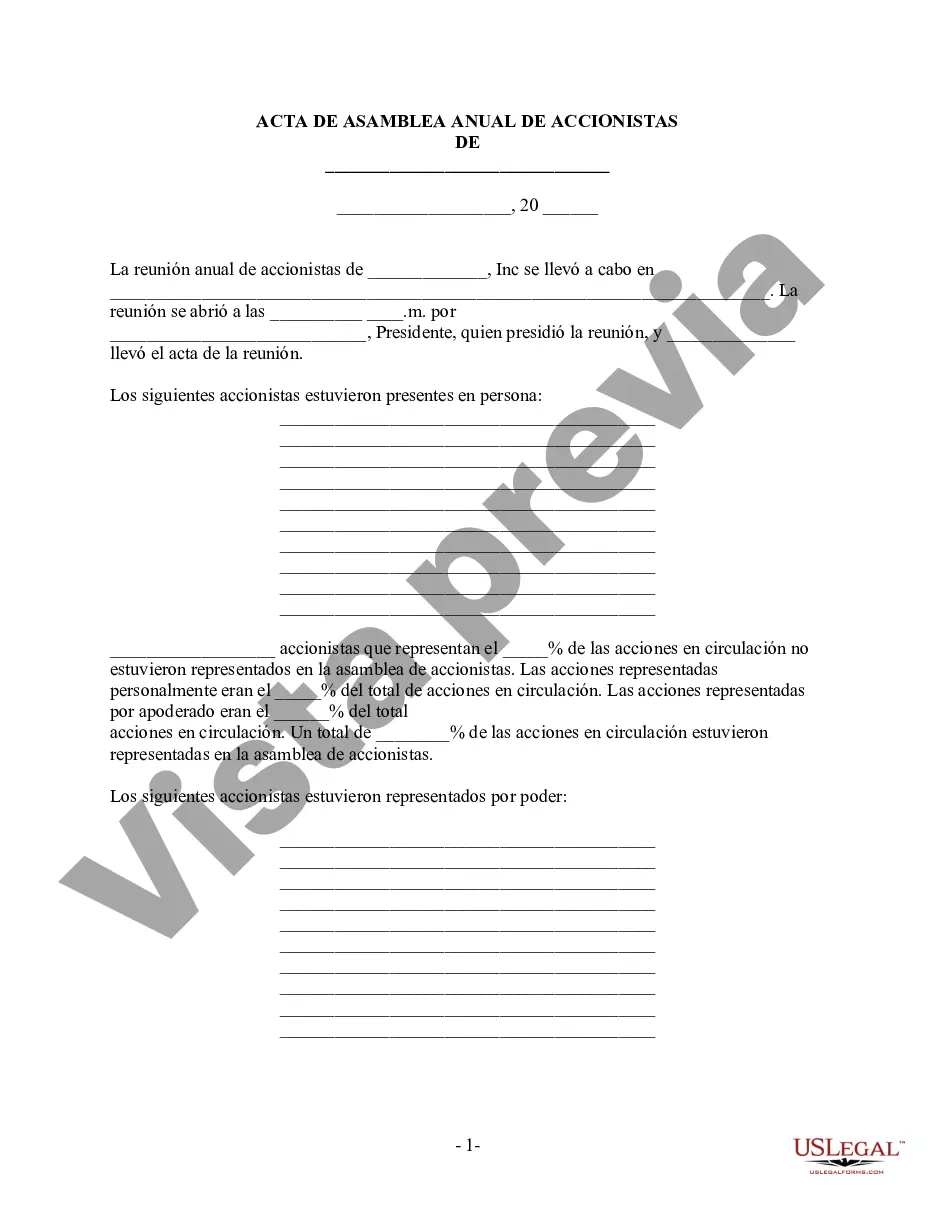

Stockholder Meeting For Private Companies In Los Angeles - Annual Stockholder Meeting Minutes - Corporate Resolutions

Description

Form popularity

FAQ

In California, executive sessions are closed-door talks that only board members, and certain other people can attend. The Davis-Stirling Act clearly says what can be discussed in private meetings. Most states require that board meetings be open to group members, so they can come and listen to the talks.

Every shareholder is given the opportunity to vote and attend meetings, but it's not a requirement. Institutional investors or those with a large position in the company may attend and vote in person. Those who choose not to attend in person but still want to make their opinion known can vote by proxy.

A private company is not required to hold an AGM, but it may choose to do so or it may have provisions in its articles of association that require it to do so. Detailed requirements as regards the convening and holding of an AGM are set out in the Companies Act 2006 (CA 2006).

California law requires ALL California corporations, even those owned by a single shareholder, to hold an annual meeting of the shareholder(s) for the purpose of electing the board of directors.

Federal and state-level laws, as well as a company's incorporation documents, require public and private corporations in the U.S. to have boards of directors (BoDs).

Annual shareholder meetings are necessary but they can be costly, ill-attended and often do not add value other than their vital purpose under corporate law.

Federal and state-level laws, as well as a company's incorporation documents, require public and private corporations—including C-corps—to have boards of directors (BoDs). Companies that are formed as LLCs (limited liability companies) do not have the same requirements, although some still choose to assemble a board.

Scheduling AGMs While not mandatory for private companies, many opt to hold their AGM, as allowed by their Memorandum of Incorporation (MOI). The first AGM must be held within 18 months of the company's incorporation, with subsequent AGMs held annually, ensuring no more than 15 months elapse between meetings.

Shareholders' meetings are held annually. The company sets a record dateThe record date is the date on which a shareholder must be registered on the books of a company in order to receive dividends or exercise a right, such as the right to vote at the general meeting of shareholders.