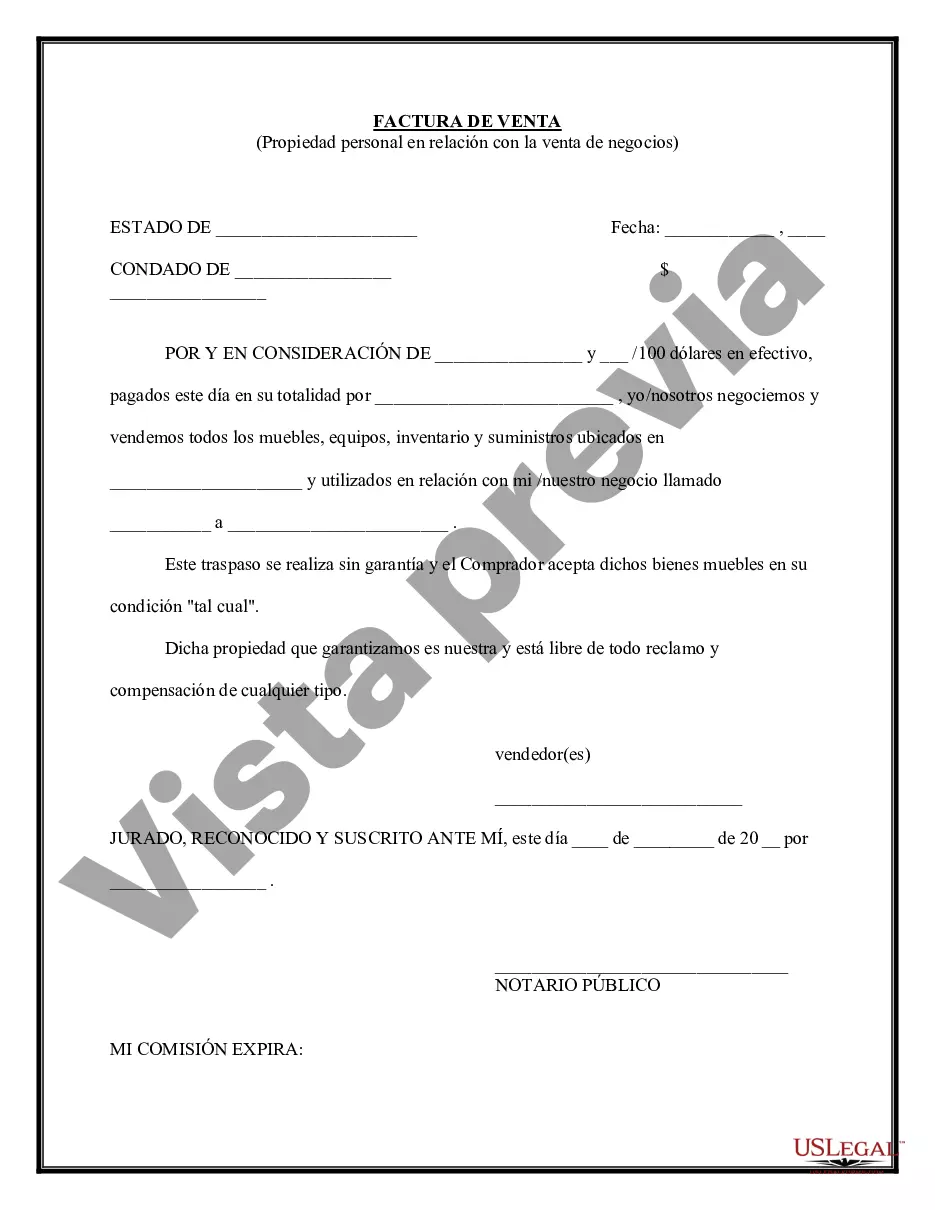

This form is a simple model for a bill of sale for personal property used in connection with a business enterprise. Adapt to fit your circumstances.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Personal Use Property Examples In Clark - Simple Bill of Sale for Personal Property Used in Connection with Business

Description

Form popularity

FAQ

Deductible personal property taxes are those based only on the value of personal property such as a boat or car. The tax must be charged to you on a yearly basis, even if it's collected more than once a year or less than once a year.

Personal property is any property that's not land and all things that are permanently attached to it such as real estate. Examples include cars, livestock, and equipment.

What Is Personal Property? Personal property is a class of property that can include any asset other than real estate. The distinguishing factor between personal property and real estate, or real property, is that personal property is movable, meaning it isn't fixed permanently to one particular location.

Where to Report Personal Property on Your Taxes. Claim the itemized deduction on Schedule A – State and local personal property taxes (Line 5c). Taxes you deduct elsewhere on your return — like for a home office or rental — don't qualify for this deduction.

These may include personally-owned cars, homes, appliances, apparel, food items, and so on. Personal use property can be insured against theft in most homeowners policies, but may require additional riders or carry limitations.

Personal property includes things like furniture, clothing, electronics, and kitchenware.

Ing to Nevada Revised Statutes, all property that is not defined or taxed as "real estate" or "real property" is considered to be "personal property." Taxable personal property includes manufactured homes, aircraft, and all property used in conjunction with a business.

Personal use property is used for personal enjoyment as opposed to business or investment purposes. These may include personally-owned cars, homes, appliances, apparel, food items, and so on.

DEFINITION of 'Personal Use Property' A type of property that an individual does not use for business purposes or hold as an investment.

Personal property can be characterized as either tangible or intangible. Examples of tangible personal property include vehicles, furniture, boats, and collectibles. Digital assets, patents, and intellectual property are intangible personal property.