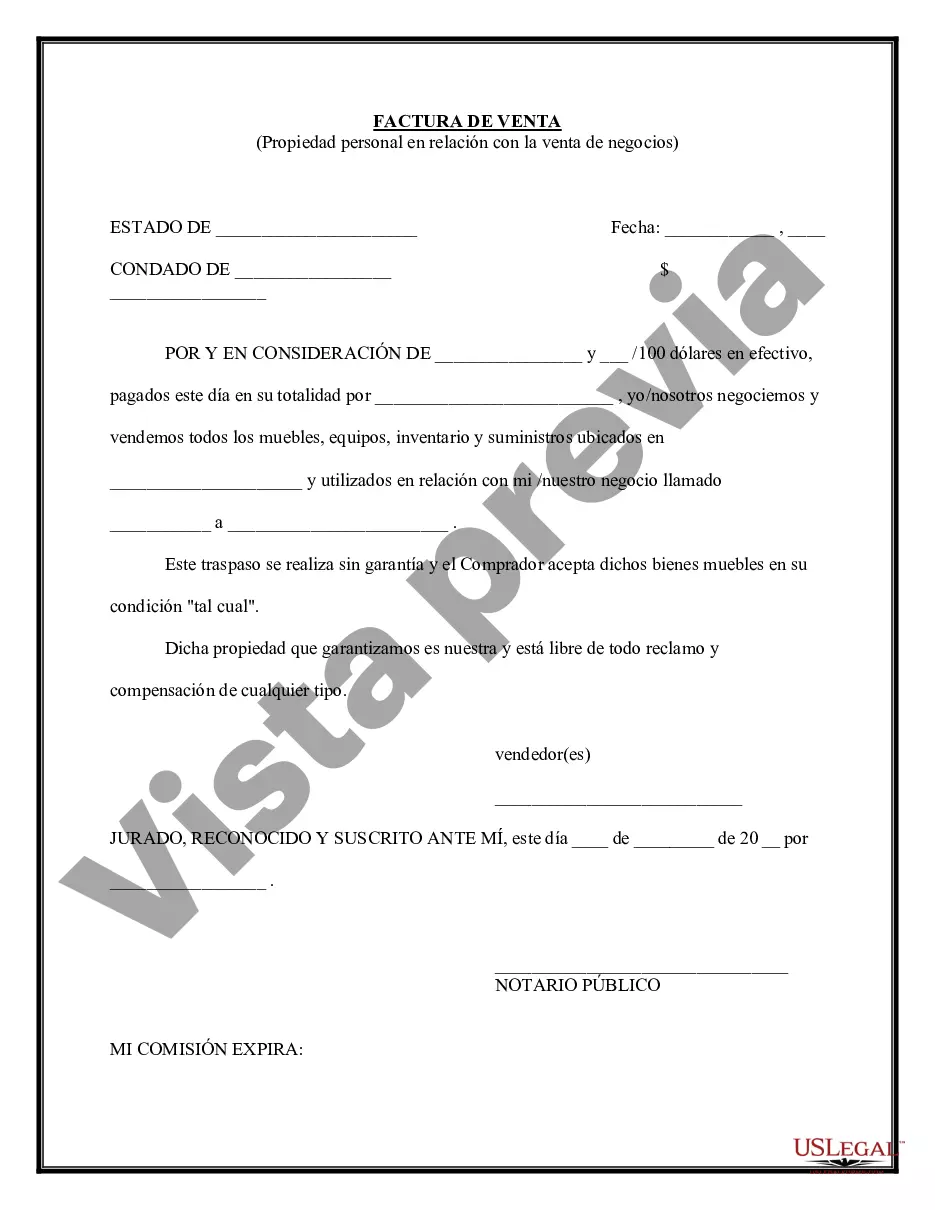

This form is a simple model for a bill of sale for personal property used in connection with a business enterprise. Adapt to fit your circumstances.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Personal Property Tax For Business In Fairfax - Simple Bill of Sale for Personal Property Used in Connection with Business

Description

Form popularity

FAQ

Tax Rates. The current tax rate for most personal property in Fairfax County is $4.57 for each $100 of assessed value.

Per the Code of Virginia § 58.1-3668, a veteran with a 100% service-connected, permanent and total disability may apply for a personal property tax exemption on one motor vehicle (passenger car or a pickup or panel truck) registered for personal use which is owned and used primarily by or for a veteran of the Armed ...

If your business or organization owns a lot of equipment, you might decide to move your business to New York, where only real property (like land and the structures attached to it) are subject to taxation.

Income tax forms Sole business owners must also submit a Schedule C (Form 1040 or Form 1040-SR), Profit or Loss from Business. Additionally, partnerships must file an information return (Form 1065, U.S. Return of Partnership Income, and Form 965-A, Individual Report of Net 965 Tax Liability).

Commercial & Industrial Property Tax Minnesota exempts personal property, including machinery and inventory, from the property tax, which lowers the effective tax rate for real and personal property.

Business Personal Property Tax is a tax assessed on tangible personal property businesses own. This type of property includes equipment, furniture, computers, machinery, and inventory, among other items not permanently attached to a building or land.

The tax rate for most vehicles is $4.57 per $100 of assessed value. For properties included in a special subclass, the tax rate is $0.01 per $100 of assessed value. This special subclass includes the following: privately-owned vans used for van pools.

When a tax due date falls on a weekend, it automatically extends to the next business day. The personal property tax rate is 3.96% of assessed value for calendar year 2024. A mobile home classified as personal property is taxed at real estate tax rate at 0.854% of assessed value for calendar year 2024.