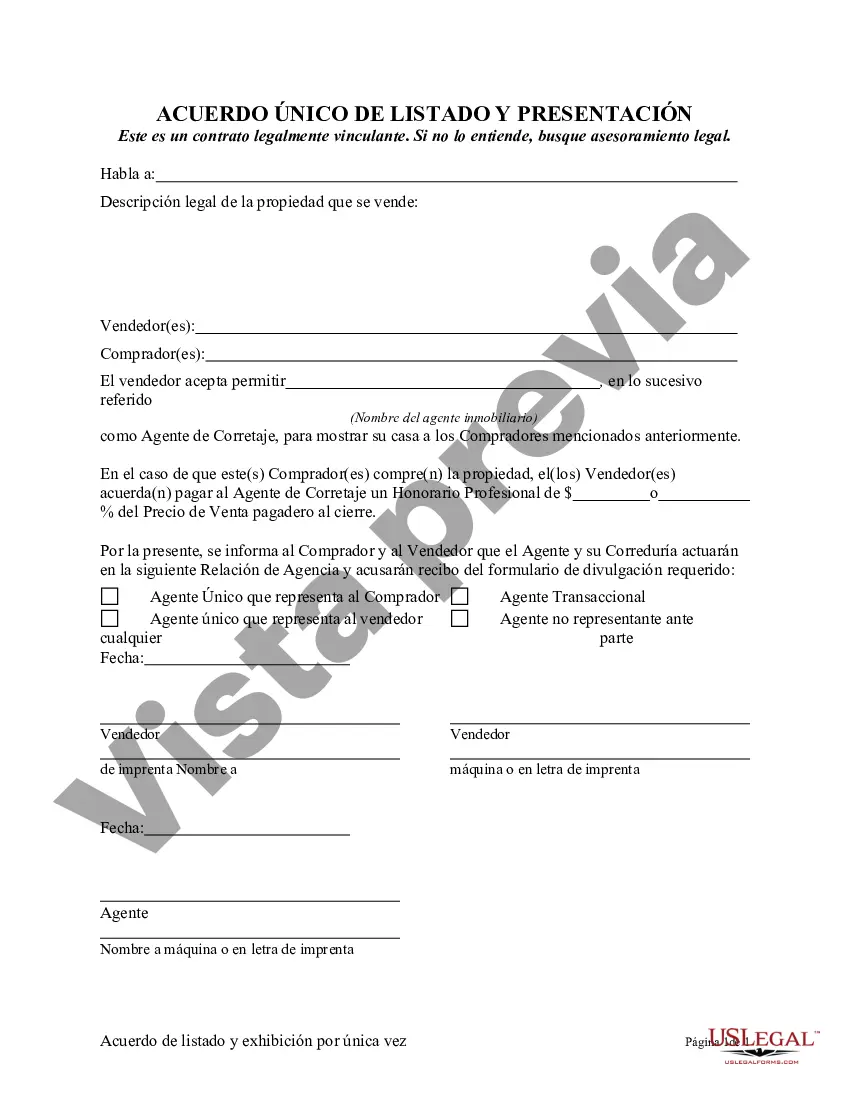

Washington State Form 17 Withholding In Travis - One Time Listing and Showing Agreement

Description

Form popularity

FAQ

How to Fill Out the W-4 Form Step 1: Basic Information. This is where you fill out the basic information on the form all about you and your personal data. Step 2: Multiple Jobs or Spouse Works. Step 3: Claim Dependents. Step 4a: Other Income (Not from Jobs) ... Step 4b: Deductions. Step 4c: Extra Withholding. Step 5: Signature.

Point of Contact Department of Revenue Washington State. 360-705-6705.

Washington's retail sales tax is made up of the state rate (6.5 percent) and the local sale tax rate. Local rates vary depending on the location. The sales tax rate for items delivered to the customer at the store location (over the counter sales) is based on the store location.

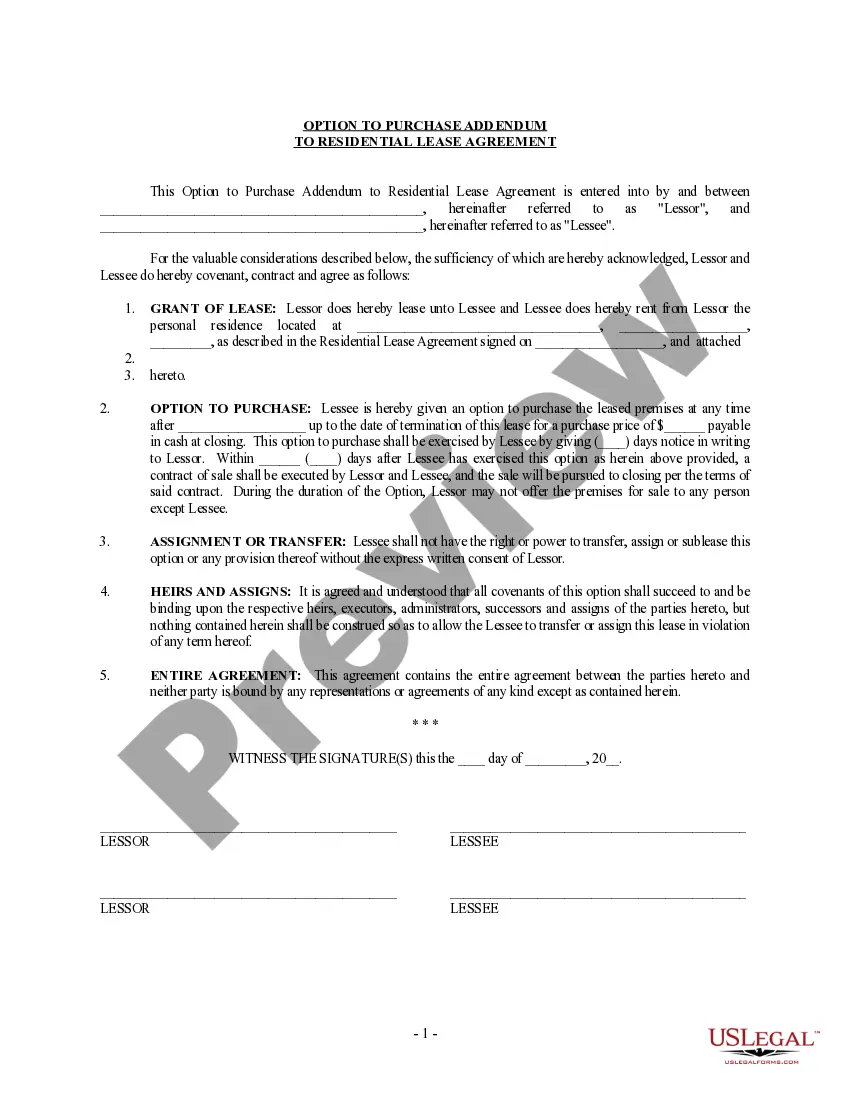

What You Need to Know about the Washington State Seller Property Disclosure – Form 17. Washington State requires sellers of residential real property to thoroughly disclose material facts on a form called the Residential Real Property Disclosure Statement (often referred to as Form 17).

How to fill out a W-4 Step 1: Enter your personal information. Fill in your name, address, Social Security number and tax filing status. Step 2: Account for multiple jobs. Step 3: Claim dependents, including children. Step 4: Refine your withholdings. Step 5: Sign and date your W-4.

Telephone Information Center Mon through Fri, 8 a.m. - 5 p.m. (PT) ... 360-705-6741 Business licensing. 360-705-6705 Tax assistance. 360-705-6706 Espaol (impuestos y licencias) 360-704-5900 Remote sales and consumer use tax. 360-534-1324 Forest tax. 360-534-1502 Claims and holder reporting.

While sellers have always been required to disclose material facts, the Form 17 has been required by law (RCW 64.06. 020) since January 1, 1995. It has undergone ten revisions since its inception, the last of which went into effect in 2021.

Why you received this call. We use an automated dialing system to call business owners who have excise tax returns that are past due. The system leaves a generic message for the business owner so that confidential taxpayer information can't be shared with the wrong person.

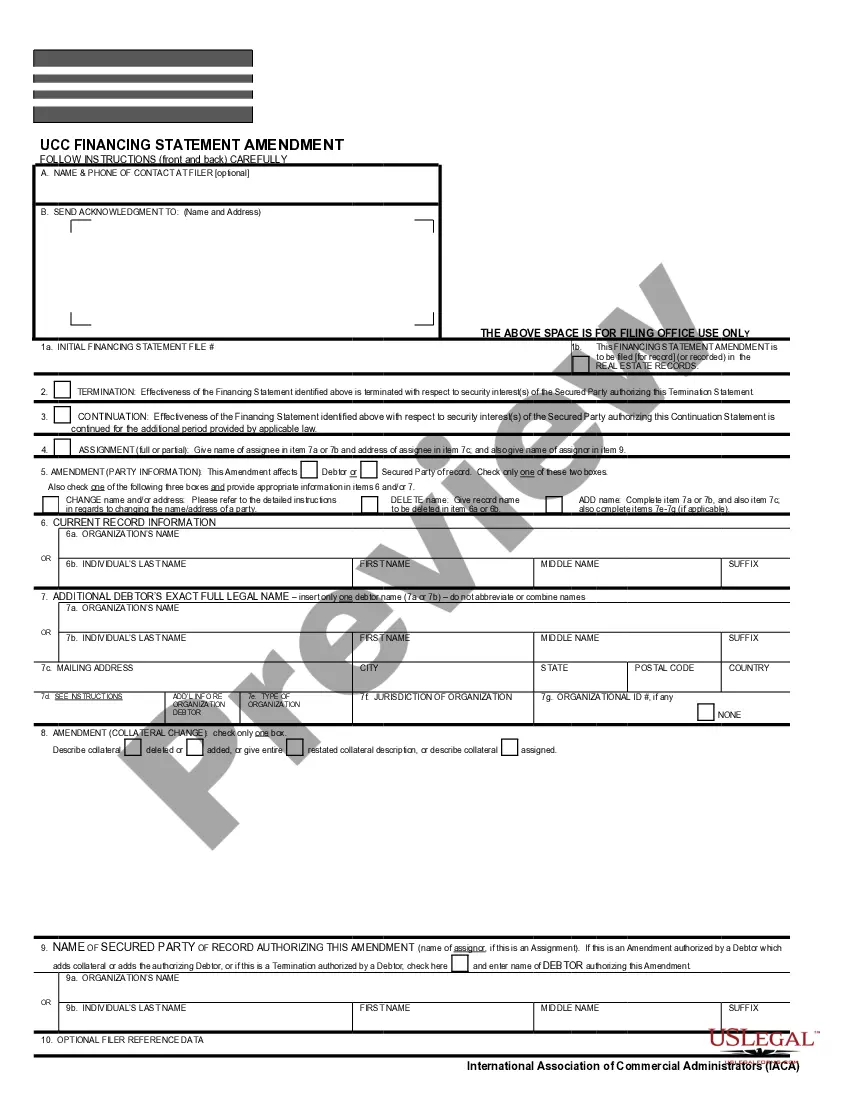

The unit represents the Department of Revenue (DOR), the state agency responsible for the administration of the state's excise tax laws. DOR also exercises overview responsibility over the administration of the state's property tax laws.

Income tax forms: The State of Washington does not have a personal or corporate Income Tax. Warning: to protect against the possibility of others accessing your confidential information, do not complete these forms on a public workstation.