The North Carolina deed withholding tax rate is an important aspect of property transactions within the state. When selling real estate, the buyer is required to withhold a portion of the purchase price as a tax payment to the North Carolina Department of Revenue. This tax rate varies depending on the type of transaction and the parties involved. In North Carolina, the standard deed withholding tax rate is currently set at 4% of the total purchase price. This means that when buying property, the buyer must withhold and remit 4% of the transaction amount to the tax authorities. However, it is essential to note that there are certain circumstances where different rates and regulations may apply, leading to specific types of deed withholding taxes. Some key variations include: 1. Nonresident Withholding Tax: North Carolina imposes a higher withholding tax rate of 7% on property sales by nonresident individuals or entities. This rate applies when the seller is not a resident of the state or when the buyer is unable to ascertain the residency status of the seller. 2. Withholding Exceptions: Certain exemptions or reduced withholding rates exist for specific types of transactions. For example, transfers between family members may qualify for a reduced withholding rate of 0.2% if the property is solely used as a residence by the seller. Additionally, transactions involving low-income housing credits or federal tax credits may also have reduced withholding rates. 3. Rehabilitation Tax Credit Exception: In cases where rehabilitation tax credits are involved, the withholding requirement does not apply. This is to encourage the revitalization of historic properties or distressed areas within the state. It is crucial for buyers and sellers to carefully consider these different rates and exceptions to ensure compliance with the North Carolina deed withholding tax regulations. Failure to withhold the required amount can result in penalties and legal implications. Therefore, it is advisable to consult with a qualified tax professional or the North Carolina Department of Revenue for accurate guidance regarding specific transactions and their corresponding tax rates. Understanding the intricacies of the various North Carolina deed withholding tax rates will help facilitate smooth property transactions and ensure compliance with the state's tax laws.

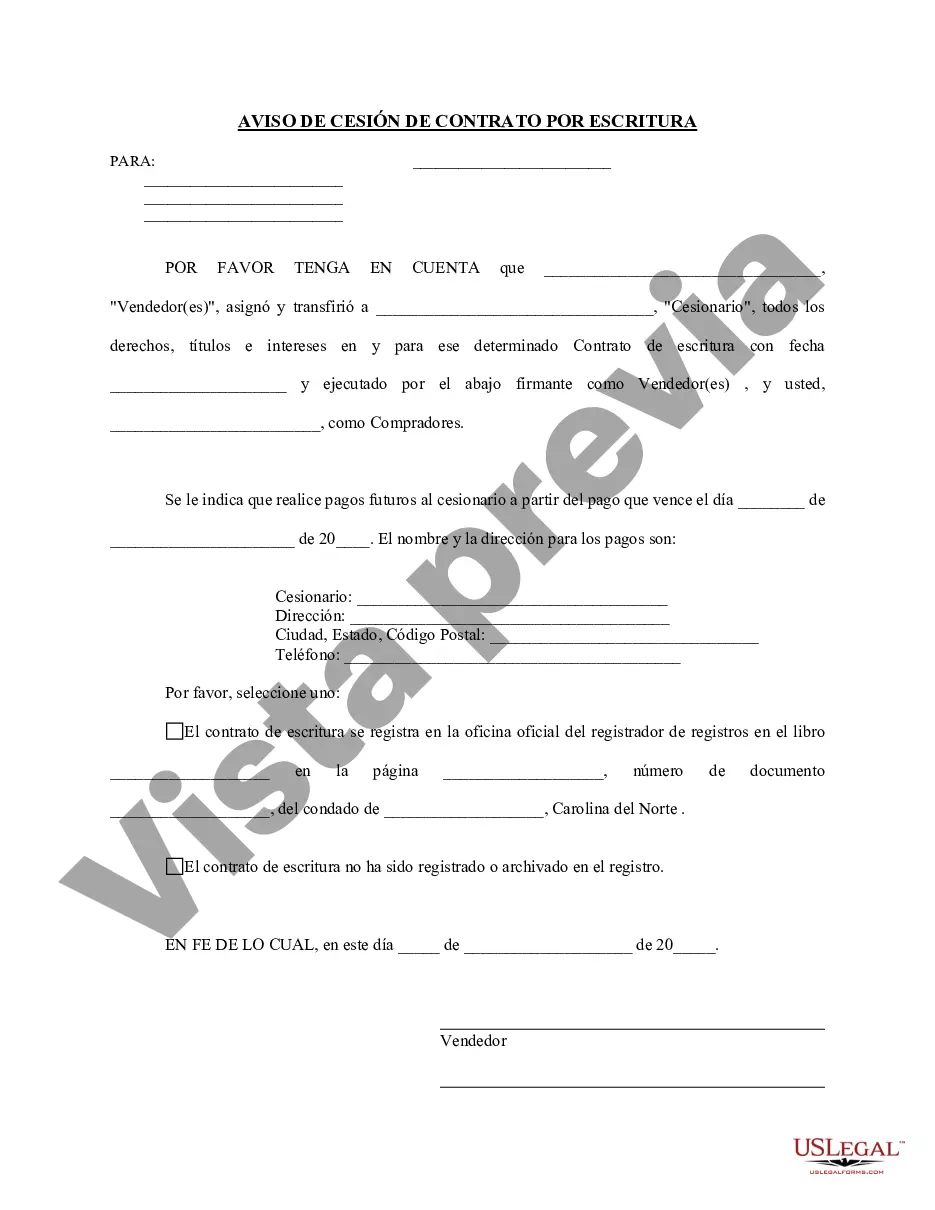

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.North Carolina Deed Withholding Tax Rate - North Carolina Notice of Assignment of Contract for Deed

Description

How to fill out North Carolina Deed Withholding Tax Rate?

Working with legal documents and operations might be a time-consuming addition to the day. North Carolina Deed Withholding Tax Rate and forms like it usually need you to look for them and navigate how to complete them appropriately. Therefore, whether you are taking care of economic, legal, or personal matters, using a thorough and convenient online catalogue of forms at your fingertips will significantly help.

US Legal Forms is the top online platform of legal templates, boasting over 85,000 state-specific forms and a number of resources that will help you complete your documents effortlessly. Check out the catalogue of pertinent papers available with just one click.

US Legal Forms offers you state- and county-specific forms offered by any moment for downloading. Safeguard your papers administration operations with a high quality service that allows you to prepare any form in minutes without extra or hidden cost. Just log in in your profile, find North Carolina Deed Withholding Tax Rate and download it straight away from the My Forms tab. You may also access formerly saved forms.

Could it be the first time utilizing US Legal Forms? Register and set up your account in a few minutes and you will have access to the form catalogue and North Carolina Deed Withholding Tax Rate. Then, stick to the steps listed below to complete your form:

- Be sure you have found the proper form using the Review option and looking at the form information.

- Pick Buy Now as soon as ready, and choose the monthly subscription plan that suits you.

- Choose Download then complete, sign, and print the form.

US Legal Forms has 25 years of expertise assisting users handle their legal documents. Get the form you require right now and improve any process without having to break a sweat.