Terreno Form Rating

Escritura Compra Bienes Form popularity

FAQ

Rather than receiving a lump sum check, construction loans pay out the loan amount over the course of the project. The installments are called draws, as the lender draws funds from the account. A draw request is necessary to ensure disbursement of the funds.

Some lenders will accept land as collateral provided the land has equity value that meets a certain percent of the sales price and the land is free and clear of all existing liens. The amount of equity required is based on the borrower's creditworthiness, the loan program applied for and other factors.

Can land be used as a down payment? And the answer is: Absolutely!

Construction loans are short-termusually no more than a year. They are typically interest only payments based on the amount you have advanced on your loan. Mortgages are long term and the money is received in a lump sum. The payments typically consist of principal and interest.

Some lenders will accept land as collateral provided the land has equity value that meets a certain percent of the sales price and the land is free and clear of all existing liens. The amount of equity required is based on the borrower's creditworthiness, the loan program applied for and other factors.

Rather than receiving a lump sum check, construction loans pay out the loan amount over the course of the project. The installments are called draws, as the lender draws funds from the account. A draw request is necessary to ensure disbursement of the funds.

Some lenders will accept land as collateral provided the land has equity value that meets a certain percent of the sales price and the land is free and clear of all existing liens. The amount of equity required is based on the borrower's creditworthiness, the loan program applied for and other factors.

Can land be used as a down payment? And the answer is: Absolutely!

Construction loans are short-termusually no more than a year. They are typically interest only payments based on the amount you have advanced on your loan. Mortgages are long term and the money is received in a lump sum. The payments typically consist of principal and interest.

Some lenders will accept land as collateral provided the land has equity value that meets a certain percent of the sales price and the land is free and clear of all existing liens. The amount of equity required is based on the borrower's creditworthiness, the loan program applied for and other factors.

Rather than receiving a lump sum check, construction loans pay out the loan amount over the course of the project. The installments are called draws, as the lender draws funds from the account. A draw request is necessary to ensure disbursement of the funds.

Some lenders will accept land as collateral provided the land has equity value that meets a certain percent of the sales price and the land is free and clear of all existing liens. The amount of equity required is based on the borrower's creditworthiness, the loan program applied for and other factors.

Can land be used as a down payment? And the answer is: Absolutely!

Construction loans are short-termusually no more than a year. They are typically interest only payments based on the amount you have advanced on your loan. Mortgages are long term and the money is received in a lump sum. The payments typically consist of principal and interest.

Some lenders will accept land as collateral provided the land has equity value that meets a certain percent of the sales price and the land is free and clear of all existing liens. The amount of equity required is based on the borrower's creditworthiness, the loan program applied for and other factors.

Rather than receiving a lump sum check, construction loans pay out the loan amount over the course of the project. The installments are called draws, as the lender draws funds from the account. A draw request is necessary to ensure disbursement of the funds.

Some lenders will accept land as collateral provided the land has equity value that meets a certain percent of the sales price and the land is free and clear of all existing liens. The amount of equity required is based on the borrower's creditworthiness, the loan program applied for and other factors.

Can land be used as a down payment? And the answer is: Absolutely!

Construction loans are short-termusually no more than a year. They are typically interest only payments based on the amount you have advanced on your loan. Mortgages are long term and the money is received in a lump sum. The payments typically consist of principal and interest.

Some lenders will accept land as collateral provided the land has equity value that meets a certain percent of the sales price and the land is free and clear of all existing liens. The amount of equity required is based on the borrower's creditworthiness, the loan program applied for and other factors.

Agreement Purchase Land With Construction Loan Related Searches

-

simple construction loan agreement

-

promissory note for construction loan

-

construction loan agreement template

-

construction loan template excel

-

commercial construction loan agreement sample

-

construction loan term sheet

-

construction loan covenants

-

land equity construction loan calculator

-

how does a construction loan work when you own the land

-

td vacant land mortgage

Interesting Questions

An agreement to purchase land with a construction loan is a legally binding contract between a buyer and a seller where the buyer agrees to purchase a piece of land and obtain a construction loan to finance the building of a property on that land.

In Alaska, purchasing land often requires a construction loan because the land might be undeveloped or lack necessary infrastructure like utilities and roads. A construction loan helps you cover the costs of building your desired property on the purchased land.

Key terms that should be included in the agreement are the purchase price of the land, the details of the construction loan, a clear description of the land being purchased, the agreed-upon timeline for construction, and any contingencies that need to be met before closing the deal.

Yes, when purchasing land with a construction loan in Alaska, you need to consider obtaining necessary permits, complying with zoning regulations, and ensuring the land is suitable for construction according to the Alaska Building Codes.

If you are unable to secure a construction loan after entering into the agreement, it can potentially terminate the agreement altogether or provide provisions for renegotiation. It is crucial to include specific clauses in the agreement that address this situation and outline possible solutions.

Yes, agreements can be modified during the construction process through a process called an addendum. The addendum allows both parties to make adjustments to the initial agreement, such as extending the construction timeline, modifying the project specifications, or revising the purchase price.

Typically, the agreement does not include warranties or guarantees specific to the constructed property. However, it may include provisions that outline the builder's responsibility to abide by industry standards and comply with local building codes.

Yes, there are risks involved in buying land with a construction loan. These risks include encountering unforeseen challenges during construction, potential changes in zoning regulations, delays in obtaining permits, and fluctuations in construction costs. It's important to thoroughly research and understand these risks before proceeding.

Once the construction is completed, the buyer typically assumes full ownership of both the land and the newly constructed property. The buyer's responsibility then includes any mortgage payments related to the construction loan and ongoing maintenance and repairs of the property.

Yes, there can be tax considerations when buying land with a construction loan. It's advisable to consult with a tax professional who can provide guidance on potential tax benefits, deductions, and any applicable property taxes related to the purchased land and the completed construction project.

More info

Trusted and secure by over 3 million people of the world’s leading companies

-

No results found.

-

Alaska

-

Alabama

-

Arizona

-

Arkansas

-

California

-

Colorado

-

Connecticut

-

Delaware

-

District of Columbia

-

Florida

-

Georgia

-

Hawaii

-

Idaho

-

Illinois

-

Indiana

-

Iowa

-

Kansas

-

Kentucky

-

Louisiana

-

Maine

-

Maryland

-

Massachusetts

-

Michigan

-

Minnesota

-

Mississippi

-

Missouri

-

Montana

-

Nebraska

-

Nevada

-

New Hampshire

-

New Jersey

-

New Mexico

-

New York

-

North Carolina

-

North Dakota

-

Ohio

-

Oklahoma

-

Oregon

-

Pennsylvania

-

Rhode Island

-

South Carolina

-

South Dakota

-

Tennessee

-

Texas

-

Utah

-

Vermont

-

Virginia

-

Washington

-

West Virginia

-

Wisconsin

-

Wyoming

Contract for Deed - General - Alaska

Alaska Statutes

TITLE 34. PROPERTY

CHAPTER 34.08. COMMON INTEREST OWNERSHIP

ARTICLE 04. PROTECTION OF PURCHASERS

34.08.620. Conversion property.

(a) A declarant of a common interest community containing conversion property, and any dealer who intends to offer units in a common interest community containing conversion units, shall give each residential tenant and each residential subtenant in possession of a portion of conversion property notice of the conversion and provide each person with the public offering statement no later than 180 days before the tenant and any subtenant in possession are required to vacate. If the conversion property consists of a mobile home park, notice of the conversion and delivery of a public offering statement shall be provided no later than one year before the tenant and any subtenant in possession are required to vacate. The notice must set out generally the rights of tenants and subtenants under this section and shall be hand delivered to the tenant or subtenant in possession or mailed by certified mail, return receipt requested, to the tenant and subtenant at the address of the unit or any other mailing address provided by a tenant. The failure to give notice as required by this section is a defense to an action for possession and the terms of the tenancy may not be altered during the notice period provided by this subsection. A tenant or subtenant may not be required to vacate upon less than 180 days' notice and a tenant and a subtenant in possession in a mobile home park may not be required to vacate upon less than one year's notice except for one of the following reasons:

(1) the tenant or subtenant has defaulted in the payment of rent owed;(2) the tenant or subtenant has been convicted of violating a federal or state law or local ordinance, and that violation is continuing and is detrimental to the health, safety, or welfare of other dwellers or tenants in the mobile home park; and

(3) the tenant or subtenant has violated a provision, enforceable under AS 34.03.130 , of the rental agreement or lease signed by both parties and not prohibited by law including rent and the terms of agreement.

(b) For 90 days after delivery or mailing of the notice described in (a) of this section, the person required to give the notice shall offer to convey each unit or proposed unit occupied for residential use to the tenant who leases or rents the unit. If a tenant fails to purchase the unit during the 90-day period, the offeror shall extend a right of first refusal to the tenant who is leasing or renting the unit at the time of the conversion. The offeror may not offer to dispose of an interest in the unit at a price or on terms more favorable to the offeree than the price or terms offered to the tenant while the tenant is in possession. The tenant must exercise the right of first refusal within 90 days from the receipt of the offer and must provide the offeror a valid letter of intent or a preliminary loan commitment from a bank or mortgage lending institution within 30 days of receipt of the offer. This subsection does not apply to a unit in conversion property if the unit will be restricted exclusively to nonresidential use or if the boundaries of the converted unit do not substantially conform to the dimensions of the residential unit before conversion.

(c) If a seller, in violation of (b) of this section, conveys a unit for value to a purchaser who has no knowledge of the violation, the recording of the deed conveying the unit or, in a cooperative, the conveyance of the unit, extinguishes any right a tenant may have under (b) of this section to purchase the unit if the deed states that the seller has complied with (b) of this section, but the conveyance does not affect the right of a tenant to recover damages from the seller for a violation of (b) of this section.

(d) If a notice of conversion specifies a date by which a unit or proposed unit must be vacated and otherwise complies with the provisions of AS 09.45.060 - 09.45.160, the notice also constitutes a notice to quit.

(e) Nothing in this section permits termination of a lease by a declarant in violation of its terms.

TITLE 34. PROPERTY

CHAPTER 34.15. CONVEYANCES

ARTICLE 01. FORM AND EFFECT

34.15.010. Manner of executing conveyances.

(a) A conveyance of land, or of an estate or interest in land, may be made by deed, signed and sealed by the person from whom the estate or interest is intended to pass, who is of lawful age, or by the lawful agent or attorney of the person, and acknowledged or proved, and recorded as directed in this chapter, without any other act or ceremony whatever.(b) In a deed or conveyance of the family home or homestead by a married man or a married woman, the husband and wife shall join in the deed or conveyance.

(c) The requirement that a spouse of a married person join in a deed or conveyance of the family home or homestead does not create a proprietary right, title, or interest in the spouse not otherwise vested in the spouse.

(d) Failure of the spouse to join in the deed or conveyance does not affect the validity of the deed or conveyance, unless the spouse appears on the title. The deed or conveyance is sufficient in law to convey the legal title to the premises described in it from the grantor to the grantee when the deed or conveyance is otherwise sufficient, and

(1) no suit is filed in a court of record in the judicial district in which the land is located within one year from the date of recording of the deed or conveyance by the spouse who failed to join in the deed or conveyance to have the deed or conveyance set aside, altered, changed, or reformed; or

(2) the spouse whose interest in the property is affected does not record, within one year in the office of the recorder for the recording district where the property is situated, a notice of an interest in the property.

TITLE 34. PROPERTY

CHAPTER 34.15. CONVEYANCES

ARTICLE 01. FORM AND EFFECT

34.15.030. Form of warranty deed.

(a) A warranty deed for the conveyance of land may be substantially in the following form, without express covenants:The grantor (here insert the name or names and place of residence) for and in consideration of (here insert consideration) in hand paid, conveys and warrants to (here insert the grantee's name or names) the following described real estate (here insert description), located in the State of Alaska.

Dated this . . . . . . . . . . day of . . . . . ., 2. . . . . .

(b) A deed substantially in the form set forth in (a) of this section, when otherwise duly executed, is considered a conveyance in fee simple to the grantee and the heirs and assigns of the grantee, with the following covenants by the grantor: (1) that at the time of the making and delivery of the deed the grantor is lawfully seized of an indefeasible estate in fee simple to the premises described, and has the right and power to convey the premises; (2) that at the time of making and delivery of the deed the premises are free from encumbrances; and (3) that the grantor warrants the quiet and peaceable possession of the premises, and will defend the title to the premises against all persons claiming the premises. The covenants are binding upon a grantor and the heirs and personal representative of a grantor as if written in the deed.

TITLE 34. PROPERTY

CHAPTER 34.15. CONVEYANCES

ARTICLE 01. FORM AND EFFECT

34.15.010. Manner of executing conveyances.

(a) A conveyance of land, or of an estate or interest in land, may be made by deed, signed and sealed by the person from whom the estate or interest is intended to pass, who is of lawful age, or by the lawful agent or attorney of the person, and acknowledged or proved, and recorded as directed in this chapter, without any other act or ceremony whatever.(b) In a deed or conveyance of the family home or homestead by a married man or a married woman, the husband and wife shall join in the deed or conveyance.

(c) The requirement that a spouse of a married person join in a deed or conveyance of the family home or homestead does not create a proprietary right, title, or interest in the spouse not otherwise vested in the spouse.

(d) Failure of the spouse to join in the deed or conveyance does not affect the validity of the deed or conveyance, unless the spouse appears on the title. The deed or conveyance is sufficient in law to convey the legal title to the premises described in it from the grantor to the grantee when the deed or conveyance is otherwise sufficient, and

(1) no suit is filed in a court of record in the judicial district in which the land is located within one year from the date of recording of the deed or conveyance by the spouse who failed to join in the deed or conveyance to have the deed or conveyance set aside, altered, changed, or reformed;

(2) the spouse whose interest in the property is affected does not record, within one year in the office of the recorder for the recording district where the property is situated, a notice of an interest in the property.

TITLE 34. PROPERTY

CHAPTER 34.15. CONVEYANCES

ARTICLE 01. FORM AND EFFECT

34.15.030. Form of warranty deed.

(a) A warranty deed for the conveyance of land may be substantially in the following form, without express covenants:The grantor (here insert the name or names and place of residence) for and in consideration of (here insert consideration) in hand paid, conveys and warrants to (here insert the grantee's name or names) the following described real estate (here insert description), located in the State of Alaska.

Dated this . . . . . . . . . . day of . . . . . ., 2. . . . . .

(b) A deed substantially in the form set forth in (a) of this section, when otherwise duly executed, is considered a conveyance in fee simple to the grantee and the heirs and assigns of the grantee, with the following covenants by the grantor: (1) that at the time of the making and delivery of the deed the grantor is lawfully seized of an indefeasible estate in fee simple to the premises described, and has the right and power to convey the premises; (2) that at the time of making and delivery of the deed the premises are free from encumbrances; and (3) that the grantor warrants the quiet and peaceable possession of the premises, and will defend the title to the premises against all persons claiming the premises. The covenants are binding upon a grantor and the heirs and personal representative of a grantor as if written in the deed.

TITLE 34. PROPERTY

CHAPTER 34.15. CONVEYANCES

ARTICLE 01. FORM AND EFFECT

34.15.040. Form of quitclaim deed.

(a) A quitclaim deed may be substantially in the following form:The grantor (here insert the name or names and place of residence), for and in consideration of (here insert consideration) conveys and quitclaims to (here insert grantee's name or names) all interest which I (we) have, if any, in the following described real estate (here insert description), located in the State of Alaska.

Dated this . . . . . . . . day of . . . . . . . . . ., 2. . . . . .

(b) A deed substantially in the form set out in (a) of this section, when otherwise duly executed, is considered a sufficient conveyance, release and quitclaim to the grantee and the heirs and assigns of the grantee, in fee of all the existing legal and equitable rights of the grantor in the premises described in the deed.

TITLE 34. PROPERTY

CHAPTER 34.15. CONVEYANCES

ARTICLE 01. FORM AND EFFECT

34.15.050. Effect of quitclaim.

A deed of quitclaim and release for the form in common use is sufficient to pass all the real estate which the grantor can convey by a deed of bargain and sale

TITLE 34. PROPERTY

CHAPTER 34.15. CONVEYANCES

ARTICLE 02. ACKNOWLEDGMENT AND PROOF

34.15.240. Penalty for refusal to appear or testify.

A person served with a subpoena described in AS 34.15.230 who, without reasonable cause, refuses or neglects to appear, or upon appearing refuses to answer upon oath regarding the execution of a deed, shall forfeit to the injured party $100, and may also be committed to jail for a contempt by the officer who issues the subpoena, to remain in jail until the person submits to answer on oath as required.

TITLE 34. PROPERTY

CHAPTER 34.20. MORTGAGES AND TRUST DEEDS

ARTICLE 02. DEEDS OF TRUST

34.20.070. Sale by trustee.

(a) If a deed of trust is executed conveying real property located in the state to a trustee as security for the payment of an indebtedness and the deed provides that in case of default or noncompliance with the terms of the trust, the trustee may sell the property for condition broken, the trustee, in addition to the right of foreclosure and sale, may execute the trust by sale of the property, upon the conditions and in the manner set forth in the deed of trust, without first securing a decree of foreclosure and order of sale from the court, if the trustee has complied with the notice requirements of (b) of this section. If the deed of trust is foreclosed judicially or the note secured by the deed of trust is sued on and a judgment is obtained by the beneficiary, the beneficiary may not exercise the nonjudicial remedies described in this section.(b) Not less than 30 days after the default and not less than 90 days before the sale, the trustee shall record in the office of the recorder of the recording district in which the trust property is located a notice of default setting out (1) the name of the trustor, (2) the book and page where the trust deed is recorded or the serial number assigned to the trust deed by the recorder, (3) a description of the trust property, including the property's street address if there is a street address for the property, (4) a statement that a breach of the obligation for which the deed of trust is security has occurred, (5) the nature of the breach, (6) the sum owing on the obligation, (7) the election by the trustee to sell the property to satisfy the obligation, (8) the date, time, and place of the sale, and (9) the statement described in (e) of this section describing conditions for curing the default. An inaccuracy in the street address may not be used to set aside a sale if the legal description is correct. At any time before the sale date stated in the notice of default or to which the sale is postponed under AS 34.20.080 (e), if the default has arisen by failure to make payments required by the trust deed, the default may be cured and sale under this section terminated by payment of the sum then in default, other than the principal that would not then be due if no default had occurred, and attorney and other foreclosure fees and costs actually incurred by the beneficiary and trustee due to the default. If, under the same trust deed, notice of default under this subsection has been recorded two or more times previously and the default has been cured under this subsection, the trustee may elect to refuse payment and continue the sale.

(c) Within 10 days after recording the notice of default, the trustee shall mail a copy of the notice by certified mail to the last known address of each of the following persons or their legal representatives: (1) the trustor in the trust deed; (2) the successor in interest to the trustor whose interest appears of record or of whose interest the trustee or the beneficiary has actual notice, or who is in actual physical possession of the property; (3) any other person actually in physical possession of the property; (4) any person having a lien or interest subsequent to the interest of the trustee in the trust deed, where the lien or interest appears of record or where the trustee or the beneficiary has actual notice of the lien or interest, except as provided in (f) of this section. The notice may be delivered personally instead of by mail.

(d) If the State of Alaska is a subsequent party, the trustee, in addition to the notice of default, shall give the state a supplemental notice of any state lien existing as of the date of filing the notice of default. This notice must set out, with such particularity as reasonably available information will permit, the nature of the state's lien, including the name and address, if known, of the person whose liability created the lien, the amount shown on the lien document, the department of the state government involved, the recording district, and the book and page on which the lien was recorded or the serial number assigned to the lien by the recorder.

(e) The statement required by (b)(9) of this section must state that, if the default has arisen by failure to make payments required by the trust deed, the default may be cured and the sale under this section terminated if

(1) payment of the sum then in default, other than the principal that would not then be due if default had not occurred, and attorney and other foreclosure fees and costs actually incurred by the beneficiary and trustee due to the default is made at any time before the sale date stated in the notice of default or to which the sale is postponed; and

(2) when notice of default under (b) of this section has been recorded two or more times previously under the same trust deed and the default has been cured under (b) of this section, the trustee does not elect to refuse payment and continue the sale.

(f) In (c)(4) of this section, if the existence of a lien or nonpossessory interest can only be inferred from an inspection of the real property, the person holding the lien or nonpossessory interest is not entitled to notice under (c) of this section unless the lien or nonpossessory interest appears of record or a written notice of the lien or nonpossessory interest has been given to the beneficiary or trustee before the recording of the notice of default.

(g) If the trustee delivers notice personally under (c) of this section to the property or to an occupant of the property, the trustee may, notwithstanding (c) of this section, deliver the notice up to 20 days after the notice of default is recorded. If there is not a structure on the property and a person is not present on the property at the time of delivery, the trustee may place the notice on the property, or as close as practicable to the property if

(1) there is not a practical road access to the property; or

(2) access to the property is restricted by gates or other barriers.

(h) If the trustee or other person who delivered notice under (g) of this section signs an affidavit for the delivery, the affidavit is prima facie evidence that the trustee complied with (g) of this section. After one year from the delivery, as evidenced by the affidavit, the trustee is conclusively presumed to have complied with (g) of this section unless, within one year from the delivery, an action has been filed in court to contest the foreclosure based on failing to comply with (g) of this section.

(i) If a person who is entitled to receive notice by mail under (c) of this section is known by the beneficiary or trustee to be deceased, the trustee may satisfy the notice requirements of (c) of this section by mailing the notice to the last known address of the deceased person and to the personal representative of the deceased person if the beneficiary or trustee knows that a personal representative has been appointed for the deceased person.

(j) If a person who is entitled to receive notice by mail under (c) of this section is known by the beneficiary or trustee to be deceased but the trustee and the beneficiary do not know that a personal representative has been appointed for the deceased person, the trustee may satisfy the notice requirements of (c) of this section by

(1) mailing the notice to the heirs and devisees of the deceased person

(A) whose names and addresses are known to the beneficiary or trustee;

(B) who have recorded a notice of their interest in the property;

(2) publishing and posting the notice of the foreclosure as provided by law for the sale of real property on execution, except that the notice must be titled To the Heirs or Devisees of (insert the name of the deceased person) and include in the body of the notice a list of the names of the persons who are known by the beneficiary or trustee to be the heirs and devisees of the deceased person.

(k) If notice is given as required by (i) and (j) of this section, an heir or devisee of the deceased person may not challenge the foreclosure on the ground that the heir or devisee did not receive notice of the sale, unless the heir or devisee challenges the foreclosure on this ground within 90 days after the sale.

(l) A person may bring an action in court to enjoin a foreclosure on real property only if the person is

(1) the trustor of the deed of trust under which the real property was foreclosed;

(2) a guarantor of the obligation that the real property is securing;

(3) a person who has an interest in the real property that has been recorded;

(4) a person who has a recorded lien against the real property;

(5) an heir to the real property;

(6) a devisee of the real property;

(7) the attorney general acting under other legal authority.

(m) If a person brings an action under (l) of this section to stop a sale of real property, and if the sale is being brought because of a default in the performance of a nonmonetary obligation required by the deed of trust that the real property is securing, the court may impose on the person the conditions that the court determines are appropriate to protect the beneficiary.

(n) In this section, devisee, heir, and personal representative have the meanings given in AS 13.06.050

TITLE 34. PROPERTY

CHAPTER 34.20. MORTGAGES AND TRUST DEEDS

ARTICLE 02. DEEDS OF TRUST

34.20.080. Sale at public auction.

(a) The sale authorized in AS 34.20.070 shall be made under the terms and conditions and in the manner set out in the deed of trust. The proceeds from a sale shall be placed in a trust account until they are disbursed. However, the sale shall be made(1) at public auction held at the front door of a courthouse of the superior court in the judicial district where the property is located, unless the deed of trust specifically provides that the sale shall be held in a different place, except that a trustee may also accept bids by telephone, the Internet, and electronic mail if the trustee has taken reasonable steps to ensure that the bidding methods using the telephone, the Internet, or electronic mail are fair, accessible, and designed to result in money that is immediately available for disbursement; and

(2) after public notice of the time and place of the sale has been given in the manner provided by law for the sale of real property on execution.

(b) The attorney for the trustee or another agent of the trustee may conduct the sale and act in the sale as the auctioneer for the trustee. The trustee may set reasonable rules and conditions for the conduct of the sale. Sale shall be made to the highest and best bidder. The beneficiary under the trust deed may bid at the trustee's sale. Except as provided by (g) of this section, the trustee shall execute and deliver to the purchaser a deed to the property sold.

(c) The deed must recite the date and the book and page of the recording of default, and the mailing or delivery of the copies of the notice of default, the true consideration for the conveyance, the time and place of the publication of notice of sale, and the time, place, and manner of sale, and refer to the deed of trust by reference to the page, volume, and place of record or to the place of record and the serial number assigned to the deed of trust by the recorder.

(d) After the sale an affidavit of mailing the notice of default and an affidavit of publication of the notice of sale shall be recorded in the mortgage records of the recording district where the property is located.

(e) The trustee may postpone sale of all or any portion of the property by delivering to the person conducting the sale a written and signed request for the postponement to a stated date and hour. The person conducting the sale shall publicly announce the postponement to the stated date and hour at the time and place originally fixed for the sale. This procedure shall be followed in any succeeding postponement, but the foreclosure may not be postponed for more than 12 months unless a new notice of the sale is given under (a)(2) of this section. A sale may be postponed for up to 12 months from the sale date stated in the notice of default under AS 34.20.070 (b) without providing a basis for challenging the validity of the foreclosure process because of the length of time the foreclosure has been pending.

(f) After delivery of a deed under (b) of this section, the trustee shall distribute any cash proceeds of the sale in the following order to

(1) the beneficiary of the deed of trust being foreclosed until the beneficiary is paid the full amount that is owed under the deed of trust to the beneficiary;

(2) the persons who held, at the time of the sale, recorded interests, except easements, in the property, that were subordinate to the foreclosed deed of trust; the distribution under this paragraph shall be made according to the priority of the recorded interest, and a recorded interest with a higher priority shall be satisfied before distribution is made to the recorded interest that is next lower in priority; however, if a person holds a recorded interest that is an assessment, the person is entitled only to the amount of the assessment that was due at the time of the sale; in this paragraph, recorded interest means an interest, including a lease, recorded under AS 40.17;

(3) the trustor in the trust deed if the trustor is still the owner of the property at the time of the foreclosure sale, but, if the trustor is not still the owner of the property at the time of the foreclosure sale, then to the trustor's successor in interest whose interest appears of record at the time of the foreclosure sale.

(g) The trustee may withhold delivery of the deed under (b) of this section for up to 10 days after the sale. If, during the 10 days, the trustee determines that the sale should not have proceeded, the trustee may not issue the deed but shall

(1) inform the beneficiary, the otherwise successful bidder, and the trustor of the trust deed or the trustor's successor in interest that the sale is rescinded; and

(2) return to the otherwise successful bidder money received from the otherwise successful bidder as a bid on the property; return of this money is the otherwise successful bidder's only remedy if the trustee withholds delivery of the deed under (b) of this section.

(h) If a trustee rescinds a sale under (g) of this section and the obligation secured by the deed of trust remains in default, the trustee may, at the request of the beneficiary, reschedule the sale for a date that is not less than 45 days after the date of the rescinded sale. Not less than 30 days before the rescheduled sale date, the trustee shall

(1) mail notice of the rescheduled sale date by certified mail to the last known address of each of the persons identified by AS 34.20.070(c); and

(2) publish and post the notice of the rescheduled sale date as provided by law for the sale of real property on execution.

(i) Unless a sale is rescinded under (g) of this section, the sale completely terminates the rights of the trustor of the trust deed in the property.

(j) If a sale is rescinded under (g) of this section, the deed of trust foreclosed in the rescinded sale is restored to the validity and priority it would have had as though the sale had not occurred.

TITLE 34. PROPERTY

CHAPTER 34.20. MORTGAGES AND TRUST DEEDS

ARTICLE 02. DEEDS OF TRUST

34.20.090. Title, interest, possessory rights, and redemption.

(a) The sale and conveyance transfers all title and interest that the party executing the deed of trust had in the property sold at the time of its execution, together with all title and interest that party may have acquired before the sale, and the party executing the deed of trust or the heirs or assigns of that party have no right or privilege to redeem the property, unless the deed of trust so declares.(b) The purchaser at a sale and the heirs and assigns of the purchaser are, after the execution of a deed to the purchaser by the trustee, entitled to the possession of the premises described in the deed as against the party executing the deed of trust or any other person claiming by, through or under that party, after recording the deed of trust in the recording district where the property is located.

(c) A recital of compliance with all requirements of law regarding the mailing or personal delivery of copies of notices of default in the deed executed under a power of sale is prima facie evidence of compliance with the requirements. The recital is conclusive evidence of compliance with the requirements in favor of a bona fide purchaser or encumbrancer for value and without notice.

TITLE 34. PROPERTY

CHAPTER 34.20. MORTGAGES AND TRUST DEEDS

ARTICLE 02. DEEDS OF TRUST

34.20.100. Deficiency judgment prohibited.

When a sale is made by a trustee under a deed of trust, as authorized by AS 34.20.070 – 34.20.130, no other or further action or proceeding may be taken nor judgment entered against the maker or the surety or guarantor of the maker, on the obligation secured by the deed of trust for a deficiency.

TITLE 34. PROPERTY

CHAPTER 34.20. MORTGAGES AND TRUST DEEDS

ARTICLE 02. DEEDS OF TRUST

34.20.110. Trust deeds recorded as mortgages.

For the purposes of record, a deed of trust, given to secure an indebtedness, shall be treated as a mortgage of real estate, and recorded in full in the book provided for mortgages of real property. The person who makes or executes the deed of trust shall be indexed as mortgagor, and the trustee and the beneficiary or cestui que trust, as the mortgagees.

TITLE 34. PROPERTY

CHAPTER 34.20. MORTGAGES AND TRUST DEEDS

ARTICLE 02. DEEDS OF TRUST

34.20.115. Procedure for reconveyance.

(a) Unless the beneficiary has requested that a title insurance company reconvey a trust deed before the title insurance company mails or delivers the notice under (b) of this section, a title insurance company shall comply with the requirements of this section before reconveying the trust deed.(b) Not less than 30 days after payment in full of the obligation secured by a trust deed and receipt of satisfactory evidence of payment in full, a title insurance company shall

(1) mail, by certified mail with postage prepaid, return receipt requested, to the beneficiary and the servicer, a notice of intent to reconvey; the notice shall be sent to the beneficiary's address and the servicer's address

(A) stated in the trust deed

(B) stated in the last recorded assignment of the trust deed, if any

(C) shown in a request for notice recorded under (g) of this section; and

(D) if any, personally known to the title insurance company; or

(2) hand deliver to the beneficiary and to the servicer a notice of intent to reconvey.

(c) The notice required by (b) of this section must be in substantially the following form and accompanied by a copy of the reconveyance to be recorded:

NOTICE OF INTENT TO RECONVEY

TO: (Beneficiary or servicer for beneficiary)FROM: (Title insurance company)

DATE: ______________

Notice is hereby given to you as follows:

(1) This notice concerns the trust deed described as follows:

Trustor: ________________________

Beneficiary: ________________________

Recording information for the trust deed:

Serial number: ______________

Book number: _______________

Page number: _______________

Recording information for current assignment of trust deed:

Serial number: ______________

Book number: _______________

Page number: _______________

(2) The undersigned title insurance company claims to have fully

paid or received satisfactory evidence of the payment in full of the

obligation secured by the trust deed described above.

(3) Unless, within 90 days following the date stated above, the

undersigned has received, by certified mail, return receipt requested,

directed to the address noted below, a notice stating that you have not

received payment in full of all obligations secured by the trust deed

or that you otherwise object to reconveyance of the trust deed, the

undersigned will fully release and reconvey the trust deed under AS

34.20.115.

(4) A copy of the reconveyance or release of the trust deed is

enclosed with this notice.

(Title insurance company)

(Address)

(Telephone number)

(d) After at least 90 days have elapsed after the mailing or

delivery of the notice of intent to reconvey under (b) of this section,

if a title insurance company has not received an objection to the

reconveyance, the title insurance company may execute and record a

reconveyance of the trust deed.

(e) The reconveyance authorized by (d) of this section must be

acknowledged under AS 09.63 and be in substantially the following form:

RECONVEYANCE OF TRUST DEED

________________________, a title insurance company authorized to

transact business in Alaska, does, by this document, reconvey, without

warranty, to the person or persons legally entitled to the trust

property, the following trust property covered by a trust deed naming

________________________ as trustor and ________________________ as

beneficiary, which was recorded on ____________________ at serial number ______________ or at book and page ________________: The following described property located in the

________________________ Judicial District, State of Alaska: (Property description) The undersigned title insurance company certifies that

(1) the undersigned title insurance company has fully paid or

received satisfactory evidence of the payment in full of the obligation

secured by the trust deed;

(2) not less than 30 days following the payment in full of the trust

deed, the undersigned hand delivered or mailed by certified mail,

return receipt requested, to the record beneficiary under the trust

deed and the servicer for the record beneficiary, at the beneficiary

and servicer's record addresses, and to any address personally known to

this title insurance company, a notice of intent to reconvey as

required by AS 34.20.115 ; and

(3) at least 90 days have elapsed after the mailing or delivery of

the notice of intent to reconvey, and the undersigned title insurance

company has not received an objection to the reconveyance.

Dated _____________________________________

___________________________________________

(Title insurance company)

(Acknowledgment)

(f) A reconveyance of a trust deed, when executed and acknowledged in substantially the form prescribed in (e) of this section, may be recorded and, when recorded, constitutes a reconveyance of the trust deed identified in the reconveyance, regardless of any deficiency in the reconveyance procedure that is not disclosed in the recorded reconveyance, except for forgery of the title insurance company's signature. The reconveyance of a trust deed under this section does not discharge a personal obligation that was secured by the trust deed at the time of its reconveyance.

(g) A person who wants to receive a copy of a notice given under (b) of this section after the deed of trust is recorded and before the reconveyance is recorded under (d) of this section may record a request for a copy of the notice in the office of the recorder in the judicial district in which a part of the real property is located. The request must be acknowledged, must state the name and address of the person requesting the copy of the notice, and must identify the deed of trust by stating the names of the parties to the deed of trust, the date of recordation, and the serial number or book and page numbers where the deed of trust is recorded.

(h) If, at any point during the procedure required by this section, the beneficiary requests the title insurance company to reconvey the trust deed, the title insurance company is not required to proceed with the rest of the procedure required by this section and may execute and record a reconveyance of the trust deed.

(i) Except as provided in (a) and (h) of this section, if a title insurance company reconveys a trust deed without having satisfactory evidence of payment in full required under (b) of this section or without providing the prior notice to the beneficiary and the servicer as required under this section, the title insurance company is liable to the beneficiary and to the heirs, successors in interest, representatives, and assigns of the beneficiary for all damages occasioned by the neglect or the wilful act, and the title insurance company is liable to the state for a penalty of $300.

(j) In this section,

(1) beneficiary means both the record owner of the beneficiary's interest under a trust deed and a successor in interest;

(2) satisfactory evidence of payment in full, with regard to an obligation secured by a trust deed or an encumbrance on the property covered by the trust deed, means a payoff letter, or, along with reasonable documentary evidence that the check was intended to effect full payment,

(A) the original cancelled check; or

(B) a copy, including a voucher copy, of a check, payable to the beneficiary or a servicer;

(3) servicer means a person who handles, for a beneficiary of a trust deed, the receipt of the beneficiary's payments under the trust deed;

(4) title insurance company means a title insurance company or a title insurance limited producer; in this paragraph, title insurance company and title insurance limited producer have the meanings given in AS 21.66.480 .

TITLE 34. PROPERTY

CHAPTER 34.20. MORTGAGES AND TRUST DEEDS

ARTICLE 02. DEEDS OF TRUST

34.20.120. Substitution of trustee.

(a) The trustee under a trust deed upon real property given to secure an obligation to pay money and conferring no duties upon the trustee other than the duties that are incidental to the exercise of the power of sale conferred in the deed may be substituted by recording in the mortgage records of the recording district in which the property is located a substitution executed and acknowledged by(1) all the beneficiaries under the trust deed, or their successors in interest; or

(2) the attorneys for all of the beneficiaries or the attorneys for all of the beneficiaries' successors in interest.

(b) The substitution must contain

(1) the date of execution of the trust deed (2) the names of the trustee, trustor, and beneficiary, and, if the substitution is executed by the attorney for the beneficiary or successor in interest to the beneficiary, the name, address, and Alaska Bar Association identification number of the attorney;

(3) the book and page where the trust deed is recorded or the serial number assigned to the trust deed by the recorder;

(4) the name of the new trustee; and

(5) an acknowledgment signed and acknowledged by the trustee named in the trust deed of a receipt of a copy of the substitution, or an affidavit of service of a copy of it.

(c) From the time the substitution is filed for record, the new trustee succeeds to all the powers, duties, authority, and title of the trustee named in the deed of trust.

(d) When a title insurance company authorized to do business by a certificate of authority granted under AS 21.66 has been purchased by, merged into, or consolidated with, or has transferred all or substantially all of its business assets to, another authorized title insurance company, the surviving or successor company, by operation of law, succeeds to the duties of the predecessor company granted to that predecessor as trustee in any trust deed described in (a) of this section.

TITLE 34. PROPERTY

CHAPTER 34.20. MORTGAGES AND TRUST DEEDS

ARTICLE 02. DEEDS OF TRUST

34.20.130. Recording assignment, subordination, or waiver.

(a) The following instruments may be recorded:(1) an assignment of the beneficial interest under a deed of trust;

(2) an instrument by which a deed of trust of real property is subordinated or waived as to priority.

(b) From the time it is filed for record, the instrument operates as constructive notice to all persons.

TITLE 34. PROPERTY

CHAPTER 34.20. MORTGAGES AND TRUST DEEDS

ARTICLE 03. MISCELLANEOUS PROVISIONS

34.20.160. Notice of other remedies.

(a) When a lender uses a note as evidence of an obligation secured by a mortgage or deed of trust, the note must affirmatively advise the mortgagor or trustor and any other party bound by the note if the mortgagee or beneficiary wants the option to bring suit directly on the note to collect an amount owing under the note without first foreclosing the mortgage or deed of trust. This option must be stated in writing within the note or as a separate document. If a note executed after May 24, 1988 fails to contain the notice specified in this section, the debt secured by the mortgage or deed of trust may be foreclosed under AS 09.45.170 – 09.45.220 or AS 34.20.070 – 34.20.135.(b) If the mortgagee or beneficiary wishes to collect an amount owing under the note without first foreclosing the mortgage or deed of trust, the following language is sufficient in the note:

The mortgagor or trustor (borrower) is personally obligated and fully liable for the amount due under the note. The mortgagee or beneficiary (lender) has the right to sue on the note and obtain a personal judgment against the mortgagor or trustor for satisfaction of the amount due under the note either before or after a judicial foreclosure of the mortgage or deed of trust under AS 09.45.170 – 09.45.220.

TITLE 34. PROPERTY

CHAPTER 34.25. VALIDATION OF FORMAL DEFECTS

34.25.040. Deeds on judicial sales.

(a) A judicial sale of real property is valid and sufficient in law to sustain a deed based on the sale when(1) the sale is heretofore or hereafter made in the state on execution to satisfy a judgment, order, or decree of a court in the state or is made under an order or decree of a court in the state;

(2) the money bid on the property is paid to the officer making the sale, or to the officer's successor; and

(3) the sale is confirmed or acquiesced in by the court from which the execution issued or where the order or decree was entered.

(b) When no deed has been executed, a judicial sale that satisfies the conditions of (a) of this section entitles a purchaser at the sale to a deed.

(c) The deed, when executed and delivered, is sufficient to convey all the title of the judgment debtor or other person affected by the order or decree in the premises sold to the purchaser at the sale.

(d) All defects and irregularities in the proceedings or suit in which execution issues or in which the order or decree is entered, in the issuance of the execution, in obtaining the order or decree of the court, or in the manner of making or conducting the sale shall be disregarded if no suit is filed in a court of record in the judicial district where the real property affected by the deed is located within 10 years from the date of the deed, to have the deed set aside, altered, or otherwise changed or reformed.

34.25.050. Sale and deed of executor, administrator, and guardian validated.

(a) A sale of real property heretofore or hereafter made by an executor, administrator, or guardian is sufficient to sustain an executor's, administrator's, or guardian's deed to the purchaser for the real property when

(1) made of the decedent's, ward's, or incompetent person's real property in the state to a purchaser for a valuable consideration;

(2) the consideration is paid by the purchaser to the executor, administrator, or guardian, or the successor of the executor, administrator, or guardian, in good faith; and

(3) the sale is not set aside by the court, but is confirmed or acquiesced in by the court.

(b) If the deed is not given, a sale that satisfies the conditions of (a) of this section entitles the purchaser to the deed.

(c) The deed is sufficient to convey to the purchaser all the title that the decedent, ward, or incompetent had in the real property.

(d) All defects or irregularities in estate or court proceedings, in obtaining the order of the court for the sale, and in the making or conducting of the sale by the executor, administrator, or guardian shall be disregarded if no suit is filed in a court of record in the judicial district in which the real property affected by the deed is located within 10 years from the date of the deed, to have the deed set aside, altered or otherwise changed, or reformed.

TITLE 34. PROPERTY

CHAPTER 34.25. VALIDATION OF FORMAL DEFECTS

34.25.060. Record of the deed as evidence.

When the deed is executed and recorded in the deed records in the proper recording district, the record, certified by the recorder, is evidence in all courts, and has the same effect as the original.

TITLE 34. PROPERTY

CHAPTER 34.25. VALIDATION OF FORMAL DEFECTS

34.25.070. Validation of sales and action to quiet title.

(a) A sale of real estate by an administrator or executor is confirmed and approved, notwithstanding irregularities or informalities in the proceedings before the sale, when(1) the real estate is heretofore or hereafter sold under a license or order of a superior court in the state;

(2) the purchaser pays the purchase money for the real estate;

(3) the sale is made in good faith, in order to provide for payment of the claims against the estate;

(4) the executor or administrator fails or neglects to make or execute a deed conveying the real estate to the purchaser, or if from mistake or omission in the deed or defect in its execution the deed is inoperative; and

(5) five years have elapsed after the making of the sale.

(b) When these facts are shown in an action to quiet title to the real property against the heirs or their assignees of the deceased person whose property is sold, in the proper court for the suit, the court shall make its decree quieting title and compelling and ordering conveyances of the real estate to the purchaser or the heirs or assignees of the purchaser as if a valid contract to convey the real property were made by the deceased while living.

(c) An action may not be maintained by the heirs of the deceased, or their heirs or assignees, to dispossess the purchaser or the heirs or assignees of the purchaser, after the expiration of five years from the sale.

TITLE 38. PUBLIC LAND

CHAPTER 38.50. EXCHANGE OF STATE LAND

38.50.150. Execution of exchange.

If a deed, contract of exchange, or other instrument of conveyance which the director receives to effectuate an exchange is properly executed, acknowledged, and authorized by the appropriate party, the director shall accept conveyance of title to the land and other property which the state is to receive as consideration, and shall issue a patent, contract of exchange, or other instrument of conveyance to the appropriate party for the property which the director is then obligated to convey. Before acceptance by the director of a deed, contract of exchange, or other instrument, no action taken by the director or by any other state official creates a right against the state with respect to state land.

TITLE 34. PROPERTY

CHAPTER 34.70. DISCLOSURES IN RESIDENTIAL REAL PROPERTY TRANSFERS

34.70.010. Disclosures in residential real property transfers.

Before the transferee of an interest in residential real property makes a written offer, the transferor shall deliver by mail or in person a completed written disclosure statement in the form established under AS 34.70.050 . Delivery to the spouse of the transferee constitutes delivery to the transferee unless the transferor and the transferee agree otherwise before the delivery.

TITLE 34. PROPERTY

CHAPTER 34.70. DISCLOSURES IN RESIDENTIAL REAL PROPERTY TRANSFERS

34.70.110. Waiver by agreement.

This chapter does not apply to the transfer of an interest in residential real property if the transferor and transferee agree in writing that the transfer will not be covered under this chapter.

TITLE 34. PROPERTY

CHAPTER 34.08. COMMON INTEREST OWNERSHIP

ARTICLE 04. PROTECTION OF PURCHASERS

34.08.620. Conversion property.

(a) A declarant of a common interest community containing conversion property, and any dealer who intends to offer units in a common interest community containing conversion units, shall give each residential tenant and each residential subtenant in possession of a portion of conversion property notice of the conversion and provide each person with the public offering statement no later than 180 days before the tenant and any subtenant in possession are required to vacate. If the conversion property consists of a mobile home park, notice of the conversion and delivery of a public offering statement shall be provided no later than one year before the tenant and any subtenant in possession are required to vacate. The notice must set out generally the rights of tenants and subtenants under this section and shall be hand delivered to the tenant or subtenant in possession or mailed by certified mail, return receipt requested, to the tenant and subtenant at the address of the unit or any other mailing address provided by a tenant. The failure to give notice as required by this section is a defense to an action for possession and the terms of the tenancy may not be altered during the notice period provided by this subsection. A tenant or subtenant may not be required to vacate upon less than 180 days' notice and a tenant and a subtenant in possession in a mobile home park may not be required to vacate upon less than one year's notice except for one of the following reasons:(1) the tenant or subtenant has defaulted in the payment of rent owed;

(2) the tenant or subtenant has been convicted of violating a federal or state law or local ordinance, and that violation is continuing and is detrimental to the health, safety, or welfare of other dwellers or tenants in the mobile home park; and

(3) the tenant or subtenant has violated a provision, enforceable under AS 34.03.130 , of the rental agreement or lease signed by both parties and not prohibited by law including rent and the terms of agreement.

(b) For 90 days after delivery or mailing of the notice described in (a) of this section, the person required to give the notice shall offer to convey each unit or proposed unit occupied for residential use to the tenant who leases or rents the unit. If a tenant fails to purchase the unit during the 90-day period, the offeror shall extend a right of first refusal to the tenant who is leasing or renting the unit at the time of the conversion. The offeror may not offer to dispose of an interest in the unit at a price or on terms more favorable to the offeree than the price or terms offered to the tenant while the tenant is in possession. The tenant must exercise the right of first refusal within 90 days from the receipt of the offer and must provide the offeror a valid letter of intent or a preliminary loan commitment from a bank or mortgage lending institution within 30 days of receipt of the offer. This subsection does not apply to a unit in conversion property if the unit will be restricted exclusively to nonresidential use or if the boundaries of the converted unit do not substantially conform to the dimensions of the residential unit before conversion.

(c) If a seller, in violation of (b) of this section, conveys a unit for value to a purchaser who has no knowledge of the violation, the recording of the deed conveying the unit or, in a cooperative, the conveyance of the unit, extinguishes any right a tenant may have under (b) of this section to purchase the unit if the deed states that the seller has complied with (b) of this section, but the conveyance does not affect the right of a tenant to recover damages from the seller for a violation of (b) of this section.

(d) If a notice of conversion specifies a date by which a unit or proposed unit must be vacated and otherwise complies with the provisions of AS 09.45.060 - 09.45.160, the notice also constitutes a notice to quit.

(e) Nothing in this section permits termination of a lease by a declarant in violation of its terms.

Contract for Deed - General - Alaska

Alaska Statutes

TITLE 34. PROPERTY

CHAPTER 34.08. COMMON INTEREST OWNERSHIP

ARTICLE 04. PROTECTION OF PURCHASERS

34.08.620. Conversion property.

(a) A declarant of a common interest community containing conversion property, and any dealer who intends to offer units in a common interest community containing conversion units, shall give each residential tenant and each residential subtenant in possession of a portion of conversion property notice of the conversion and provide each person with the public offering statement no later than 180 days before the tenant and any subtenant in possession are required to vacate. If the conversion property consists of a mobile home park, notice of the conversion and delivery of a public offering statement shall be provided no later than one year before the tenant and any subtenant in possession are required to vacate. The notice must set out generally the rights of tenants and subtenants under this section and shall be hand delivered to the tenant or subtenant in possession or mailed by certified mail, return receipt requested, to the tenant and subtenant at the address of the unit or any other mailing address provided by a tenant. The failure to give notice as required by this section is a defense to an action for possession and the terms of the tenancy may not be altered during the notice period provided by this subsection. A tenant or subtenant may not be required to vacate upon less than 180 days' notice and a tenant and a subtenant in possession in a mobile home park may not be required to vacate upon less than one year's notice except for one of the following reasons:

(1) the tenant or subtenant has defaulted in the payment of rent owed;(2) the tenant or subtenant has been convicted of violating a federal or state law or local ordinance, and that violation is continuing and is detrimental to the health, safety, or welfare of other dwellers or tenants in the mobile home park; and

(3) the tenant or subtenant has violated a provision, enforceable under AS 34.03.130 , of the rental agreement or lease signed by both parties and not prohibited by law including rent and the terms of agreement.

(b) For 90 days after delivery or mailing of the notice described in (a) of this section, the person required to give the notice shall offer to convey each unit or proposed unit occupied for residential use to the tenant who leases or rents the unit. If a tenant fails to purchase the unit during the 90-day period, the offeror shall extend a right of first refusal to the tenant who is leasing or renting the unit at the time of the conversion. The offeror may not offer to dispose of an interest in the unit at a price or on terms more favorable to the offeree than the price or terms offered to the tenant while the tenant is in possession. The tenant must exercise the right of first refusal within 90 days from the receipt of the offer and must provide the offeror a valid letter of intent or a preliminary loan commitment from a bank or mortgage lending institution within 30 days of receipt of the offer. This subsection does not apply to a unit in conversion property if the unit will be restricted exclusively to nonresidential use or if the boundaries of the converted unit do not substantially conform to the dimensions of the residential unit before conversion.

(c) If a seller, in violation of (b) of this section, conveys a unit for value to a purchaser who has no knowledge of the violation, the recording of the deed conveying the unit or, in a cooperative, the conveyance of the unit, extinguishes any right a tenant may have under (b) of this section to purchase the unit if the deed states that the seller has complied with (b) of this section, but the conveyance does not affect the right of a tenant to recover damages from the seller for a violation of (b) of this section.

(d) If a notice of conversion specifies a date by which a unit or proposed unit must be vacated and otherwise complies with the provisions of AS 09.45.060 - 09.45.160, the notice also constitutes a notice to quit.

(e) Nothing in this section permits termination of a lease by a declarant in violation of its terms.

TITLE 34. PROPERTY

CHAPTER 34.15. CONVEYANCES

ARTICLE 01. FORM AND EFFECT

34.15.010. Manner of executing conveyances.

(a) A conveyance of land, or of an estate or interest in land, may be made by deed, signed and sealed by the person from whom the estate or interest is intended to pass, who is of lawful age, or by the lawful agent or attorney of the person, and acknowledged or proved, and recorded as directed in this chapter, without any other act or ceremony whatever.(b) In a deed or conveyance of the family home or homestead by a married man or a married woman, the husband and wife shall join in the deed or conveyance.

(c) The requirement that a spouse of a married person join in a deed or conveyance of the family home or homestead does not create a proprietary right, title, or interest in the spouse not otherwise vested in the spouse.

(d) Failure of the spouse to join in the deed or conveyance does not affect the validity of the deed or conveyance, unless the spouse appears on the title. The deed or conveyance is sufficient in law to convey the legal title to the premises described in it from the grantor to the grantee when the deed or conveyance is otherwise sufficient, and

(1) no suit is filed in a court of record in the judicial district in which the land is located within one year from the date of recording of the deed or conveyance by the spouse who failed to join in the deed or conveyance to have the deed or conveyance set aside, altered, changed, or reformed; or

(2) the spouse whose interest in the property is affected does not record, within one year in the office of the recorder for the recording district where the property is situated, a notice of an interest in the property.

TITLE 34. PROPERTY

CHAPTER 34.15. CONVEYANCES

ARTICLE 01. FORM AND EFFECT

34.15.030. Form of warranty deed.

(a) A warranty deed for the conveyance of land may be substantially in the following form, without express covenants:The grantor (here insert the name or names and place of residence) for and in consideration of (here insert consideration) in hand paid, conveys and warrants to (here insert the grantee's name or names) the following described real estate (here insert description), located in the State of Alaska.

Dated this . . . . . . . . . . day of . . . . . ., 2. . . . . .

(b) A deed substantially in the form set forth in (a) of this section, when otherwise duly executed, is considered a conveyance in fee simple to the grantee and the heirs and assigns of the grantee, with the following covenants by the grantor: (1) that at the time of the making and delivery of the deed the grantor is lawfully seized of an indefeasible estate in fee simple to the premises described, and has the right and power to convey the premises; (2) that at the time of making and delivery of the deed the premises are free from encumbrances; and (3) that the grantor warrants the quiet and peaceable possession of the premises, and will defend the title to the premises against all persons claiming the premises. The covenants are binding upon a grantor and the heirs and personal representative of a grantor as if written in the deed.

TITLE 34. PROPERTY

CHAPTER 34.15. CONVEYANCES

ARTICLE 01. FORM AND EFFECT

34.15.010. Manner of executing conveyances.

(a) A conveyance of land, or of an estate or interest in land, may be made by deed, signed and sealed by the person from whom the estate or interest is intended to pass, who is of lawful age, or by the lawful agent or attorney of the person, and acknowledged or proved, and recorded as directed in this chapter, without any other act or ceremony whatever.(b) In a deed or conveyance of the family home or homestead by a married man or a married woman, the husband and wife shall join in the deed or conveyance.

(c) The requirement that a spouse of a married person join in a deed or conveyance of the family home or homestead does not create a proprietary right, title, or interest in the spouse not otherwise vested in the spouse.

(d) Failure of the spouse to join in the deed or conveyance does not affect the validity of the deed or conveyance, unless the spouse appears on the title. The deed or conveyance is sufficient in law to convey the legal title to the premises described in it from the grantor to the grantee when the deed or conveyance is otherwise sufficient, and

(1) no suit is filed in a court of record in the judicial district in which the land is located within one year from the date of recording of the deed or conveyance by the spouse who failed to join in the deed or conveyance to have the deed or conveyance set aside, altered, changed, or reformed;

(2) the spouse whose interest in the property is affected does not record, within one year in the office of the recorder for the recording district where the property is situated, a notice of an interest in the property.

TITLE 34. PROPERTY

CHAPTER 34.15. CONVEYANCES

ARTICLE 01. FORM AND EFFECT

34.15.030. Form of warranty deed.

(a) A warranty deed for the conveyance of land may be substantially in the following form, without express covenants:The grantor (here insert the name or names and place of residence) for and in consideration of (here insert consideration) in hand paid, conveys and warrants to (here insert the grantee's name or names) the following described real estate (here insert description), located in the State of Alaska.

Dated this . . . . . . . . . . day of . . . . . ., 2. . . . . .

(b) A deed substantially in the form set forth in (a) of this section, when otherwise duly executed, is considered a conveyance in fee simple to the grantee and the heirs and assigns of the grantee, with the following covenants by the grantor: (1) that at the time of the making and delivery of the deed the grantor is lawfully seized of an indefeasible estate in fee simple to the premises described, and has the right and power to convey the premises; (2) that at the time of making and delivery of the deed the premises are free from encumbrances; and (3) that the grantor warrants the quiet and peaceable possession of the premises, and will defend the title to the premises against all persons claiming the premises. The covenants are binding upon a grantor and the heirs and personal representative of a grantor as if written in the deed.

TITLE 34. PROPERTY

CHAPTER 34.15. CONVEYANCES

ARTICLE 01. FORM AND EFFECT

34.15.040. Form of quitclaim deed.

(a) A quitclaim deed may be substantially in the following form:The grantor (here insert the name or names and place of residence), for and in consideration of (here insert consideration) conveys and quitclaims to (here insert grantee's name or names) all interest which I (we) have, if any, in the following described real estate (here insert description), located in the State of Alaska.

Dated this . . . . . . . . day of . . . . . . . . . ., 2. . . . . .

(b) A deed substantially in the form set out in (a) of this section, when otherwise duly executed, is considered a sufficient conveyance, release and quitclaim to the grantee and the heirs and assigns of the grantee, in fee of all the existing legal and equitable rights of the grantor in the premises described in the deed.

TITLE 34. PROPERTY

CHAPTER 34.15. CONVEYANCES

ARTICLE 01. FORM AND EFFECT

34.15.050. Effect of quitclaim.

A deed of quitclaim and release for the form in common use is sufficient to pass all the real estate which the grantor can convey by a deed of bargain and sale

TITLE 34. PROPERTY

CHAPTER 34.15. CONVEYANCES

ARTICLE 02. ACKNOWLEDGMENT AND PROOF

34.15.240. Penalty for refusal to appear or testify.

A person served with a subpoena described in AS 34.15.230 who, without reasonable cause, refuses or neglects to appear, or upon appearing refuses to answer upon oath regarding the execution of a deed, shall forfeit to the injured party $100, and may also be committed to jail for a contempt by the officer who issues the subpoena, to remain in jail until the person submits to answer on oath as required.

TITLE 34. PROPERTY

CHAPTER 34.20. MORTGAGES AND TRUST DEEDS

ARTICLE 02. DEEDS OF TRUST

34.20.070. Sale by trustee.