Forward Contract Default Risk

Description

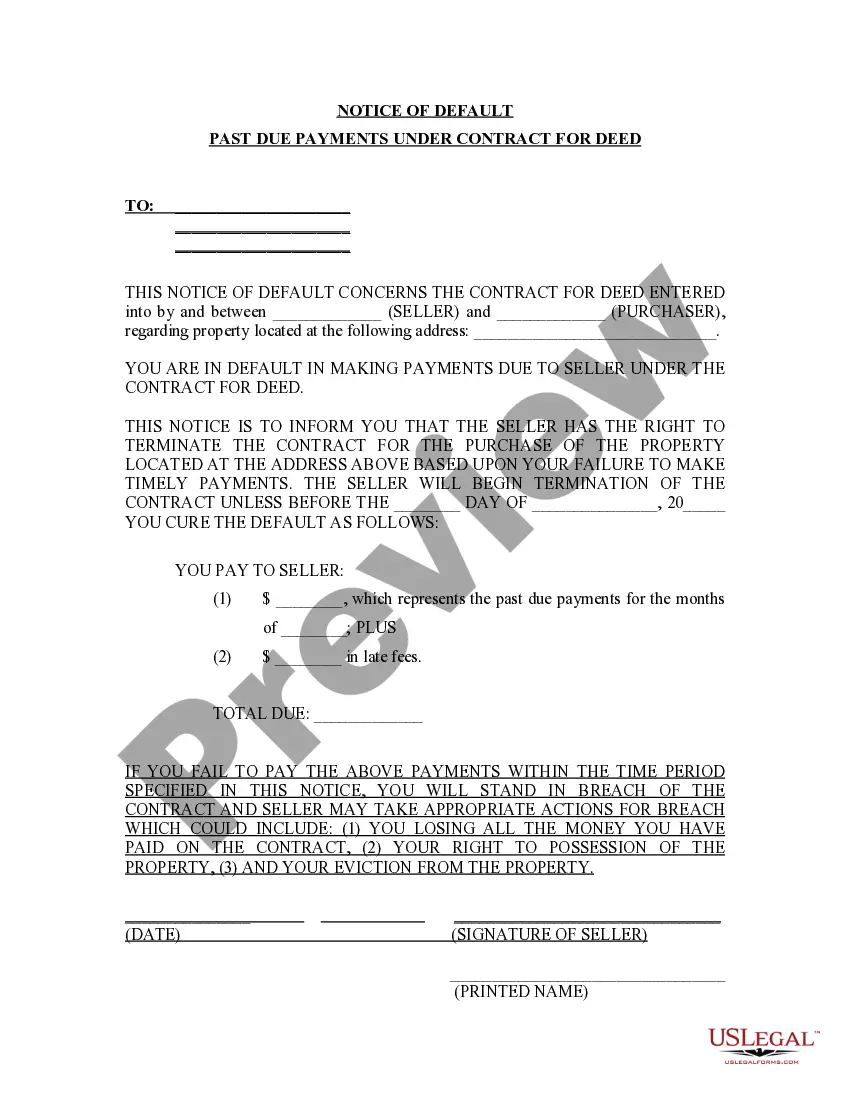

How to fill out Alabama Notice Of Default For Past Due Payments In Connection With Contract For Deed?

Individuals typically link legal documents with something complex that only an expert can manage.

In a certain sense, this holds true, as formulating a Forward Contract Default Risk necessitates significant knowledge in subject matters, inclusive of state and local regulations.

However, with US Legal Forms, the process has become simpler: pre-made legal templates for any personal and business circumstance tailored to state laws are compiled in a single online library and are now accessible to everyone.

All templates within our library are reusable: once acquired, they remain stored in your profile. You can access them anytime you need via the My documents tab. Explore all the benefits of utilizing the US Legal Forms platform. Subscribe today!

- US Legal Forms provides over 85,000 current documents sorted by state and usage category, making it easy to find the Forward Contract Default Risk or any other specific template in just a few minutes.

- Previously registered users with an active subscription must sign in to their account and click Download to access the form.

- New users will need to establish an account and subscribe before downloading any documentation.

- Follow this step-by-step guide to obtain the Forward Contract Default Risk.

- Carefully review the page content to ensure it satisfies your requirements.

- Read the form description or view it through the Preview feature.

- If the previous sample is unsuitable, search for another example using the Search bar above.

- Once you identify the appropriate Forward Contract Default Risk, click Buy Now.

- Select a pricing plan that matches your needs and budget.

Form popularity

FAQ

Forward contracts can involve the exchange of foreign currency and other goods, not just commodities. For example, if oil is trading at $50 a barrel, the company might sign a forward contract with its supplier to buy 10,000 barrels of oil at $55 each every month for the next year.

Their use is limited by three major problems with forward contracts: (1) it is often costly/difficult to find a willing counterparty; (2) the market for forwards is illiquid due to their idiosyncratic nature so they are not easily sold to other parties if desired; (3) one party usually has an incentive to break the

Unlike forwards, where there is no guarantee until the contract settles, futures require a deposit or margin. This acts as collateral to cover the risk of default.

The exchange has several safeguards in place to reduce the risk of default on Futures. But there is no regulatory intervention in a Forward contract. With Forwards, the risk of a party not honouring the contract terms is high.

In a forward contract, the buyer and seller agree to buy or sell an underlying asset at a price they both agree on at an established future date. This price is called the forward price. This price is calculated using the spot price and the risk-free rate. The former refers to an asset's current market price.