Law Us Legal Forms Dave Ramsey In Washington

Description

Form popularity

FAQ

Ramsey is an evangelical Christian who describes himself as conservative, both fiscally and culturally. He has blamed politics for what he considers Americans' economic dependence, and has said presidents should do "as little as possible" about the economy.

Ramsey has no professional credentials. He isn't a licensed investment advisor, nor does he possess any professional credential like the Certified Financial Planner (CFP) designation. Ramsey isn't accountable for the advice he gives.

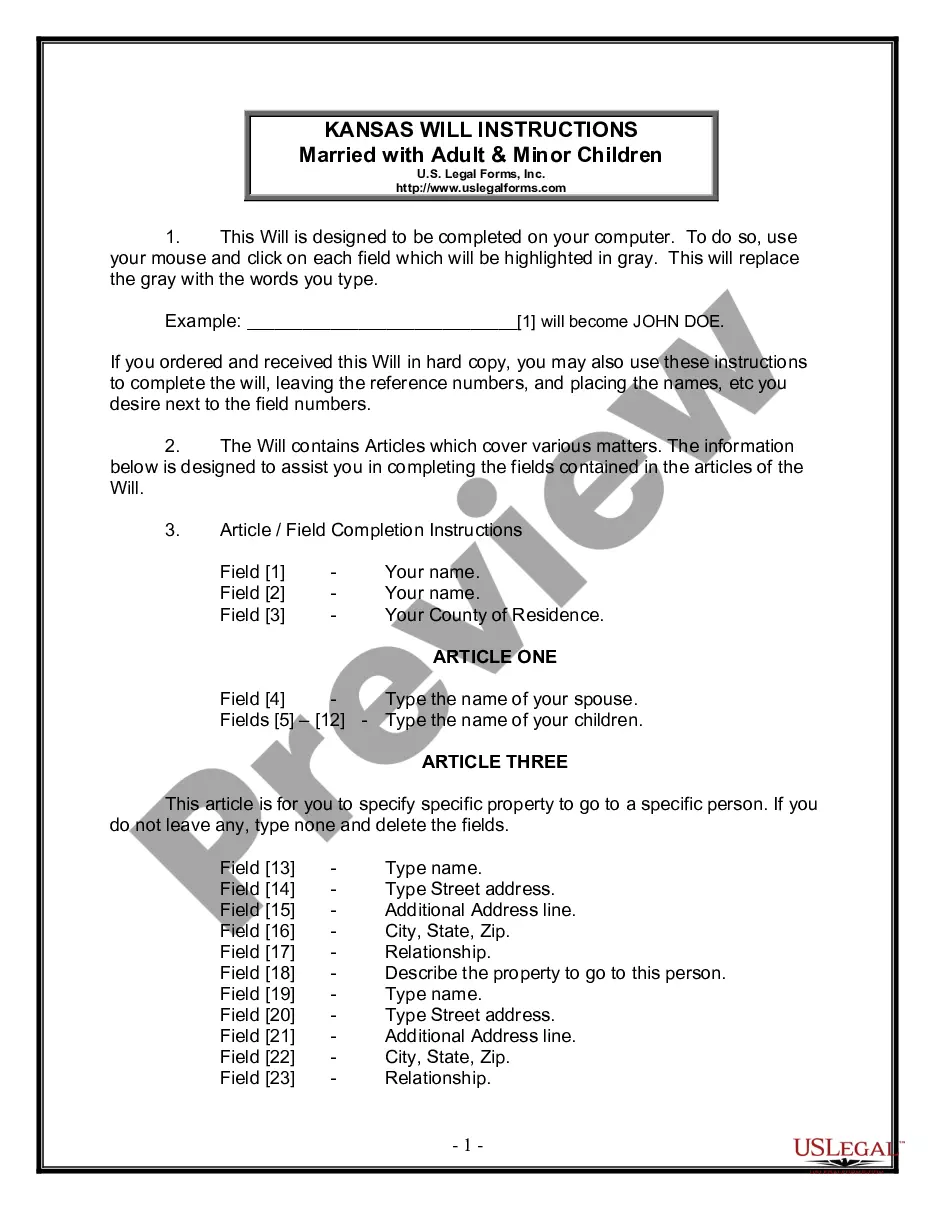

Top five mistakes when writing a Will Failing to have the Will witnessed correctly. All Wills need to be signed in the presence of two independent witnesses, who in turn must sign the document. Creating a DIY Will. Forgetting key assets. Not updating the Will after your circumstances change. Not writing one at all.

How to make a will in 10 steps Decide how you'll write your will. List your assets in your will. Decide who should receive your assets. Choose your will executor. Choose guardians for your minor children. Leave a gift to charity. Sign your will in front of witnesses to make it legally valid.

Well, Liz, I know what I own and I know who I'd like to receive that property upon my death so can I just write my own will? The short answer is yes, you can write your own will. However, every state is different with respect to the requirements for what a will must say in order to be valid.

Steps to Create a Will in Washington Decide what property to include in your will. Decide who will inherit your property. Choose an executor to handle your estate. Choose a guardian for your children. Choose someone to manage children's property. Make your will. Sign your will in front of witnesses.

To ask Ramsey a question, call in during the show at 1-888-825-5225 or send an e-mail to daveonair@daveramsey.

Will execution requirements vary by state, but in most states, you need to sign your will in front of two witnesses, who also sign. Once you do that, your will is a valid legal document — no notarization required! (Unless you live in Louisiana, of course.)

Some folks will need $10 million to have the kind of retirement lifestyle they've always dreamed about. Others can comfortably live out their golden years with a $1 million nest egg. There's no right or wrong answer here—it all depends on how you want to live in retirement!

To ask Ramsey a question, call in during the show at 1-888-825-5225 or send an e-mail to daveonair@daveramsey.