Letter Donation Form With Check Enclosed In Alameda - Sample Letter for Acknowledgment of Receipt of Gift or Donation - Appreciative

Description

Form popularity

FAQ

How to Write a Fundraising Letter Address the donor by their preferred name. Including the recipient's name demonstrates that you value their support as an individual, rather than a nameless source of revenue. Incorporate storytelling. Add compelling visuals. Emphasize the impact of donations. Include a call to action.

1. Greet the recipient formally and personally to start. 2. Introduce yourself and give a succinct explanation of the reason for your email. 3. Clearly clarify your desire for a donation and describe the initiative or cause you are supporting.

How do you write a fundraising letter? Key steps Start with a personalized greeting. Explain your mission. Describe your current initiative. Outline your project's needs and what you hope to accomplish. Add meaningful photographs or infographics. Show the tangible impact associated with specific donation amounts.

As mentioned above, to claim a charitable donation, you need to itemize your deductions using Form 1040, Schedule A as part of your tax preparation. Schedule A reports your itemized deductions, including charitable contributions. Fill out this form carefully to ensure accurate information about your donations.

About Form 8283, Noncash Charitable Contributions. Internal Revenue Service.

What we call a donation receipt / charity receipt is a written, official proof of a donation made to a registered charity. Registered charities can issue receipts, including official donation receipts. These receipts are used to reduce the income tax of the person or the business that makes a donation.

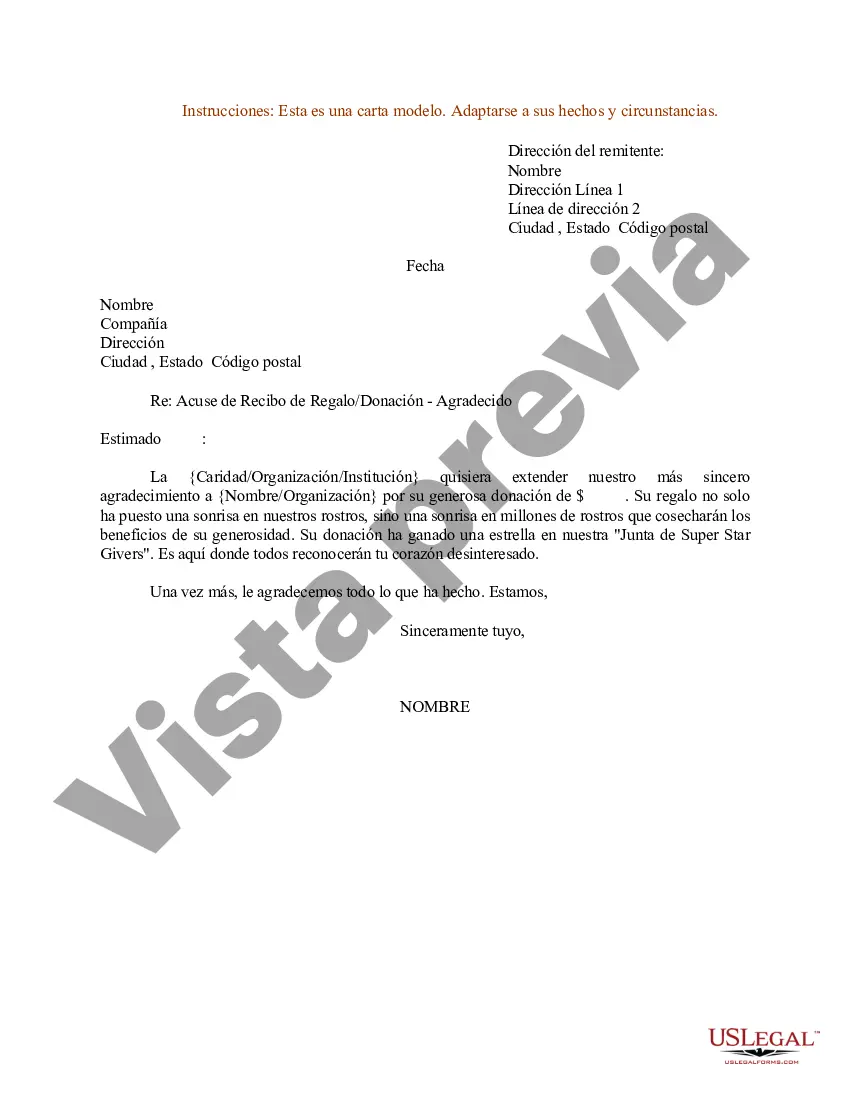

A donation acknowledgment letter is a type of donor letter that you send to donors to document their charitable gifts and donations. Sometimes your donation receipt functions as a donor acknowledgement. However, that's not always the case. All donors deserve to be thanked, no matter the size of their gift.

Example 2: Individual Acknowledgment Letter Hi donor name, We're super grateful for your contribution of $250 to nonprofit's name on date received. As a thank you, we sent you a T-shirt with an estimated fair market value of $25 in exchange for your contribution.

Founded in 1977, the Alameda Food Bank is a non-profit organization that helps Alameda community by providing nourishing food to those in need in a compassionate and respectful manner with the support of dedicated volunteers and local partners.

Here's what every letter should cover: Donor's name. Address the donor by name. Organization's name. Clearly state your nonprofit's name to make the letter official and avoid confusion. Donation amount and date. Be specific about the gift. Type of donation. Tax information. Mission impact. Closing with gratitude.