A factor is a person who sells goods for a commission. A factor takes possession of goods of another and usually sells them in his/her own name. A factor differs from a broker in that a broker normally doesn't take possession of the goods. A factor may be a financier who lends money in return for an assignment of accounts receivable (A/R) or other security.

Many times factoring is used when a manufacturing company has a large A/R on the books that would represent the entire profits for the company for the year. That particular A/R might not get paid prior to year end from a client that has no money. That means the manufacturing company will have no profit for the year unless they can figure out a way to collect the A/R.

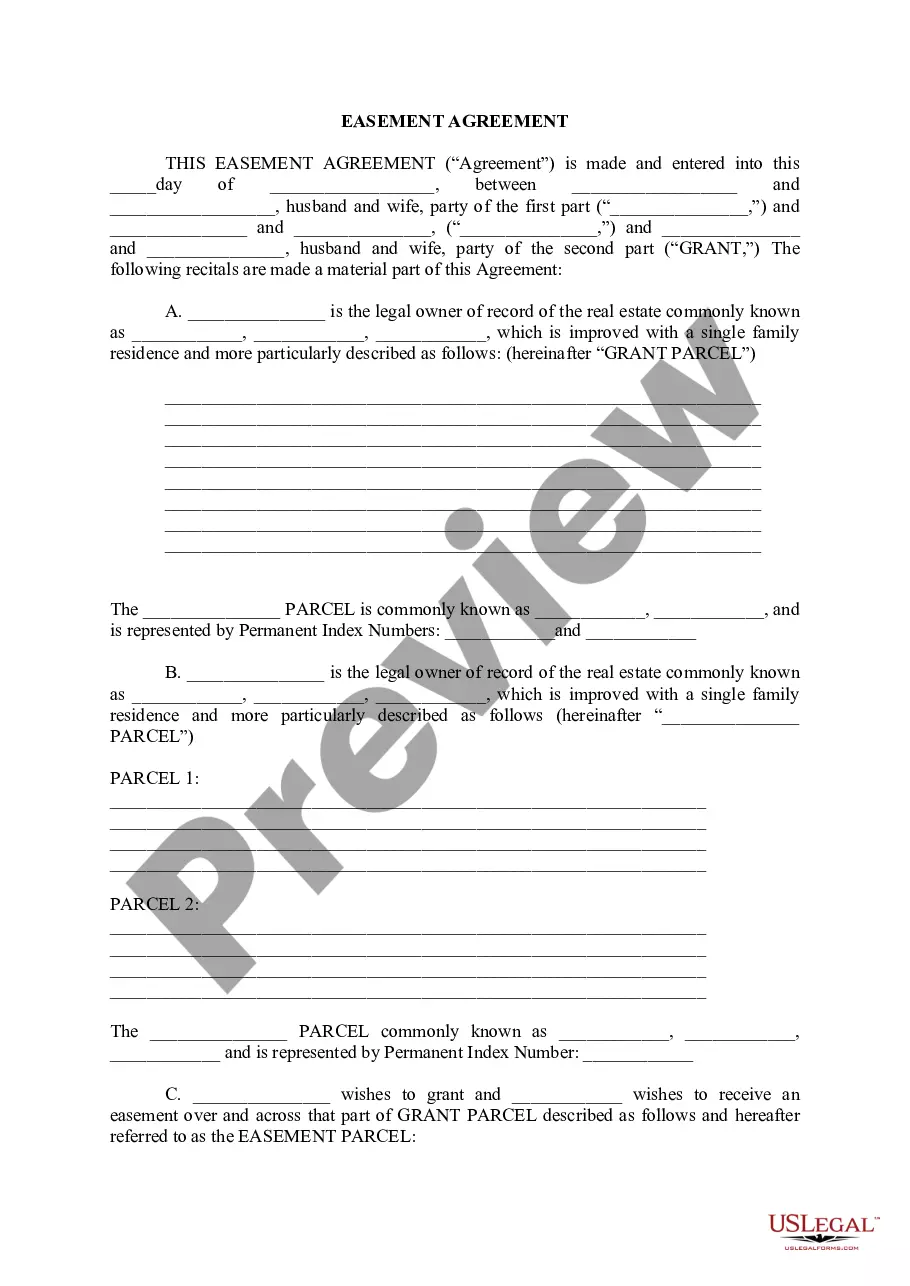

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.