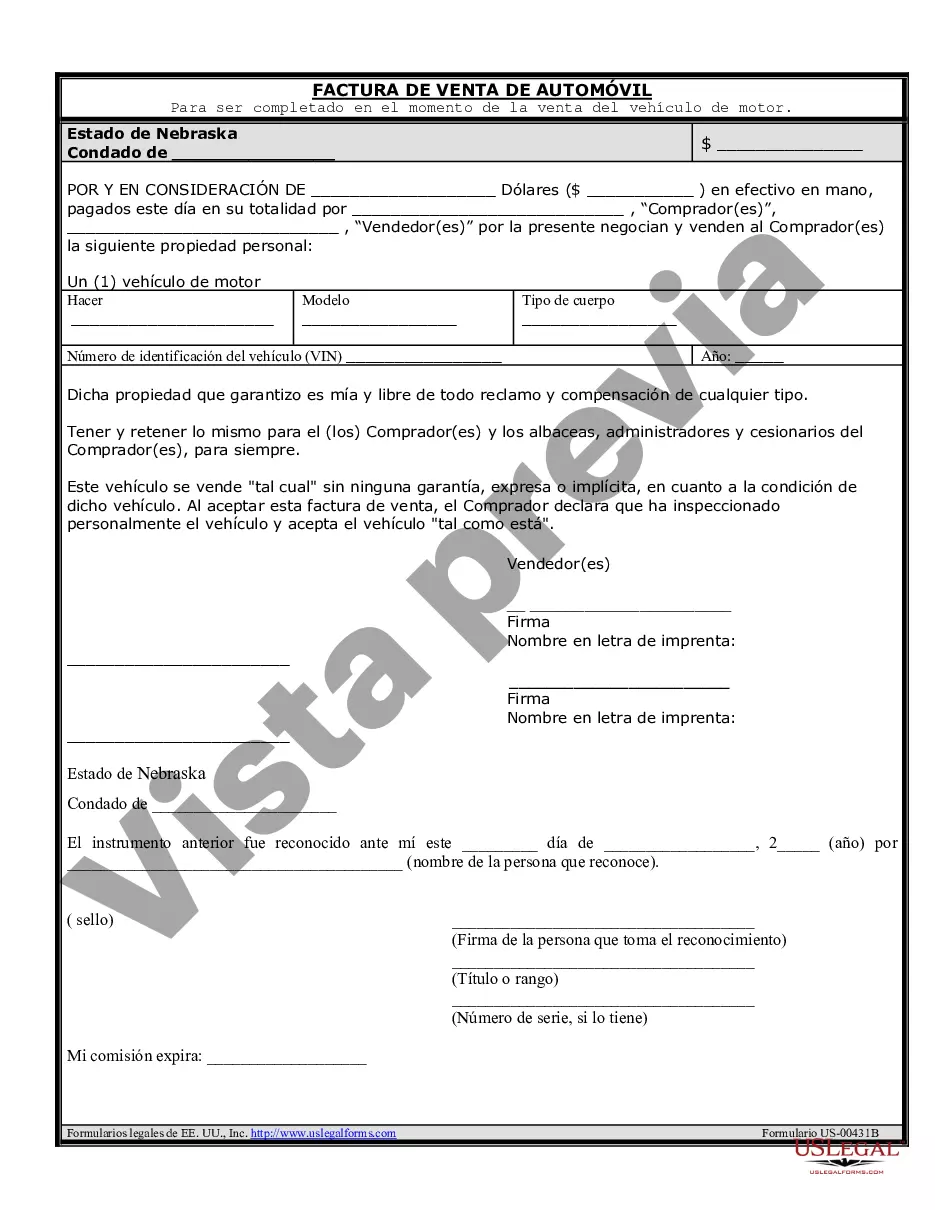

Nebraska Bill Of Sale For Car - Nebraska Bill of Sale of Automobile and Odometer Statement for As-Is Sale

Description

How to fill out Nebraska Bill Of Sale For Car?

Red tape necessitates exactness and correctness.

If you do not engage in filling out documents like the Nebraska Bill Of Sale For Car on a daily basis, it may result in some misunderstanding.

Choosing the appropriate example from the outset will guarantee that your document submission will proceed smoothly and avert any troubles of resubmitting a file or having to redo the work entirely from the beginning.

If you are not a subscribed user, locating the necessary example will require a few additional steps.

- You can always acquire the right example for your documentation in US Legal Forms.

- US Legal Forms is the largest online collection of forms that holds over 85 thousand examples across various fields.

- You can access the latest and most pertinent edition of the Nebraska Bill Of Sale For Car by simply navigating through the website.

- Find, store, and save templates in your profile or verify with the description to ensure you have the appropriate one available.

- With an account at US Legal Forms, it is simple to gather, store in one spot, and browse the templates you save for easy access in a few clicks.

- When on the website, click the Log In/">Log In button to verify your identity.

- Then, visit the My documents page, where your document history is stored.

- Review the descriptions of the forms and save the ones you require whenever needed.

Form popularity

FAQ

Nebraska requires a bill of sale to be filled out by the buyer and the seller for private vehicle purchases. The official form for this is form 6 which records information like the purchase price, the odometer reading, and the VIN of the vehicle in question.

The Seller must also provide the buyer with a Bill of Sale or a completed Nebraska Department of Revenue Form 6 Nebraska Sales/Use Tax and Tire Fee Statement for Motor Vehicle And Trailer Sales.

How Do I Write a Nebraska Bill of Sale?Their names (printed)The date of the bill of sale.Certain information about the item being sold.The amount the item was sold for.The signatures of the involved parties.In some instances, the bill of sale may also need to be notarized.

Nebraska Bill of Sale RequirementsYou can use the form the state of Nebraska provides, or you can draft your own.