Kentucky Divorce And 401k - Kentucky Divorce Worksheet and Law Summary for Contested or Uncontested Case of over 25 pages - Ideal Client Interview Form

State:

Kentucky

Control #:

KY-080-D

Format:

Word

Instant download

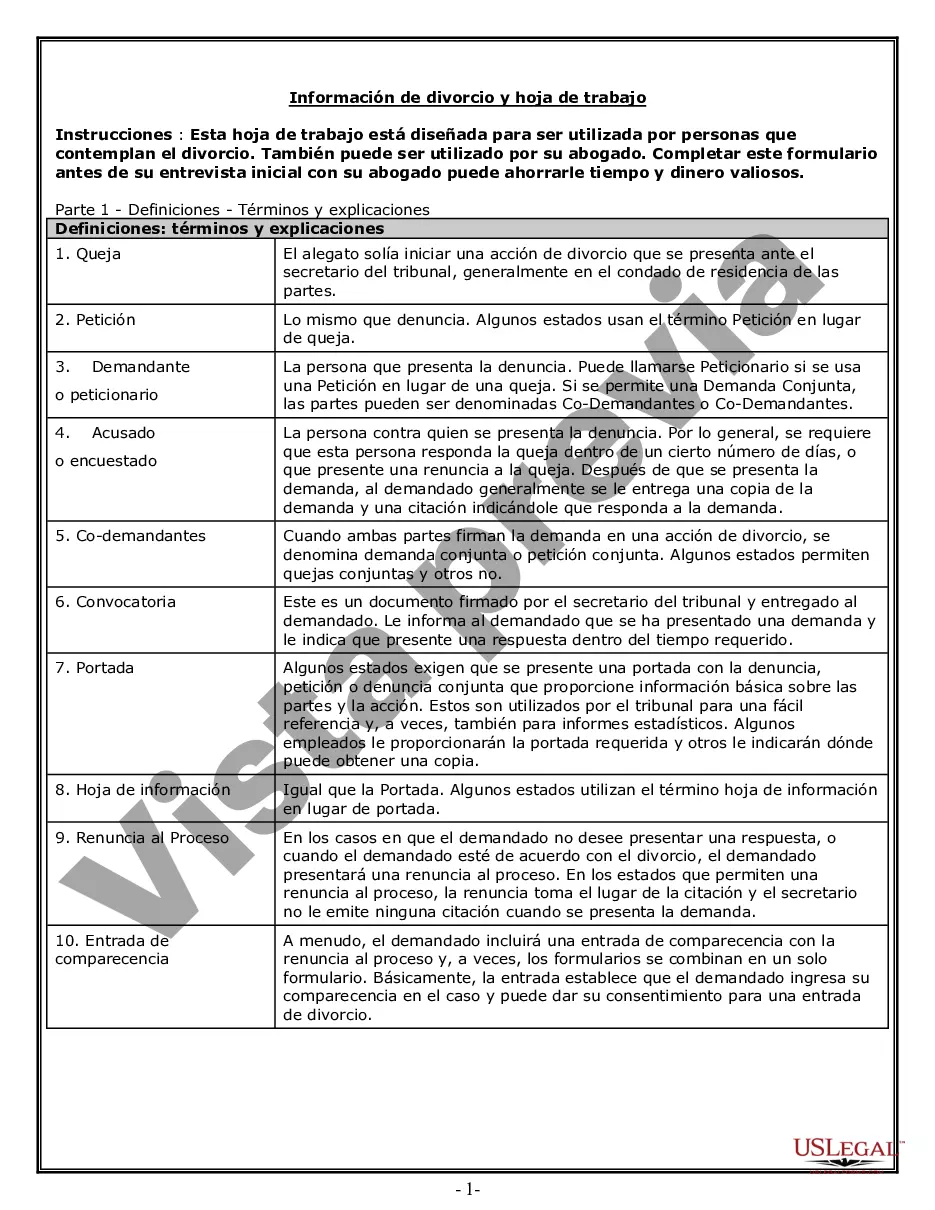

Description Kentucky Trabajo Divorcio

Hojas de trabajo y paquete de información. Impugnado o No impugnado. Formulario de entrevista de cliente ideal. Multiestado.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés.

For your convenience, the complete English version of this form is attached below the Spanish version.

Free preview Hoja Divorcio