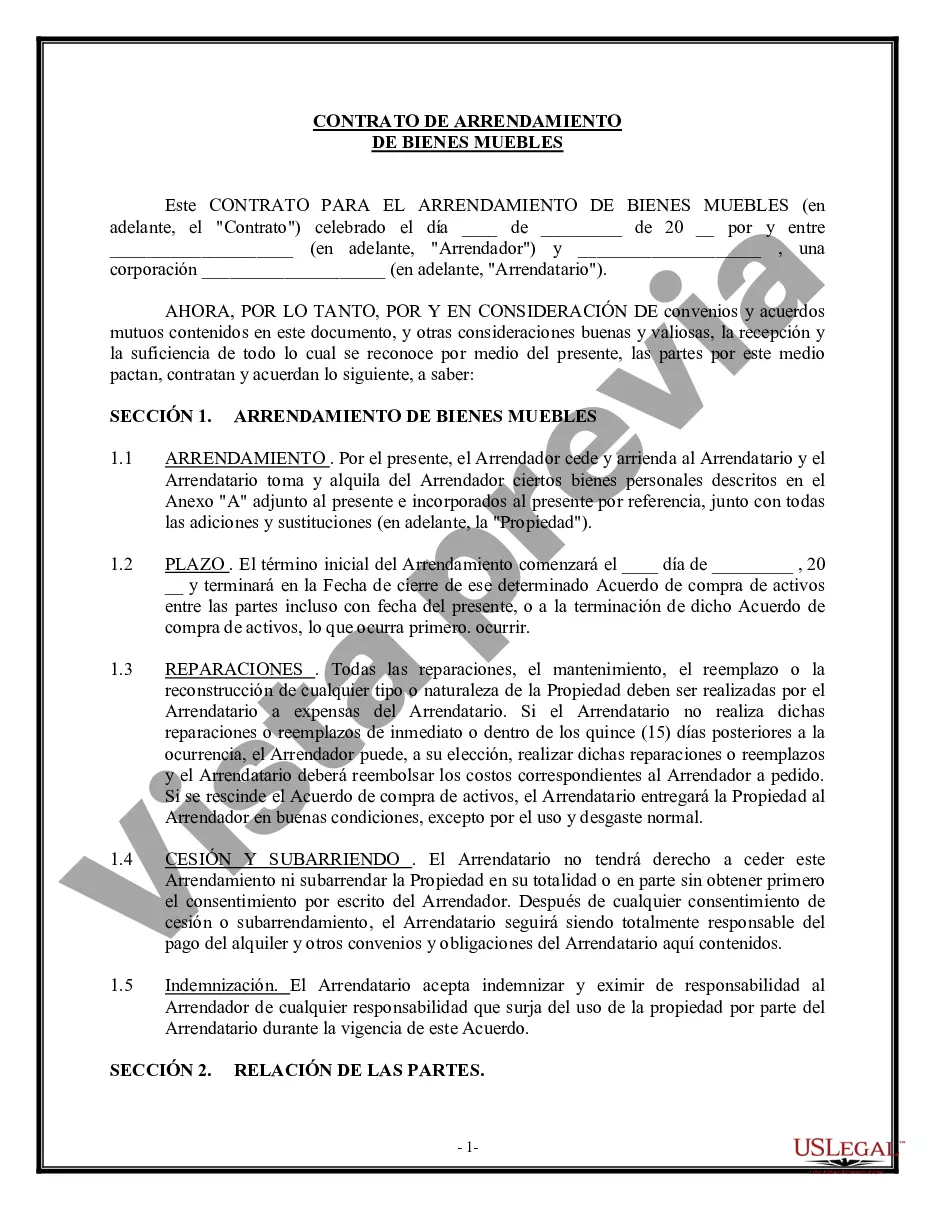

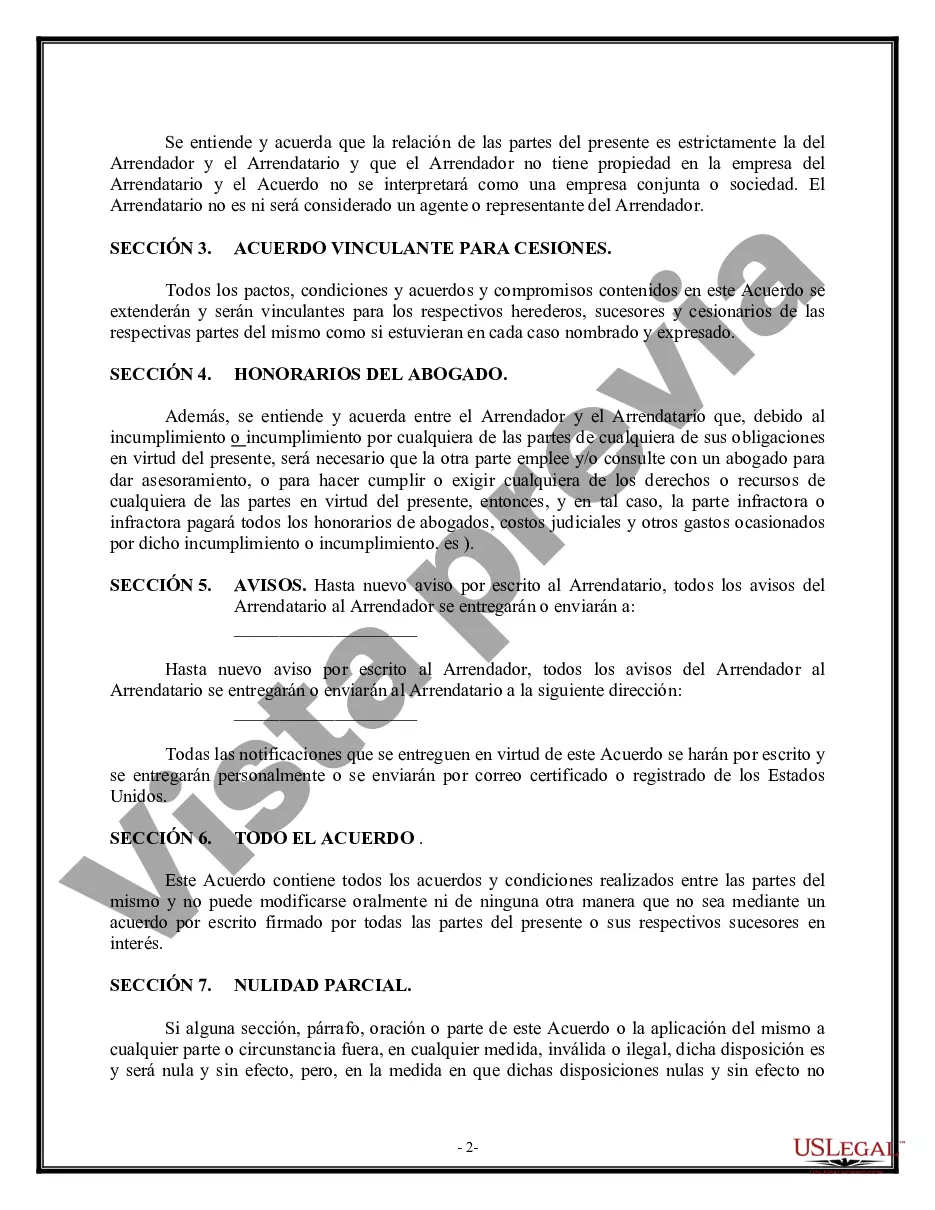

Tangible personal property consisting of programmable computer equipment and peripherals used in business . . . . . . . . . . . 16. In general, tangible personal property is a moveable item that is real, material, substantive, and not permanently affixed to any real property.Virginia Bill of Sale of Personal Property (Sold as Is). The Commissioner of the Revenue is responsible for the assessment of all personal property with taxable status in Virginia Beach. You are required to file a Personal Property Form each year. Personal Property Assessment. An itemized asset listing of all assets owned, including a description of each asset, date of purchase, and original cost is required. Owners have 60 days from the purchase date or move date to file. If the owner files after 60 days, a late filing fee is added to the tax bill. Online forms provide the option of submitting the form electronically to our office.