Trust Amendment In Budget 2021 - Illinois Amendment to Living Trust

State:

Illinois

Control #:

IL-E0178A

Format:

Word

Instant download

Description

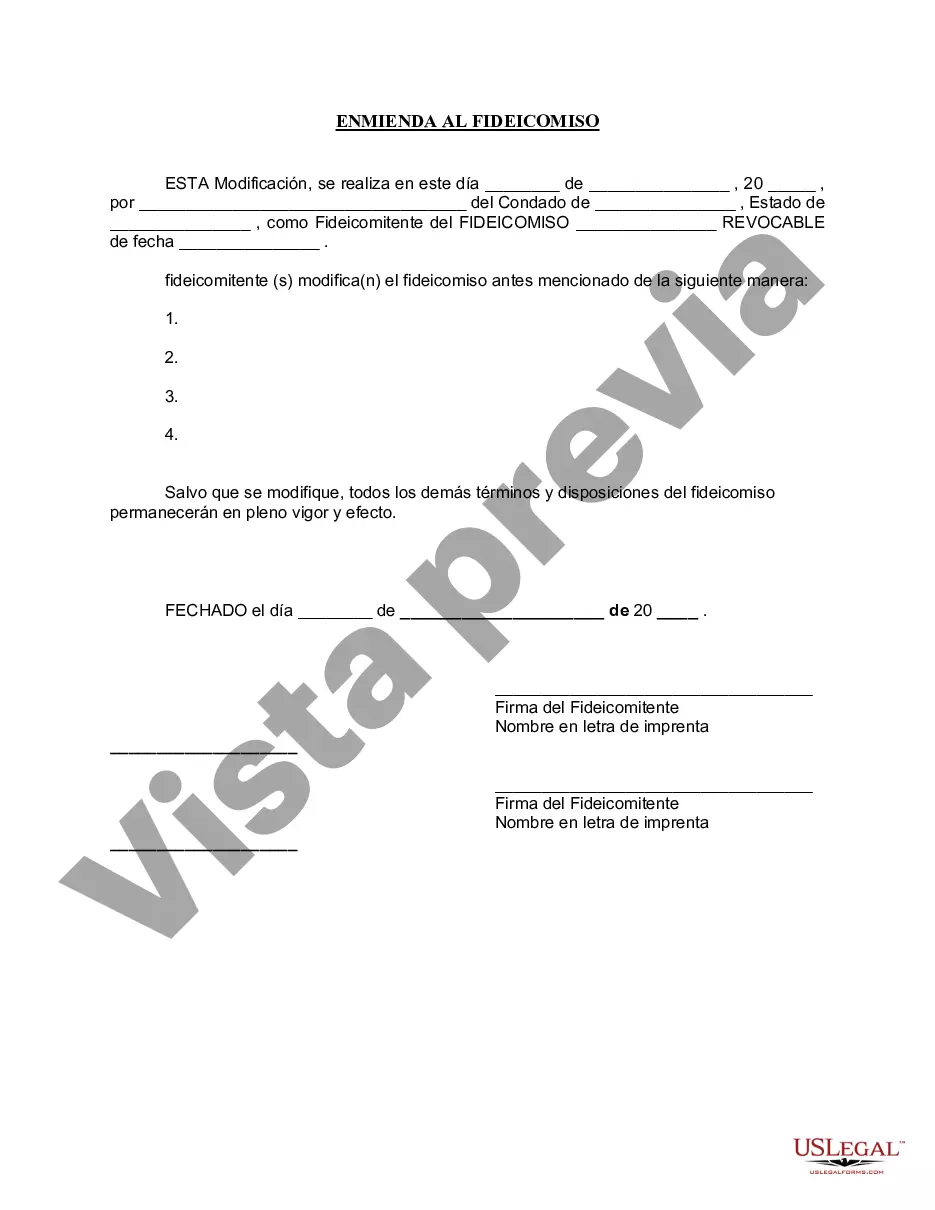

Formulario para modificar un fideicomiso en vida.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés.

For your convenience, the complete English version of this form is attached below the Spanish version.

Free preview