North Carolina Trust Form For Employees - North Carolina Notice of Assignment to Living Trust

State:

North Carolina

Control #:

NC-E0178F

Format:

Word

Instant download

Description

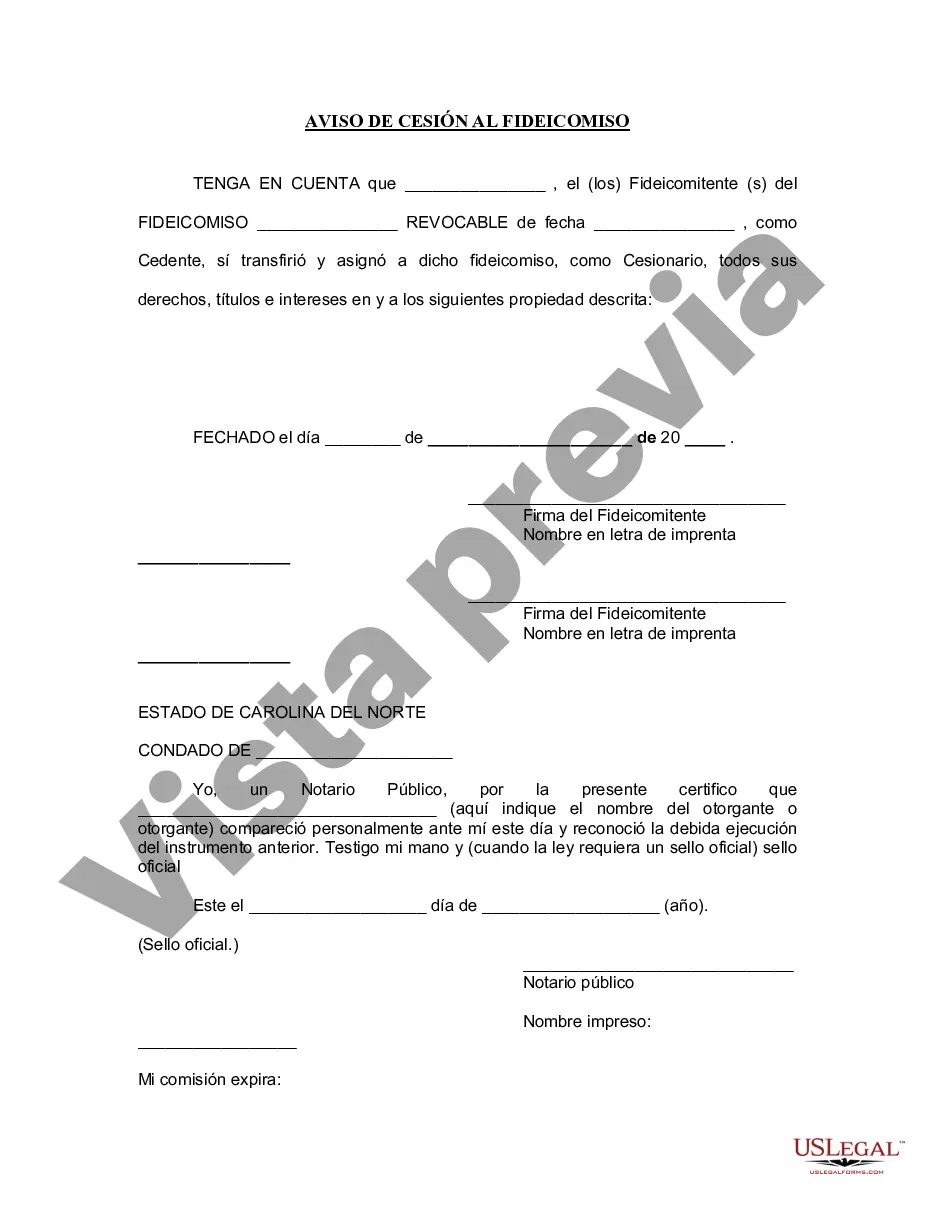

Formulario para la notificación (es decir, a los acreedores) de que ciertos bienes han sido transferidos a un fideicomiso en vida. Use uno para cada propiedad transferida.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés.

For your convenience, the complete English version of this form is attached below the Spanish version.

Free preview