Living Trust With Revocable With Pour Over Will - Delaware Living Trust for Individual Who is Single, Divorced or Widow or Widower With No Children

Description

Form popularity

FAQ

The main purpose of a pour-over trust is to ensure that any assets not transferred into your living trust during your lifetime automatically move into the trust upon your death. This ensures a seamless transition and management of your estate without the need for lengthy probate processes. By incorporating a pour-over trust into your estate planning, you ensure that all your assets, even those overlooked, are governed by the terms you established in your living trust with revocable with pour over will.

While a pour-over will is advantageous, it does have some downsides to consider. One significant drawback is that assets transferred through a pour-over will may incur probate, which can delay the distribution process and potentially increase legal costs. Furthermore, relying heavily on a pour-over will may mean that some assets are not managed as efficiently as intended in your living trust, making it essential to keep your living trust with revocable with pour over will up to date.

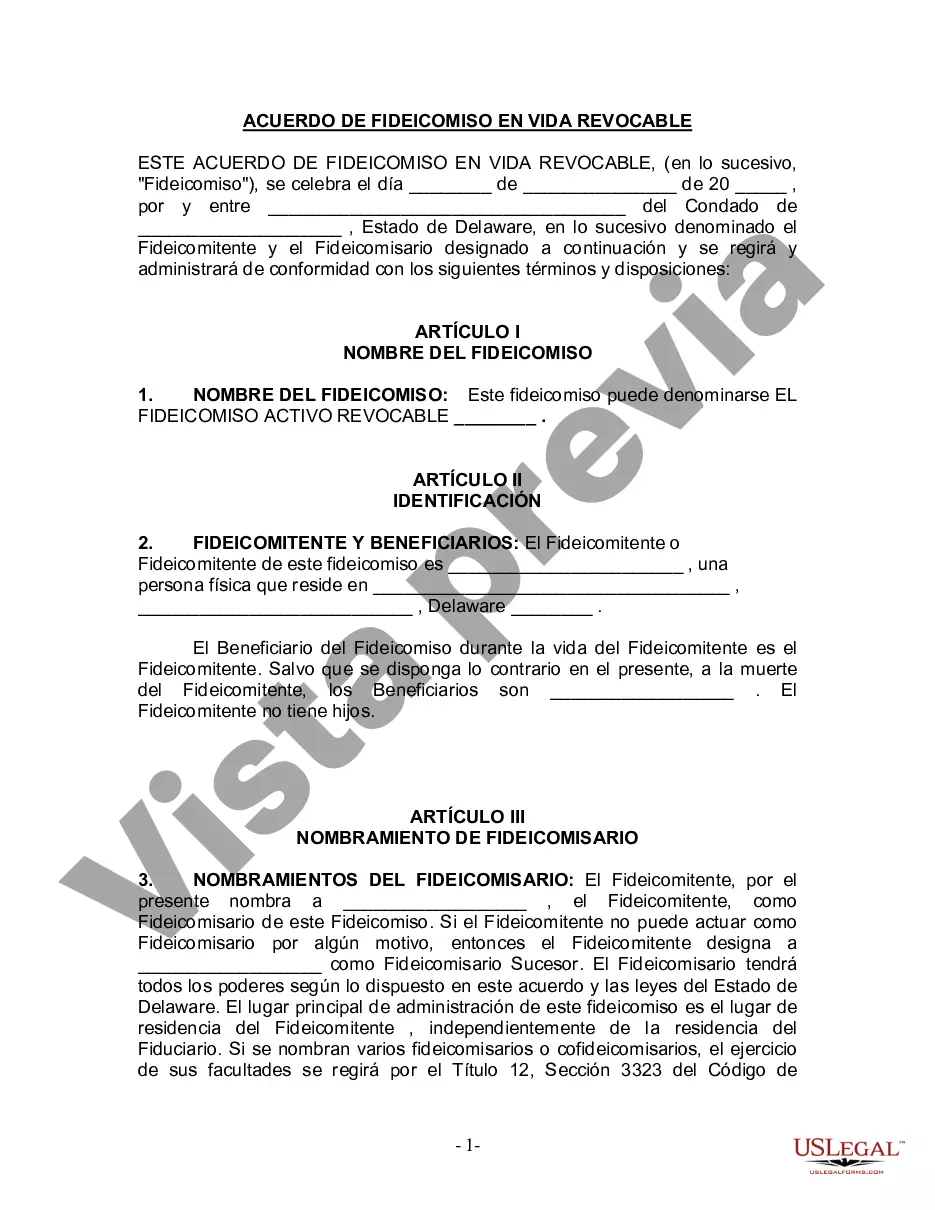

Filling out a revocable living trust involves several straightforward steps. First, you’ll need to identify the assets you want to include in the trust, such as real estate or bank accounts. Next, you create the trust document, specifying the terms of the trust and naming a trustee. To complete the process, you transfer ownership of the identified assets into your living trust, effectively ensuring they are managed according to your wishes through your living trust with revocable with pour over will.

A last will, commonly known simply as a will, outlines how you want your assets to be distributed after your death. In contrast, a pour-over will works in conjunction with your living trust. It ensures that any assets not placed directly into your living trust during your lifetime flow into the trust upon your passing. Essentially, a pour-over will acts as a safety net, safeguarding your intentions within the framework of your living trust with revocable with pour over will.

Typically, a living trust takes precedence over a will for the assets it controls. When you establish a living trust with revocable with pour over will, it manages the distribution of your assets more efficiently than a will alone. However, it is important to ensure that all your assets are properly transferred into the trust. Consulting with a platform like USLegalForms can help you navigate these details and ensure your estate plan is cohesive.

over will acts as a safety net for assets not placed in your revocable trust during your lifetime. Upon your passing, any remaining assets pour over into your living trust with revocable with pour over will, ensuring they are managed per the trust's terms. This mechanism simplifies the transfer of property and aligns it with your overall estate plan. Using this method can help safeguard your intentions and reduce potential legal complications.

Certain assets, like retirement accounts and life insurance policies, typically cannot be placed directly in a revocable trust. Instead, you can name the trust as a beneficiary of these accounts. Furthermore, depending on state laws, some types of property, such as personal injury claims, also may not be placed in a living trust with revocable with pour over will. Always check with a legal expert to ensure proper handling of these assets.

In general, a will does not supersede a revocable trust. Instead, a revocable trust governs how your assets transfer upon your passing. However, if your will names assets that are not included in your living trust with revocable with pour over will, those specific assets will follow the instructions in the will. This highlights the importance of coordinating both documents for a seamless estate plan.

Yes, you can definitely have both a pour-over will and a revocable trust. A living trust with revocable with pour over will is designed to work together, ensuring that any assets not placed in the trust will be directed into it after your passing. This dual strategy maximizes your estate planning effectiveness and secures your wishes for asset distribution.

If you have a will, you may still benefit from a revocable trust. A living trust with revocable with pour over will can help avoid probate, making asset distribution faster and less costly for your heirs. Ultimately, this combination offers peace of mind in knowing your wishes will be honored without unnecessary delays.