Sample Letter To Irs Requesting Penalty Waiver In Collin - Sample Letter to Client to Notify of Full, Final and Absolute Release

Category:

State:

Multi-State

County:

Collin

Control #:

US-0003LTR

Format:

Word

Instant download

Description

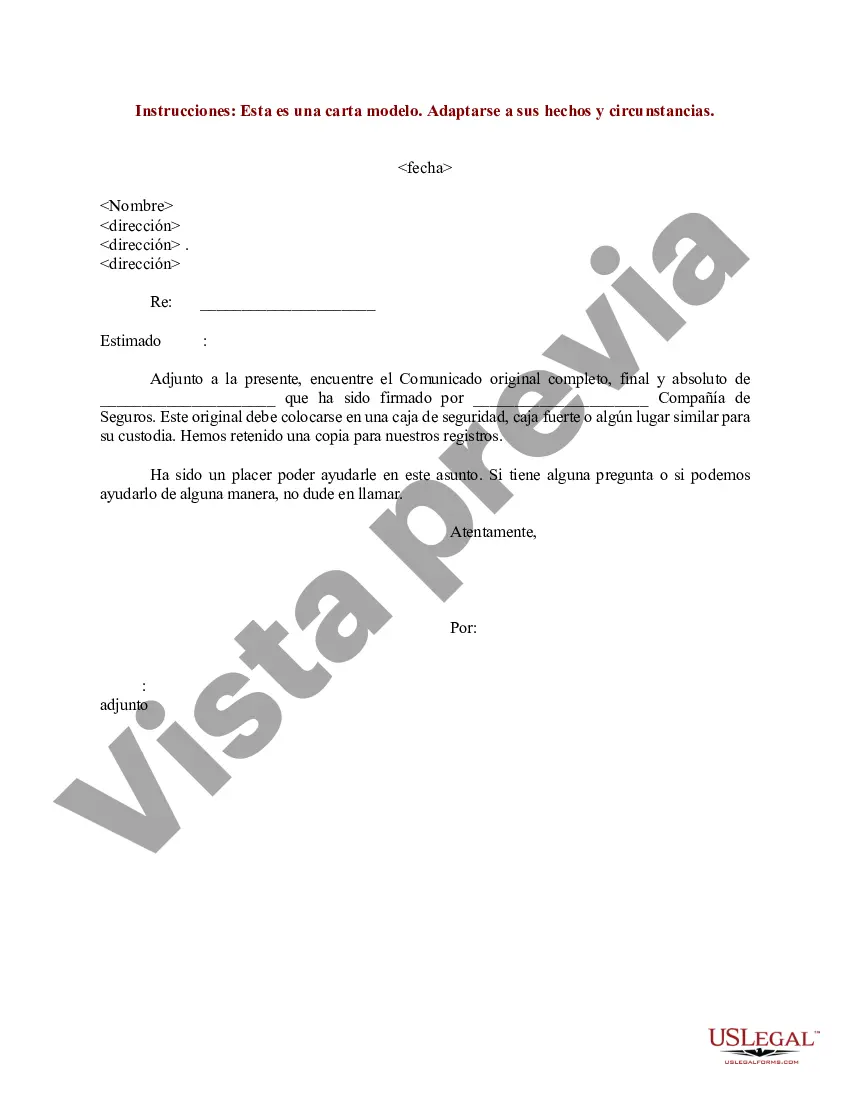

Carta al cliente de un bufete de abogados sobre la liberación total, final y absoluta firmada por una compañía de seguros.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés.

For your convenience, the complete English version of this form is attached below the Spanish version.