Amendment Living Trust Sample Withdrawal - Kentucky Amendment to Living Trust

Description

Form popularity

FAQ

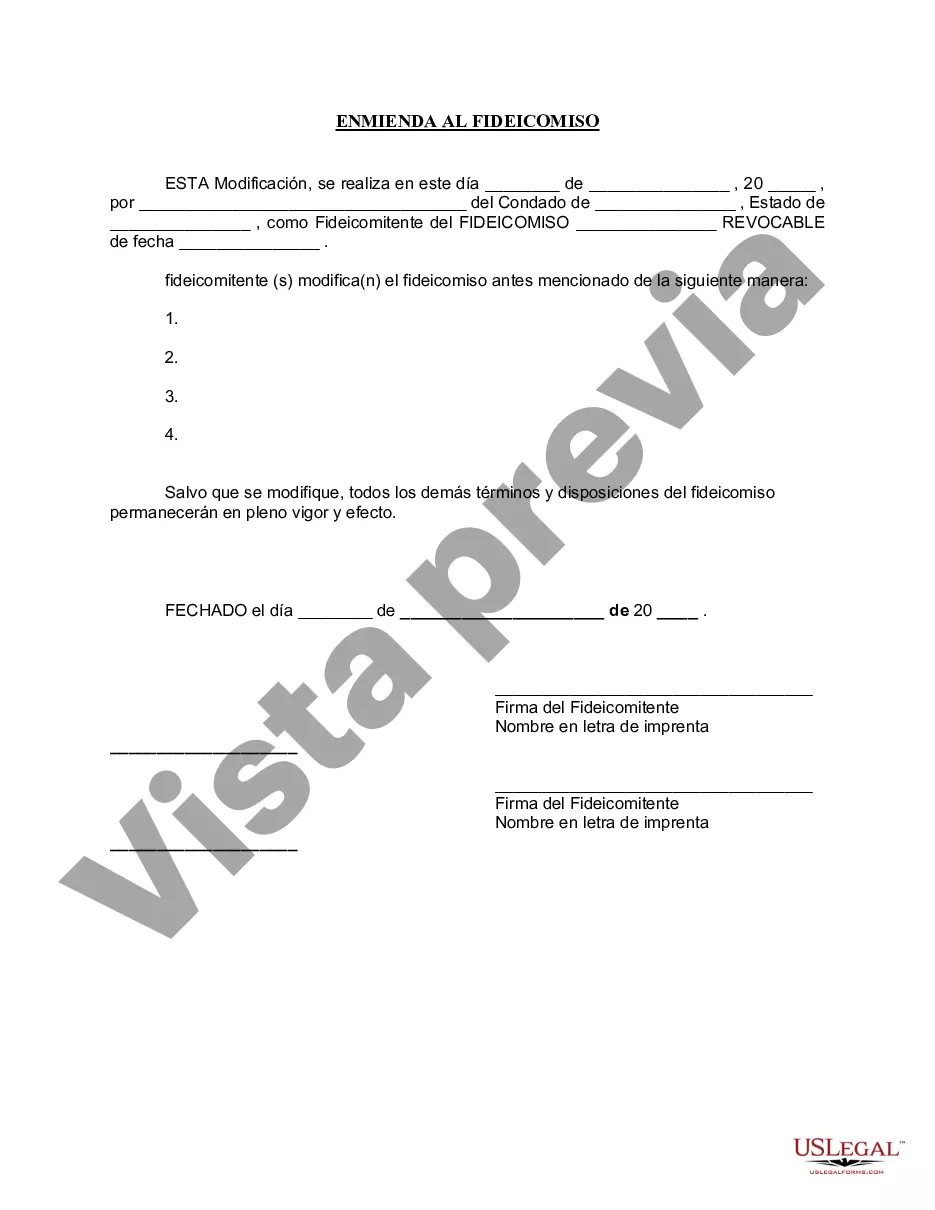

Removing someone from a living trust requires a formal amendment process. This involves drafting an amendment that specifically states the individual's removal, ensuring compliance with the Amendment living trust sample withdrawal. It is essential to follow the trustee's guidelines on this process and may require the consent of other beneficiaries. For clarity and legality, consider using resources from US Legal Forms to assist you.

Writing a codicil to a trust involves creating a document that outlines specific changes or updates to the existing trust. You should clearly state the amendments, referring explicitly to the Amendment living trust sample withdrawal for context. Be sure to follow the signing and witnessing requirements as stipulated in your state. To simplify this process, you can explore the templates available on the US Legal Forms platform.

To take distributions from a trust, the trustee must follow the guidelines set within the trust document. Typically, the process involves requesting a withdrawal from the trust and ensuring that it aligns with the terms specified in the Amendment living trust sample withdrawal. Always consult the trust's provisions to understand any specific requirements or limitations. If you need assistance navigating these details, US Legal Forms can provide reliable resources and templates.

Handwritten changes to a trust, also known as a holographic amendment, can be legal, but it depends on state laws. It's crucial to follow proper procedures, as the amendment living trust sample withdrawal may require certain formalities to be valid. Ideally, rely on a well-drafted document or amendment to avoid confusion among beneficiaries. Consulting with a legal expert ensures that your changes comply with statutory requirements.

To remove assets from a living trust, you must create a formal amendment, which acts as an amendment living trust sample withdrawal. This document should specify which assets you want to withdraw and must be signed by the trustee. Additionally, update the title or deed to reflect the changes, ensuring that the asset is officially removed from the trust. Proper documentation simplifies future management of your estate.

An amendment to a trust generally does not need to be recorded like a deed. However, it is wise to keep it with the original trust document and inform any relevant parties. If you're using an amendment living trust sample withdrawal, ensure that you follow state laws regarding documentation and updates. Proper record keeping protects your intentions and aids in clarity for beneficiaries.

Writing an amendment to a living trust requires clarity and simplicity. Start by clearly stating that you wish to amend the trust, and outline the specific changes in detail. Make sure to sign and date the amendment according to your state’s requirements to ensure its legal standing. Always keep your amendment living trust sample withdrawal organized with your original trust documents, as this helps maintain transparency.

While codicils are commonly associated with wills, you can add amendments to a trust instead. An amendment serves a similar purpose by changing specific provisions without the need to restate the entire trust. Ensure that your amendments comply with state laws to maintain the validity of your trust. This can be particularly helpful when considering an amendment living trust sample withdrawal.

To amend your own trust, you should first review the original trust document to understand the amendment process. Generally, you can create an amendment document that specifies the changes you wish to make. This document should follow your state's legal requirements for trust amendments. After drafting the amendment, keep it with your original trust documents for reference and clarity regarding your amendment living trust sample withdrawal.

Yes, you can amend your trust by yourself if you feel comfortable with the process. It's helpful to refer to an amendment living trust sample withdrawal, as it can provide critical insights and a framework for your amendment. However, if your amendments are complex or if you're uncertain about any legal implications, consulting with an attorney is a wise choice. Navigating these changes confidently can help ensure your trust functions as intended.