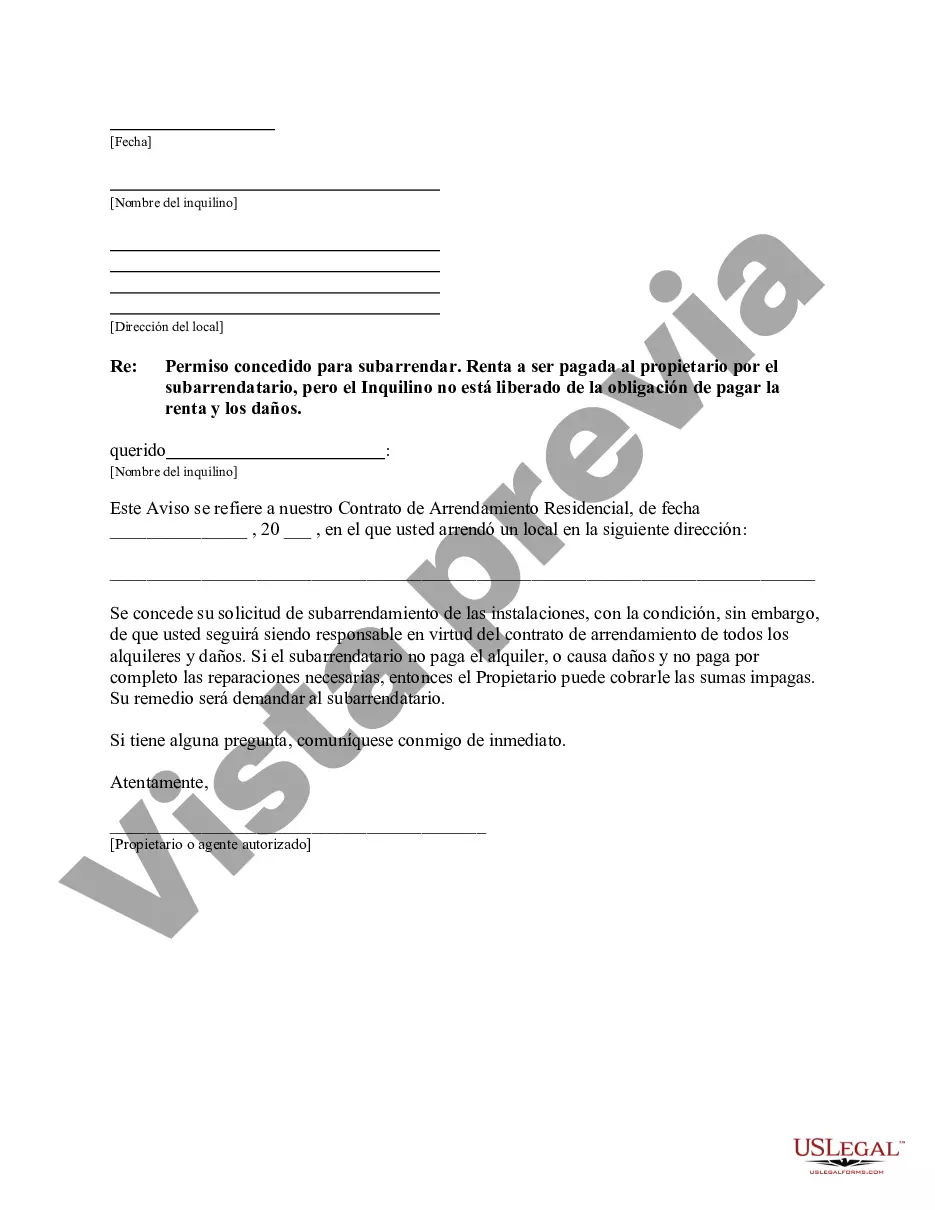

Landlord Rent Paid For Residence Journal Entry - Florida Letter from Landlord to Tenant that Sublease granted - Rent Paid by Subtenant, but Tenant Still Liable for Rent and Damages

State:

Florida

Control #:

FL-1071LT

Format:

Word

Instant download

Description Subarrendamiento Alquiler Siendo

This is a letter from Landlord to Tenant that the Sublease has been granted. Rent will be paid by sub-tenant, but Tenant remains liable for rent and damages.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés.

For your convenience, the complete English version of this form is attached below the Spanish version.

Free preview Subarrendamiento Subarrendatario Daños