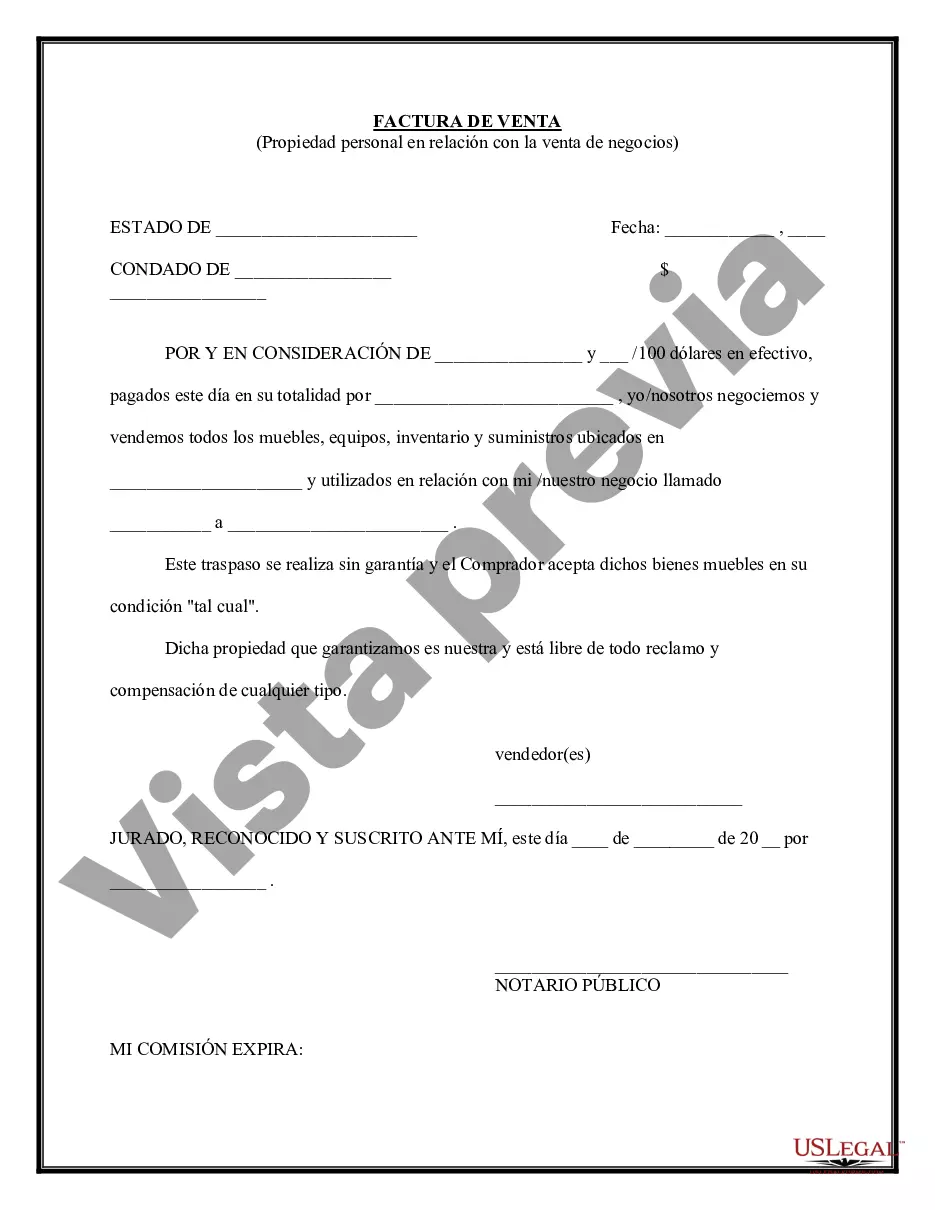

This form is a simple model for a bill of sale for personal property used in connection with a business enterprise. Adapt to fit your circumstances.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Private Property In Business In Nevada - Simple Bill of Sale for Personal Property Used in Connection with Business

Description

Form popularity

FAQ

Other types of organizations and companies are exempt from filing for a business license, including government entities, non-profit organizations (religious groups, fraternal organizations, and charitable organizations), a person who is a natural citizen and operates a business from their home if the business does make ...

A business owner is one person who is in control of the operational and monetary aspects of a business. Any entity that produces and sells goods and services for profit, such as an ecommerce store or freelance writer, is considered a business. Businesses can be run alone or with a group of people.

I would like to operate an owner-occupied short-term rental; do I still need a business license? Yes. You must still apply for a business license.

Start with a Good Business Idea Like other successful businesses, you'll want to make sure you have a good idea first. From there, you can build a product or service that solves a need for consumers. But before you jump into anything, you'll want to make sure you do your research.

Private property refers to the ownership of property by private parties - essentially anyone or anything other than the government. Private property may consist of real estate, buildings, objects, intellectual property (copyright, patent, trademark, and trade secrets).

Ing to Nevada Revised Statutes, all property that is not defined or taxed as "real estate" or "real property" is considered to be "personal property." Taxable personal property includes manufactured homes, aircraft, and all property used in conjunction with a business.

WHICH STATES DO NOT TAX BUSINESS PERSONAL PROPERTY? North Dakota. South Dakota. Ohio. Pennsylvania. New Jersey. New York. New Hampshire. Hawaii.

Factories and corporations are considered private property. The legal framework of a country or society defines some of the practical implications of private property. There are no expectations that these rules will define a rational and consistent model of economics or social system.

Business Personal Property Tax is a tax assessed on tangible personal property businesses own. This type of property includes equipment, furniture, computers, machinery, and inventory, among other items not permanently attached to a building or land.

The Fifth Amendment specifies that the government cannot seize private property for public use without providing fair compensation. Additionally, the Fourteenth Amendment states, “nor shall any State deprive any person of life, liberty, or property, without due process of law.”