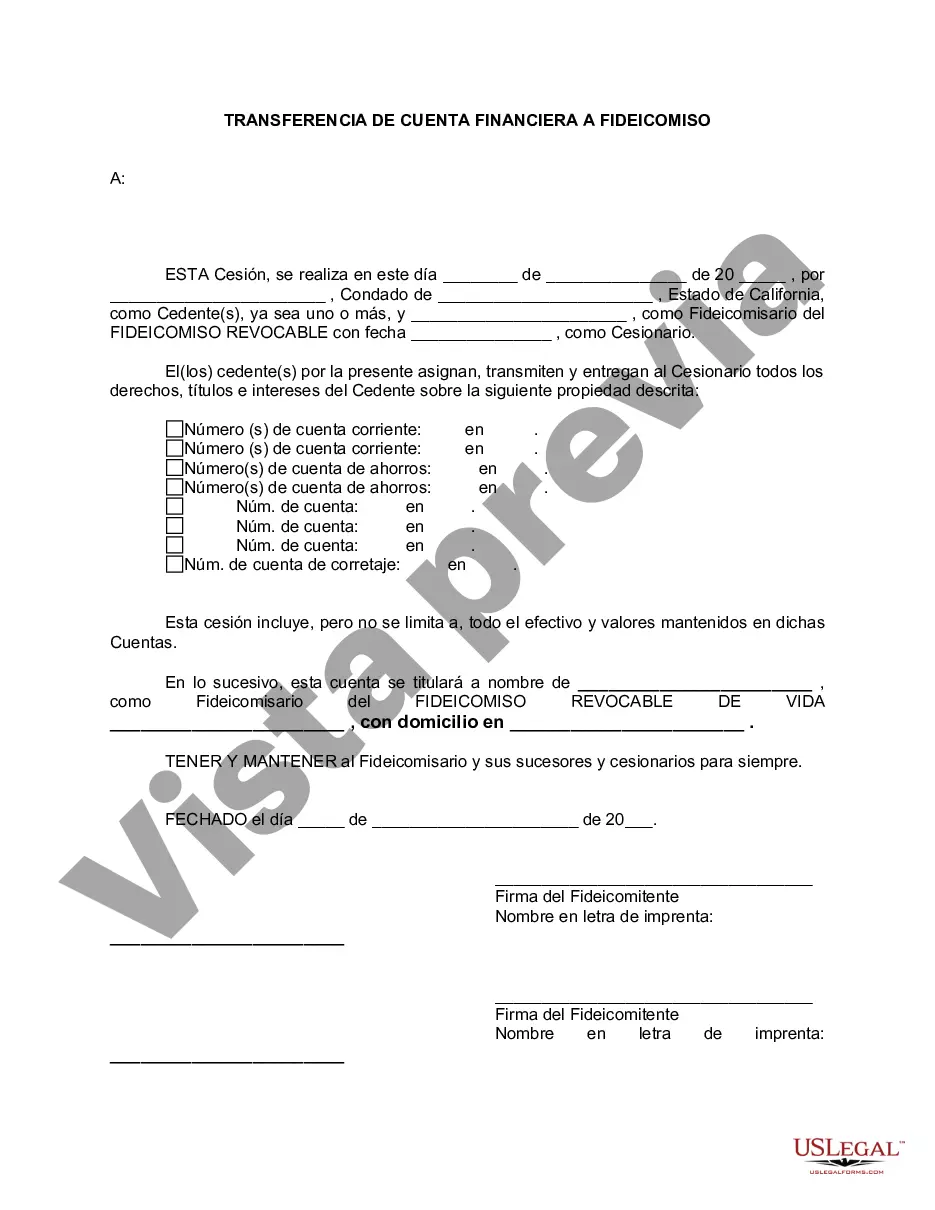

Trust Account With Fnb - California Financial Account Transfer to Living Trust

Description

Form popularity

FAQ

When establishing a trust, consider a trust account with fnb. This type of account is specifically designed to manage assets on behalf of beneficiaries. It offers features like separate accounting for trust funds and compliance with legal requirements. A trust account with fnb provides a secure solution while simplifying the administration of the trust.

Opening a trust account with FNB involves a straightforward process. First, gather the necessary documentation, such as the trust agreement, identification, and tax identification number for the trust. After that, visit your nearest FNB branch or their website to initiate the account opening process. They can guide you through the specific requirements and help you establish your trust account effectively.

In QuickBooks, a trust account is typically classified as a special account type used to track and manage client funds held in trust. When setting up a trust account with FNB in QuickBooks, ensure that it is designated as a liability account, allowing you to accurately monitor funds designated for beneficiaries. This setup ensures compliance and proper financial reporting for trust activities.

A trust itself is a legal arrangement that allows a trustee to manage assets for the benefit of a beneficiary. A trust account with FNB is the financial component of this arrangement, designated to house the assets placed in the trust. It is essential for the fiduciary to maintain proper recordkeeping and to adhere to the trust's guidelines to protect the beneficiaries' interests.

A trust account with FNB serves as a financial tool to hold assets on behalf of a beneficiary. These accounts can include fiduciary, escrow, and investment accounts, ensuring that the funds are managed according to the trust's terms. Trust accounts are designed to safeguard clients' interests and provide structured financial management for both personal and business needs.

A trust account with FNB can be categorized as either business or personal, depending on its purpose. Individuals often use personal trust accounts to manage assets for beneficiaries. On the other hand, business owners may establish trust accounts specifically for handling funds related to their business operations. Understanding the context will help you determine which type of trust account is appropriate for your situation.

Not everything needs to go into a trust account with FNB. While many assets can benefit from being placed in a trust, it's often wise to keep some assets outside, such as personal items or accounts you may need immediate access to. Evaluating your specific situation and consulting with a professional can help you determine the best approach for your needs.

Setting up a bank account for a trust with FNB is straightforward. First, you'll need to provide the necessary legal documents that establish the trust, including the trust agreement. After this, you can visit an FNB branch or their online platform to open the account, ensuring that the trustee understands their duties concerning managing the account.

Filling out a trust fund requires specific information about the assets and beneficiaries. First, you should gather relevant documents, such as property deeds and bank statements. Then, when you create a trust account with FNB, you will need to specify how each asset will be managed and distributed among the beneficiaries to ensure clarity and compliance with your wishes.

Certain assets may not be suitable for inclusion in a trust account with FNB. Personal items, such as your primary residence or personal bank accounts, may be better managed outside the trust to maintain accessibility. Additionally, assets that you may need to retain full control over, such as certain retirement accounts, often do not belong in a trust.