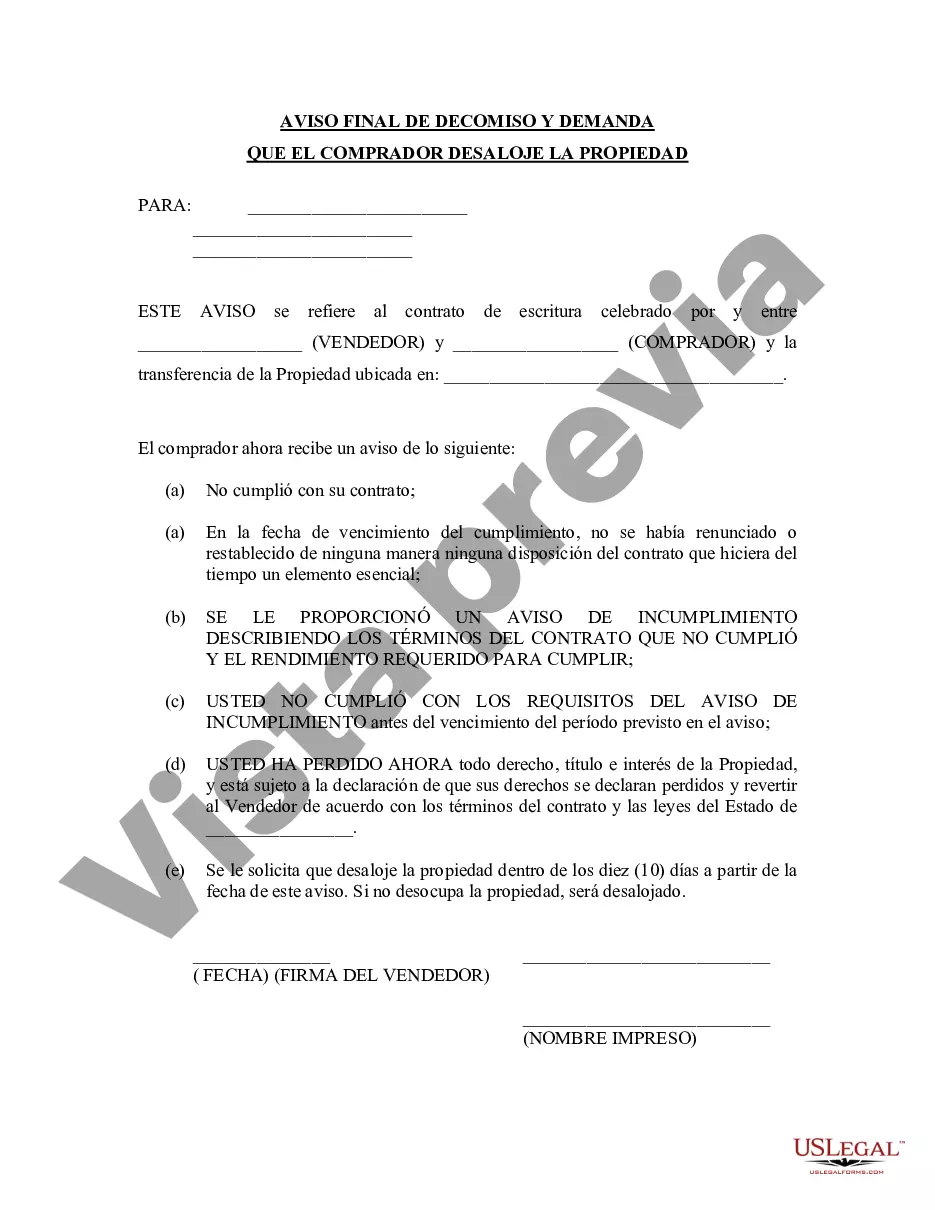

North Carolina Notice Withholding Form 2020 - North Carolina Final Notice of Forfeiture and Request to Vacate Property under Contract for Deed

Description

How to fill out North Carolina Notice Withholding Form 2020?

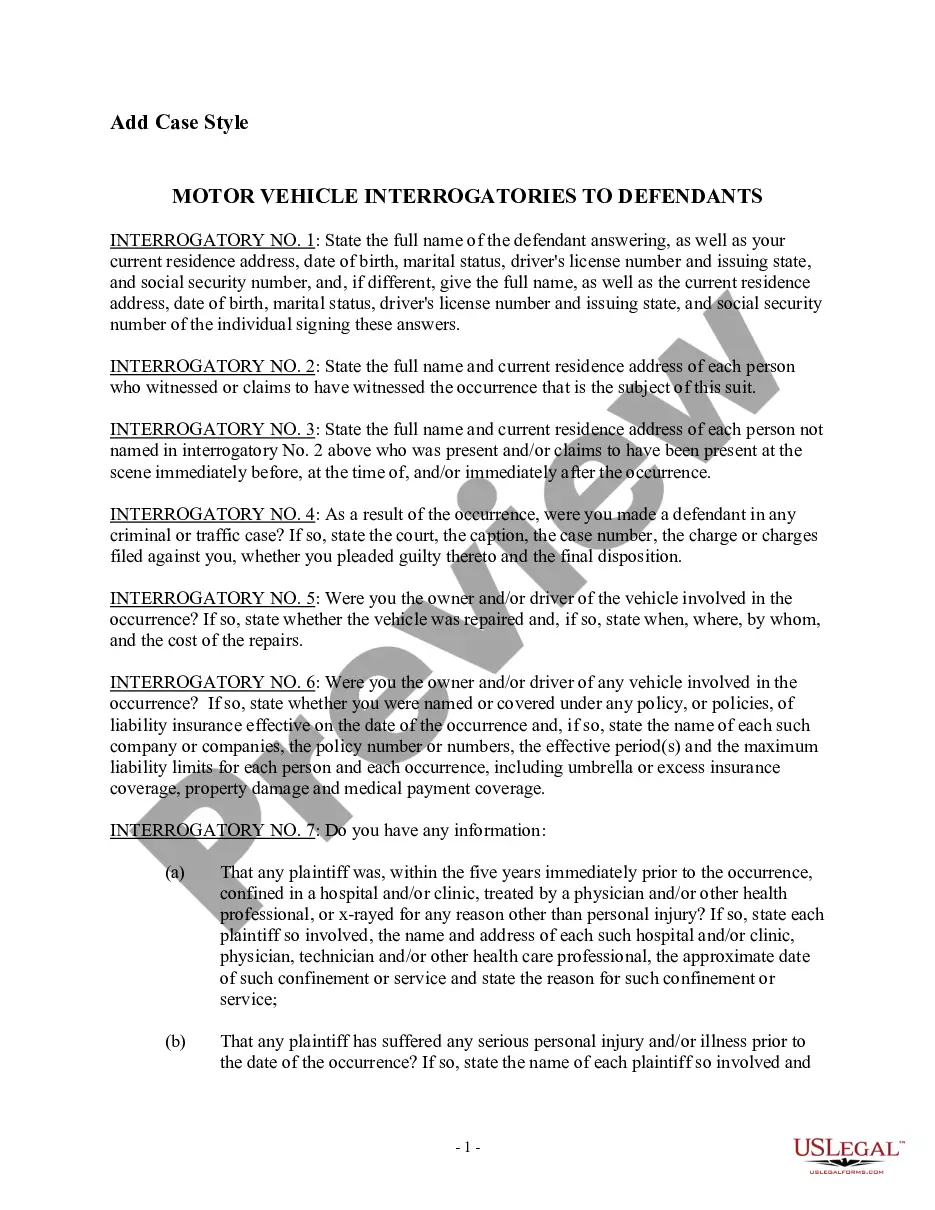

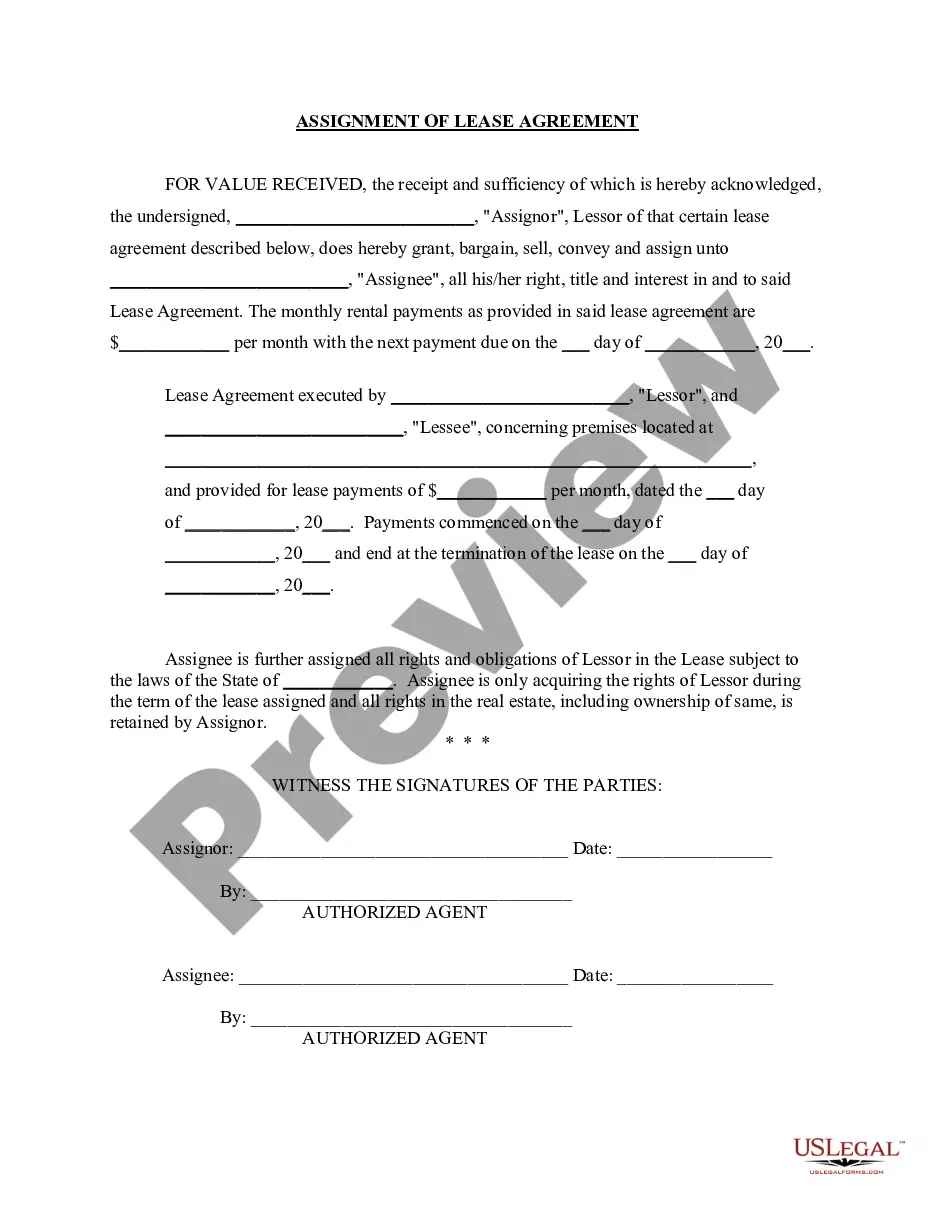

How to get professional legal papers compliant with your state laws and prepare the North Carolina Notice Withholding Form 2020 without applying to an attorney? A lot of services on the web offer templates to cover different legal occasions and formalities. Still, it may take time to determine which of the available samples fulfill both use case and juridical requirements for you. US Legal Forms is a reliable platform that helps you locate formal papers composed according to the most recent state law updates and save money on juridical assistance.

US Legal Forms is not a standard web catalog. It's a collection of over 85k verified templates for various business and life situations. All papers are organized by field and state to make your search process faster and more hassle-free. Additionally, it integrates with powerful tools for PDF editing and electronic signature, enabling users with a Premium subscription to rapidly fill out their documentation online.

It takes minimum effort and time to obtain the required paperwork. If you already have an account, log in and make sure your subscription is valid. Download the North Carolina Notice Withholding Form 2020 using the related button next to the file name. In case you don't have an account with US Legal Forms, then follow the instruction below:

- Look through the web page you've opened and check if the form fits your needs.

- To do this, utilize the form description and preview options if available.

- Search for another sample in the header providing your state if necessary.

- Click the Buy Now button when you find the appropriate document.

- Select the best suitable pricing plan, then log in or pregister for an account.

- Opt for the payment method (by credit card or via PayPal).

- Choose the file format for your North Carolina Notice Withholding Form 2020 and click Download.

The acquired documents remain in your possession: you can always return to them in the My Forms tab of your profile. Join our library and prepare legal documents by yourself like an experienced legal professional!

Form popularity

FAQ

Absolutely, North Carolina has a designated state tax withholding form. This is essential for employees in determining the correct amount to withhold from their paychecks. For clarity and compliance, make sure you understand how the North Carolina notice withholding form 2020 works in conjunction with this required paperwork.

North Carolina does have an AW-4 form, which is a specific withholding allowance certificate. This form allows employees to claim their withholding allowances for state purposes. Making sure you use the proper AW-4 along with the North Carolina notice withholding form 2020 can streamline your tax process.

Yes, North Carolina offers a state withholding form that is crucial for income tax purposes. This form is necessary for employers to report the amount of state tax withheld from employee wages. Utilize the North Carolina notice withholding form 2020 for an efficient way of fulfilling your tax obligations.

The NC5 form is specifically used for reporting North Carolina income tax withheld from employees' wages. Employers must submit this form regularly to report the tax amounts withheld. Understanding how to fill out this form accurately is important for compliance, especially alongside the North Carolina notice withholding form 2020.

You can contact N.C. withholding by visiting the North Carolina Department of Revenue's website, where you will find resources and information on how to get assistance. They provide phone numbers and email contact options as well. Take advantage of these services to clarify any uncertainties regarding the North Carolina notice withholding form 2020.

Choosing between N.C. 4EZ and NC-4 depends on your specific financial situation. If you have more straightforward withholding needs, N.C. 4EZ could be suitable. However, if you need to account for multiple income sources or deductions, the NC-4 form may offer the detail you require. It’s important to get the right form submitted alongside the North Carolina notice withholding form 2020.

Yes, North Carolina does impose a state payroll tax. Employers are required to withhold these taxes from employees’ wages. This is essential for funding state services and programs. To ensure compliance, make sure to understand the North Carolina notice withholding form 2020 and its implications.

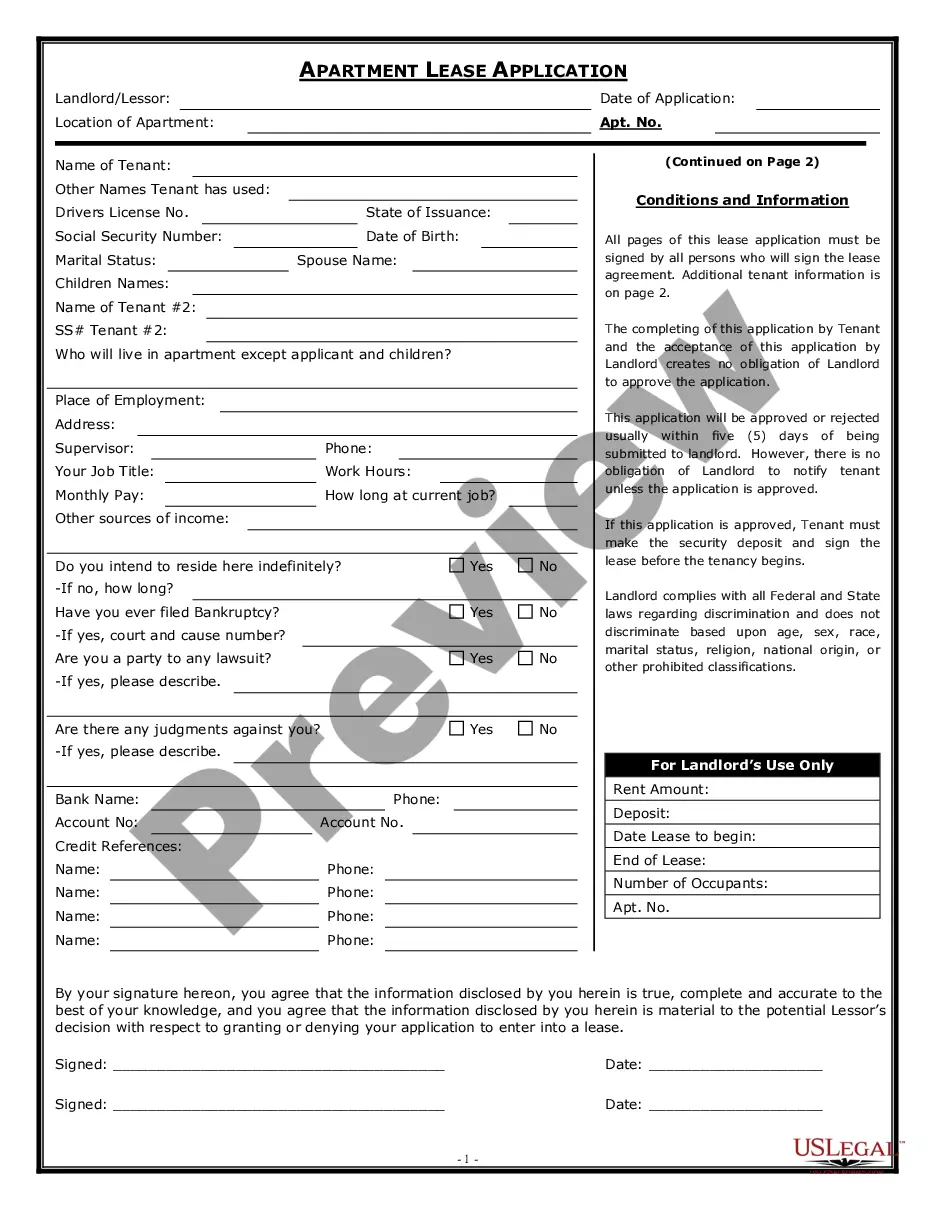

When filling out your tax withholding form, such as the North Carolina Notice Withholding Form 2020, carefully follow the instructions provided. Indicate your filing status and exemptions accurately to help determine the correct withholding amount. Review each section before submission to avoid errors that could impact your tax return. Resources like US Legal Forms can aid you in completing the form accurately.

Filling out your withholding form, like the North Carolina Notice Withholding Form 2020, begins by entering personal details such as name, address, and Social Security number. Next, provide your desired withholding amount based on your financial situation. Ensuring accuracy is critical, so double-check your entries before submitting the form to your employer.

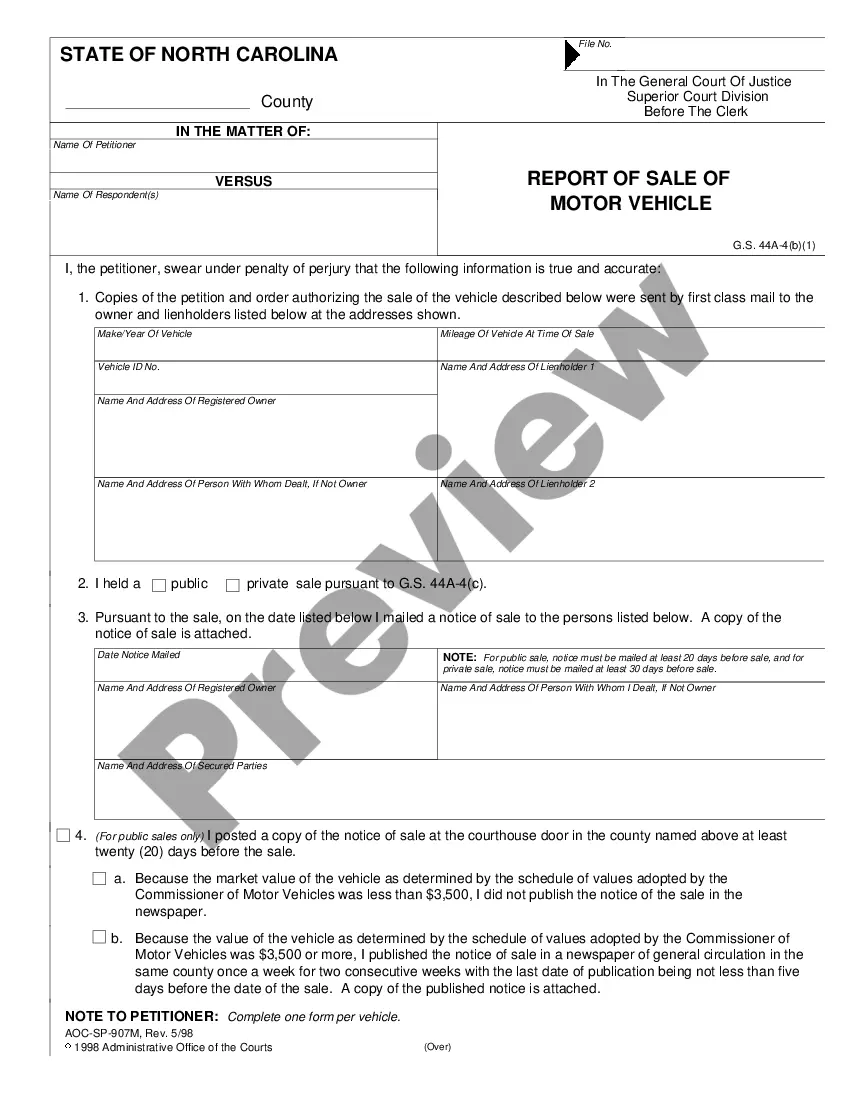

Filing NC withholding tax typically involves reporting your withheld amounts to the North Carolina Department of Revenue. Employers must submit the North Carolina Notice Withholding Form 2020 along with their payroll records. You can file online or via mail, based on the guidelines provided on the Department's website. Keeping accurate records will help streamline this process.