Revocation Living Trust Without Spouse - California Revocation of Living Trust

Description

Form popularity

FAQ

Yes, you can exclude your spouse from a trust if that is your intention. This can be a strategic decision in estate planning, allowing you to direct assets according to your personal wishes. However, it is crucial to understand the implications of such decisions on your financial situation and family dynamics. Utilizing a platform like uslegalforms can simplify the process of setting up or modifying your trust efficiently.

Removing someone from a living trust generally requires a written amendment to the trust document. It’s essential to follow the instructions laid out in the trust regarding amendments. Once you revise the trust, ensure that you communicate these changes to the individual involved. By doing so, you effectively manage the revocation living trust without spouse dynamics.

Yes, you can set up a revocation living trust without your spouse. Individuals often choose this option for estate planning to maintain control over their assets. When you create a trust individually, you establish specific terms and conditions that align with your personal wishes. This arrangement can also simplify the management of your estate according to your preferences.

A trust can become invalid for several reasons. For instance, if the trust does not meet specific legal requirements or lacks the necessary documentation, it may not hold up in court. Additionally, a trust can be deemed invalid if it was created under duress or if the creator lacked the mental capacity to establish the trust. When considering revocation of a living trust without a spouse, it’s vital to follow the correct procedures to ensure that your new trust is valid.

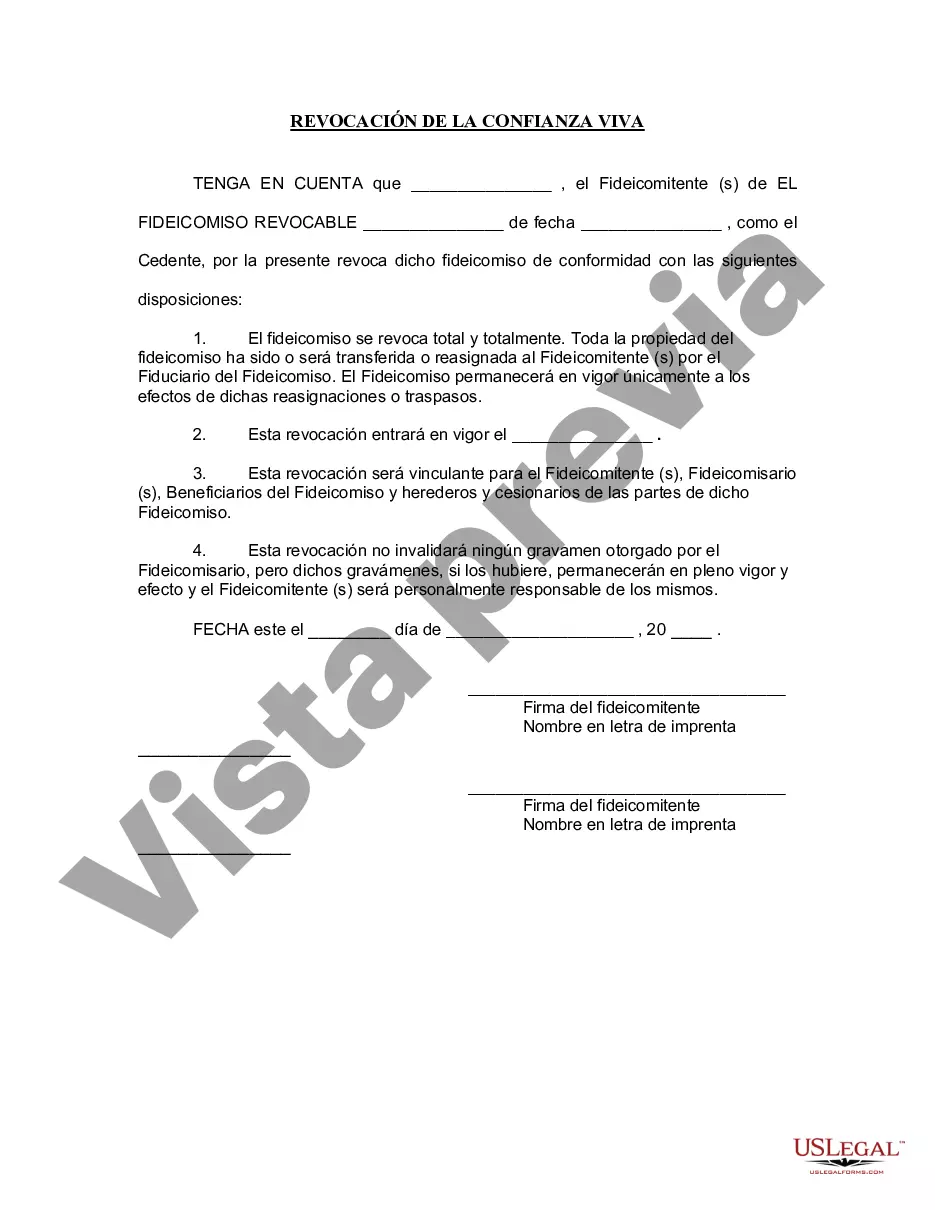

To revoke a revocable living trust, you need to prepare and sign a revocation document, declaring your intention to dissolve the trust. Then, deliver this document to any relevant parties and ensure you remove all assets from the trust. Utilizing services like uslegalforms can simplify this process and help ensure your revocation living trust without spouse proceeds correctly.

One of the biggest mistakes parents make is failing to fund the trust properly after its establishment. A trust needs to hold assets to be effective, so neglecting this step can void its benefits. Additionally, overlooking updates to beneficiaries or terms can complicate future distributions. Ensuring clarity and completeness during the setup is vital, especially for a revocation living trust without spouse.

A trust can become null and void for various reasons, including lack of funding, illegal purpose, or failure to follow necessary legal formalities. If the required documents and intentions are not present, the trust may not hold its intended purpose. Being informed about these details helps in managing your revocation living trust without spouse effectively.

A trust can be terminated through revocation by the grantor, through the expiration of its terms, or by a court order. Each method serves different scenarios depending on the intent behind the trust. Should you decide on a revocation living trust without spouse, ensure you follow legal procedures. Consulting with uslegalforms may help clarify the options available to you.

Yes, you can absolutely set up a living trust without your spouse. Creating a revocation living trust without spouse allows you to maintain full control over your assets and their distribution. This option is useful in certain financial or personal situations. However, it's wise to consult with a legal expert to ensure you meet state requirements.

A sample of a revocation of living trust typically includes your statement of revocation, the trust's name, and your signature. It’s important to specify which trust you are revoking. For accuracy and legality, consider using uslegalforms, where you can access detailed templates ready for your unique needs. Using a solid format creates a clear revocation living trust without spouse.