New Mexico Residential Estate Withholding Tax: Everything You Need to Know In New Mexico, residential estate transactions are subject to a withholding tax to ensure compliance with the state's tax laws. The New Mexico residential estate withholding tax aims to collect any unpaid tax liabilities associated with the sale or transfer of residential real estate properties. It is crucial for homebuyers and sellers to understand this tax to avoid any unexpected financial obligations during real estate transactions. Types of New Mexico Residential Estate Withholding Tax: 1. Withholding Tax on Franchise Tax Liability: Homebuyers or transferees must withhold and remit a portion of the sale proceeds when acquiring a residential property from a nonresident seller. The withholding rate is 3% of the purchase price or appraised value, whichever is higher. This amount is submitted to the New Mexico Taxation and Revenue Department (TRY) as an estimated payment towards the seller's potential state income tax obligations. 2. Withholding Tax on Pass-Through Entity Income: In cases where the seller is a pass-through entity, such as a partnership, limited liability company (LLC), or S-corporation, the buyer is required to withhold a portion of the sale proceeds and submit it to the TRY. The withholding rate is again 3% of the purchase price or appraised value, whichever is higher. 3. Voluntary Withholding Tax Agreement: Under certain circumstances, sellers may choose to enter into a Voluntary Withholding Tax Agreement with the TRY. This agreement allows the seller to voluntarily withhold a specific amount from the sale proceeds. This amount is then remitted to the TRY to fulfill their state income tax obligations. The voluntary withholding tax agreement provides an alternative to the mandatory withholding requirements. It is crucial to note that if the seller's actual tax liability is less than the withholding amount, they can file a tax return to claim a refund for the excess withholding. The seller should consult with a qualified tax professional to assess their situation and navigate the residential estate withholding tax effectively. Keywords: New Mexico, residential estate, withholding tax, franchise tax liability, pass-through entity income, Voluntary Withholding Tax Agreement, nonresident seller, tax liabilities, tax laws, homebuyers, transferees, purchase price, appraised value, Taxation and Revenue Department, state income tax obligations.

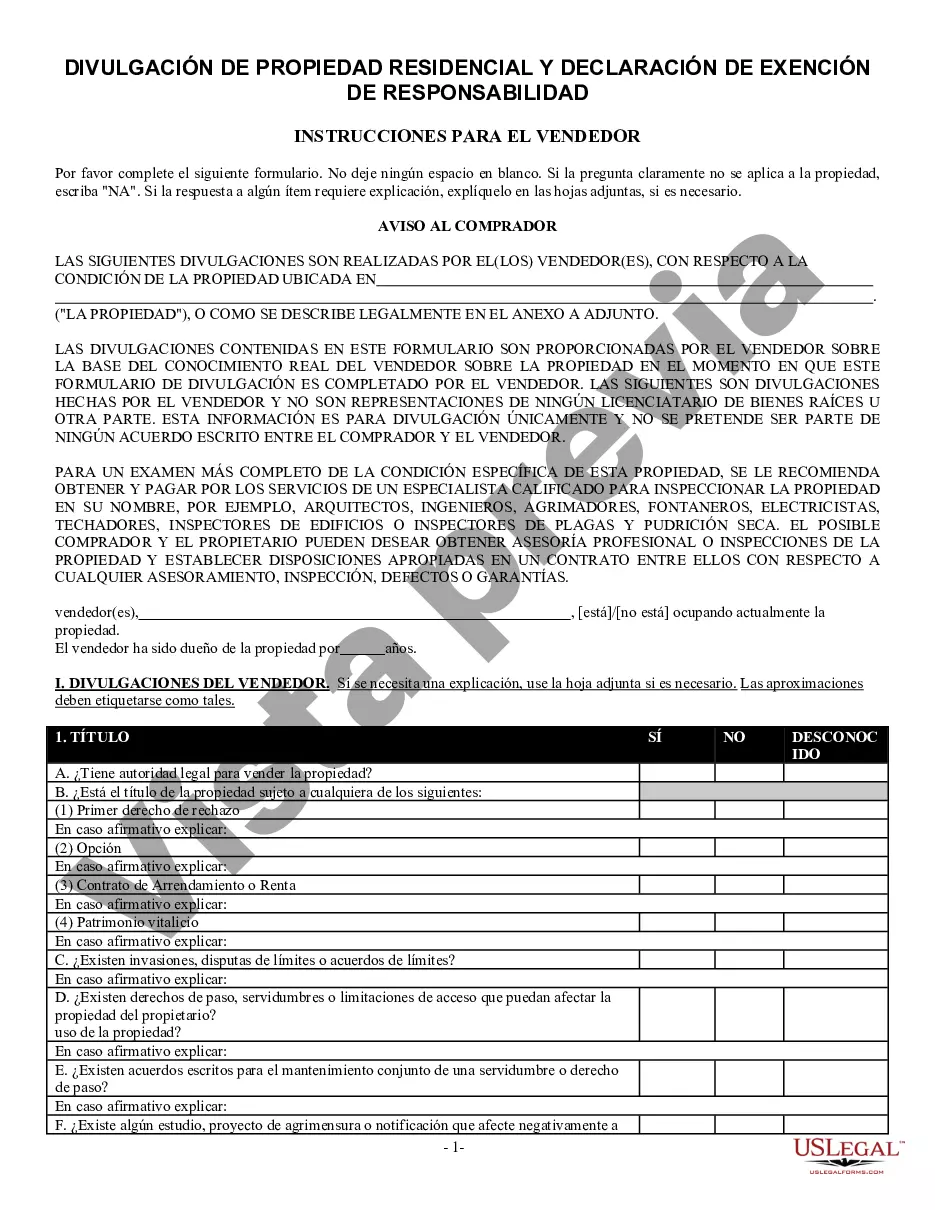

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.New Mexico Residential Estate Withholding Tax - New Mexico Residential Real Estate Sales Disclosure Statement

State:

New Mexico

Control #:

NM-37014

Format:

Word

Instant download

Description

Divulgación de Bienes Raíces para Terminación en una transacción de venta de casa.

New Mexico Residential Estate Withholding Tax: Everything You Need to Know In New Mexico, residential estate transactions are subject to a withholding tax to ensure compliance with the state's tax laws. The New Mexico residential estate withholding tax aims to collect any unpaid tax liabilities associated with the sale or transfer of residential real estate properties. It is crucial for homebuyers and sellers to understand this tax to avoid any unexpected financial obligations during real estate transactions. Types of New Mexico Residential Estate Withholding Tax: 1. Withholding Tax on Franchise Tax Liability: Homebuyers or transferees must withhold and remit a portion of the sale proceeds when acquiring a residential property from a nonresident seller. The withholding rate is 3% of the purchase price or appraised value, whichever is higher. This amount is submitted to the New Mexico Taxation and Revenue Department (TRY) as an estimated payment towards the seller's potential state income tax obligations. 2. Withholding Tax on Pass-Through Entity Income: In cases where the seller is a pass-through entity, such as a partnership, limited liability company (LLC), or S-corporation, the buyer is required to withhold a portion of the sale proceeds and submit it to the TRY. The withholding rate is again 3% of the purchase price or appraised value, whichever is higher. 3. Voluntary Withholding Tax Agreement: Under certain circumstances, sellers may choose to enter into a Voluntary Withholding Tax Agreement with the TRY. This agreement allows the seller to voluntarily withhold a specific amount from the sale proceeds. This amount is then remitted to the TRY to fulfill their state income tax obligations. The voluntary withholding tax agreement provides an alternative to the mandatory withholding requirements. It is crucial to note that if the seller's actual tax liability is less than the withholding amount, they can file a tax return to claim a refund for the excess withholding. The seller should consult with a qualified tax professional to assess their situation and navigate the residential estate withholding tax effectively. Keywords: New Mexico, residential estate, withholding tax, franchise tax liability, pass-through entity income, Voluntary Withholding Tax Agreement, nonresident seller, tax liabilities, tax laws, homebuyers, transferees, purchase price, appraised value, Taxation and Revenue Department, state income tax obligations.

Free preview

How to fill out New Mexico Residential Estate Withholding Tax?

The New Mexico Residential Estate Withholding Tax you see on this page is a reusable formal template drafted by professional lawyers in accordance with federal and local laws. For more than 25 years, US Legal Forms has provided people, companies, and attorneys with more than 85,000 verified, state-specific forms for any business and personal occasion. It’s the fastest, easiest and most reliable way to obtain the documents you need, as the service guarantees bank-level data security and anti-malware protection.

Getting this New Mexico Residential Estate Withholding Tax will take you only a few simple steps:

- Search for the document you need and review it. Look through the file you searched and preview it or review the form description to confirm it satisfies your needs. If it does not, make use of the search bar to find the appropriate one. Click Buy Now when you have located the template you need.

- Sign up and log in. Select the pricing plan that suits you and register for an account. Use PayPal or a credit card to make a quick payment. If you already have an account, log in and check your subscription to proceed.

- Get the fillable template. Select the format you want for your New Mexico Residential Estate Withholding Tax (PDF, Word, RTF) and download the sample on your device.

- Fill out and sign the paperwork. Print out the template to complete it manually. Alternatively, use an online multi-functional PDF editor to quickly and precisely fill out and sign your form with a eSignature.

- Download your papers one more time. Utilize the same document once again anytime needed. Open the My Forms tab in your profile to redownload any previously saved forms.

Subscribe to US Legal Forms to have verified legal templates for all of life’s situations at your disposal.