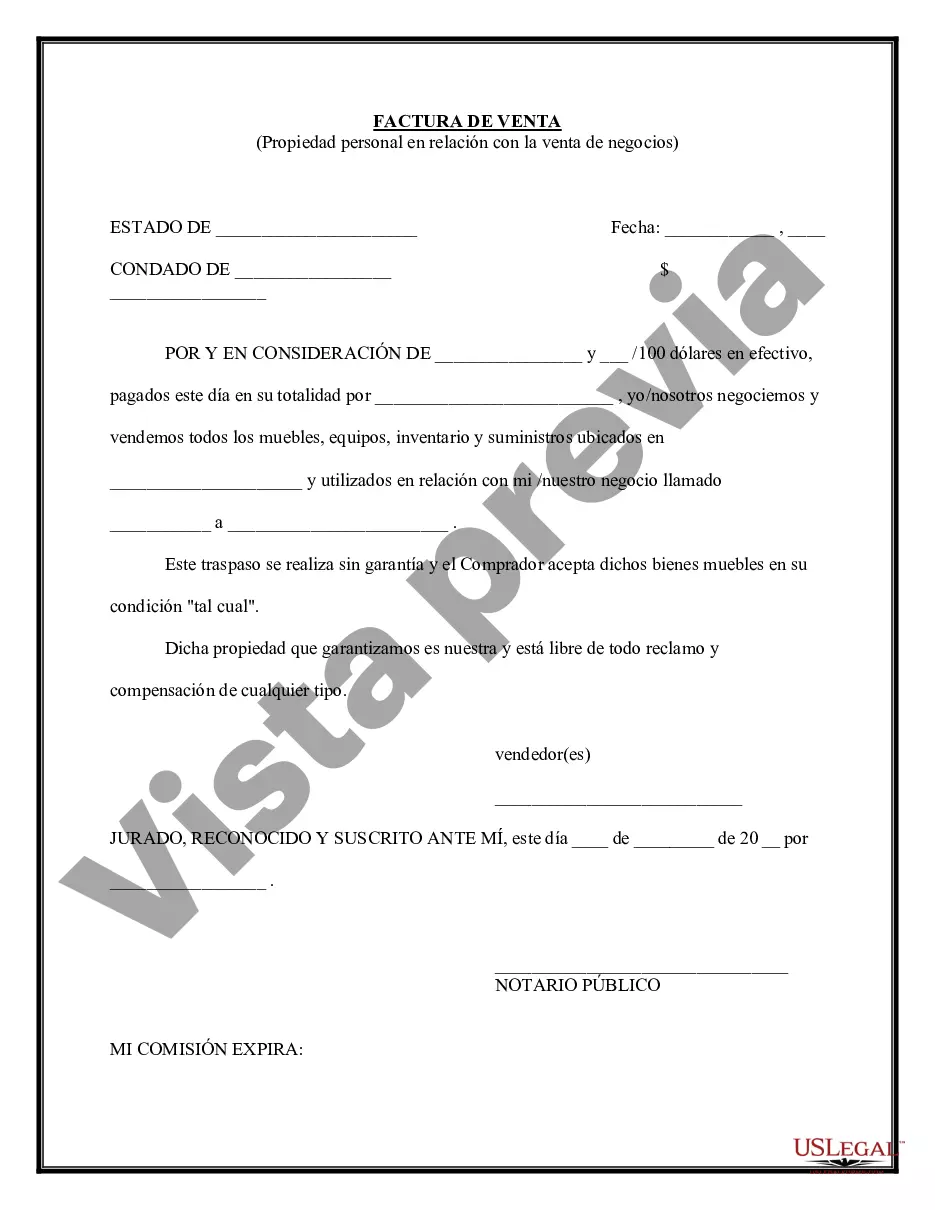

This form is a simple model for a bill of sale for personal property used in connection with a business enterprise. Adapt to fit your circumstances.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Bill Personal Property Form With Two Points In Nassau - Simple Bill of Sale for Personal Property Used in Connection with Business

Description

Form popularity

FAQ

ANNUAL REAL PROPERTY TAX RATES: On the value of owner/occupied properties between $300,000 and $500,000, the rate is 0.625% per annum of the market value. On the portion over $500,000 the tax rate is 1% per annum of the market value of the property.

Calculated Tax Rate Meaning the taxable assessed value is just 0.1% of the market value. For example, if a property in Nassau has a market value of $500,000, the assessed value would be $500 ($500,000 x . 001 LOA).

Your New York adjusted gross income is your federal adjusted gross income after certain New York additions and New York subtractions (modifications). New York State taxes certain items of income not taxed by the federal government. You must add these New York additions to your federal adjusted gross income.

Calculated Tax Rate For 2025 and 2026, the Assessor set residential properties (Class 1) at a level of assessment of 0.1%. Meaning the taxable assessed value is just 0.1% of the market value. For example, if a property in Nassau has a market value of $500,000, the assessed value would be $500 ($500,000 x . 001 LOA).

What kind of tax exemptions are there and when do I file? Homeowners may be eligible to receive a Senior Citizens, Veterans, Disability/Limited Income, STAR, Home Improvement and/or Volunteer Firefighter/Ambulance Personnel exemption. Applications are accepted by the Nassau County Department of Assessment year-round.

Citizens of The Bahamas are exempt from real property tax on vacant land and on property in the Family Islands. However, all commercial and residential property on New Providence are taxable unless the residential property is owner-occupied and is valued less than $250,000.

All Tangible Personal Property accounts are eligible to receive up to a $25,000 exemption if a Tangible Personal Property return (DR-405) has been timely filed with the Property Appraiser. All new businesses are required to file this return in order to receive the exemption.

Where to Report Personal Property on Your Taxes. Claim the itemized deduction on Schedule A – State and local personal property taxes (Line 5c). Taxes you deduct elsewhere on your return — like for a home office or rental — don't qualify for this deduction.

Tangible personal property (TPP) is all goods, property other than real estate, and other articles of value that the owner can physically possess and has intrinsic value. Inventory, household goods, and some vehicular items are excluded.

Tangible personal property, or TPP as it is often called, is personal property that can be felt or touched and physically relocated. That covers a lot of stuff, including equipment, livestock, and jewelry. In many states, these items are subject to ad valorem taxes.