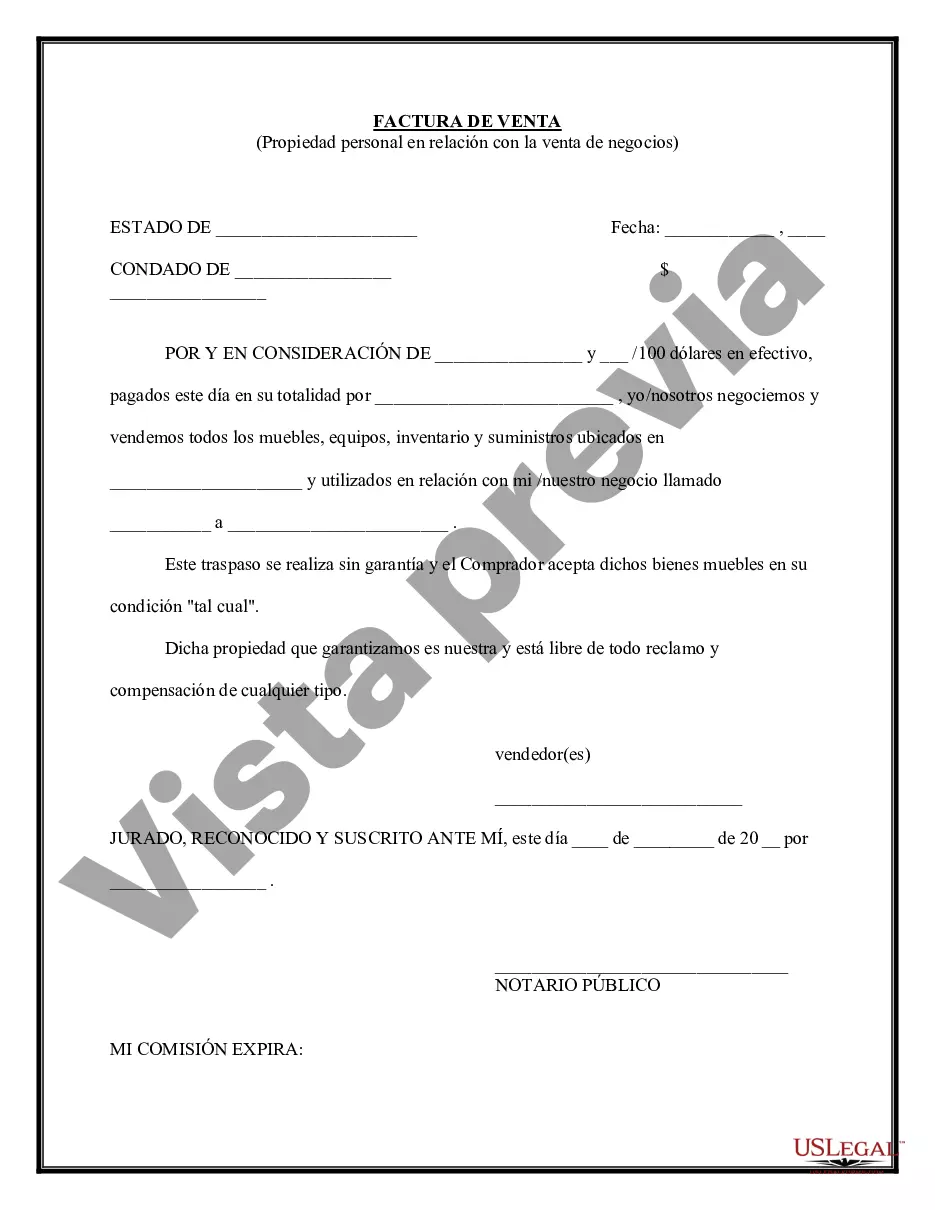

This form is a simple model for a bill of sale for personal property used in connection with a business enterprise. Adapt to fit your circumstances.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Personal Use Property Examples In Middlesex - Simple Bill of Sale for Personal Property Used in Connection with Business

Description

Form popularity

FAQ

What are examples of personal property? Clothing. Furniture. Electronics. Tools. Decorations. Jewelry. Art and collectibles. Bicycles.

Personal-use property is not purchased with the primary intent of making a profit, nor do you use it for business or rental purposes.

Personal-use property is not purchased with the primary intent of making a profit, nor do you use it for business or rental purposes. It includes things like your home, furniture, appliances, personal vehicle, and clothing.

Personal Property Personal belongings such as clothing and jewelry. Household items such as furniture, some appliances, and artwork. Vehicles such as cars, trucks, and boats. Bank accounts and investments such as stocks, bonds, and insurance policies.

Personal use property is used for personal enjoyment as opposed to business or investment purposes. These may include personally-owned cars, homes, appliances, apparel, food items, and so on.

Personal property can be characterized as either tangible or intangible. Examples of tangible personal property include vehicles, furniture, boats, and collectibles. Digital assets, patents, and intellectual property are intangible personal property.

Personal property depends on a surprisingly simple test: Can you physically move it? The outcome of that test determines the distinction between real property and personal property, which in turn has real implications for taxation.