North Dakota Trust Form Formula - North Dakota Financial Account Transfer to Living Trust

Description

Form popularity

FAQ

To report income from a trust, you typically use IRS Form 1041 and provide the necessary information about the income generated. Additionally, state-specific forms should be completed to comply with local regulations. For assistance in navigating these processes, the North Dakota trust form formula offers a comprehensive guide to help you through reporting.

The passthrough entity tax in North Dakota refers to taxes imposed on business entities that pass income directly to their owners or shareholders. This can include partnerships and S-corporations. Understanding how this interacts with the North Dakota trust form formula can help trusts manage their tax responsibilities effectively.

In general, a federal extension is recognized by many states, including North Dakota. However, each state may have its rules and deadlines that you must follow. To navigate these complexities smoothly, the North Dakota trust form formula provides a clear structure to help manage your filings.

Yes, North Dakota accepts federal extensions for trusts and estates. When you file for an extension federally, it generally applies to your state filing as well. By following the North Dakota trust form formula, you can ensure compliance with both federal and state requirements.

Minnesota does accept federal extensions for trusts, allowing you extra time to file without penalties. However, be mindful that the state may have specific requirements that differ from federal regulations. Utilizing the North Dakota trust form formula can help streamline your filing process across states.

Yes, IRS extensions do apply to trusts. If a trust requires additional time for filing, it can file for an extension using Form 7004. It's essential to remember that the North Dakota trust form formula follows the same procedure for obtaining an extension as individual tax returns.

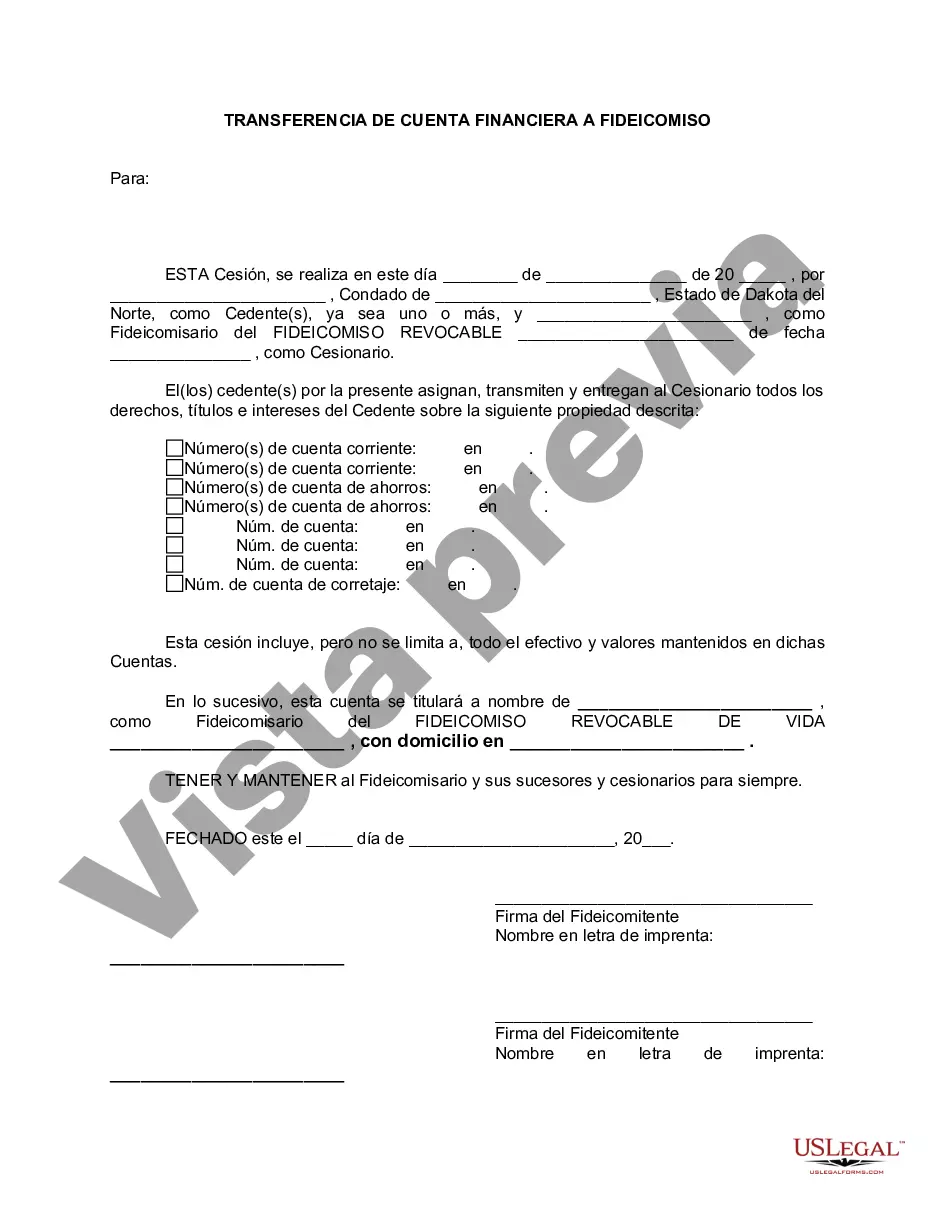

To create a valid trust in North Dakota, you must meet certain legal requirements. This includes specifying a clear purpose for the trust and identifying the trustee and beneficiaries. Additionally, your North Dakota trust form formula should comply with state laws. Ensuring these elements are in place can help you establish a trust that serves your needs effectively.

Setting up a trust in North Dakota involves several steps. First, decide on the type of trust that suits your needs. Next, complete a North Dakota trust form formula, detailing the trustee, beneficiaries, and assets. For convenience and accuracy, consider using platforms like uslegalforms, which provide comprehensive templates to guide you through the process.

Yes, North Dakota accepts federal extensions for trusts, allowing you additional time to file. However, it's essential to understand the specific requirements that apply. Making sure that you accurately utilize the North Dakota trust form formula can help streamline this process. Consulting a professional can further aid in navigating these regulations.

Many parents overlook the importance of updating their trust fund as life circumstances change. Failing to revise the beneficiaries or adjust assets can lead to unintended consequences. It’s vital to clearly communicate intentions and ensure that the North Dakota trust form formula reflects current desires. Regular reviews help avoid potential disputes in the future.