Letter Receipt Donation Statement With Multiple Conditions In Harris - Sample Letter for Acknowledgment of Receipt of Gift or Donation - Appreciative

Description

Form popularity

FAQ

For a Charity Gift Card the SENDER (you) chooses the charity. You can send the card by email to yourself or your recipient/s. As you are making a donation to a charity you will receive a tax receipt. For a Charity Gift Voucher the RECEIVER chooses the charity.

Contribution statements are a summary of giving for the year that your donors use when writing off charitable contributions on their tax returns.

Yes. Whether you wish to give on behalf of someone who is alive or has passed away, if you make the intention of doing it on their behalf, it will be accepted with the permission of Allah (SWT). It also benefits those in need and beyond. For some, an act of Sadaqah Jariyah can provide immediate and long-lasting relief.

A donation receipt format must include the donor's name, address and contact number, date, name of the organisation, amount, reason for payment, receipt number, and name of the receiver.

'I know how much this cause means to you, so I've made a donation to X Organization in your honor. '

Ing to the IRS, donation tax receipts should include the following information: The name of the organization. A statement confirming that the organization is a registered 501(c)(3) organization, along with its federal tax identification number. The date the donation was made.

Each letter should include the following information: The donor's name. The full legal name of your organization. A declaration of your organization's tax-exempt status. Your organization's employer identification number. The date the gift was received. A description of the gift and the amount received.

Here's how to do it: Begin with something that grabs attention. Maybe it's a fact, a question, or a story about how your cause makes a difference. Clearly say why help is needed. Tell them what their donation will do. Don't beat around the bush. End by thanking them.

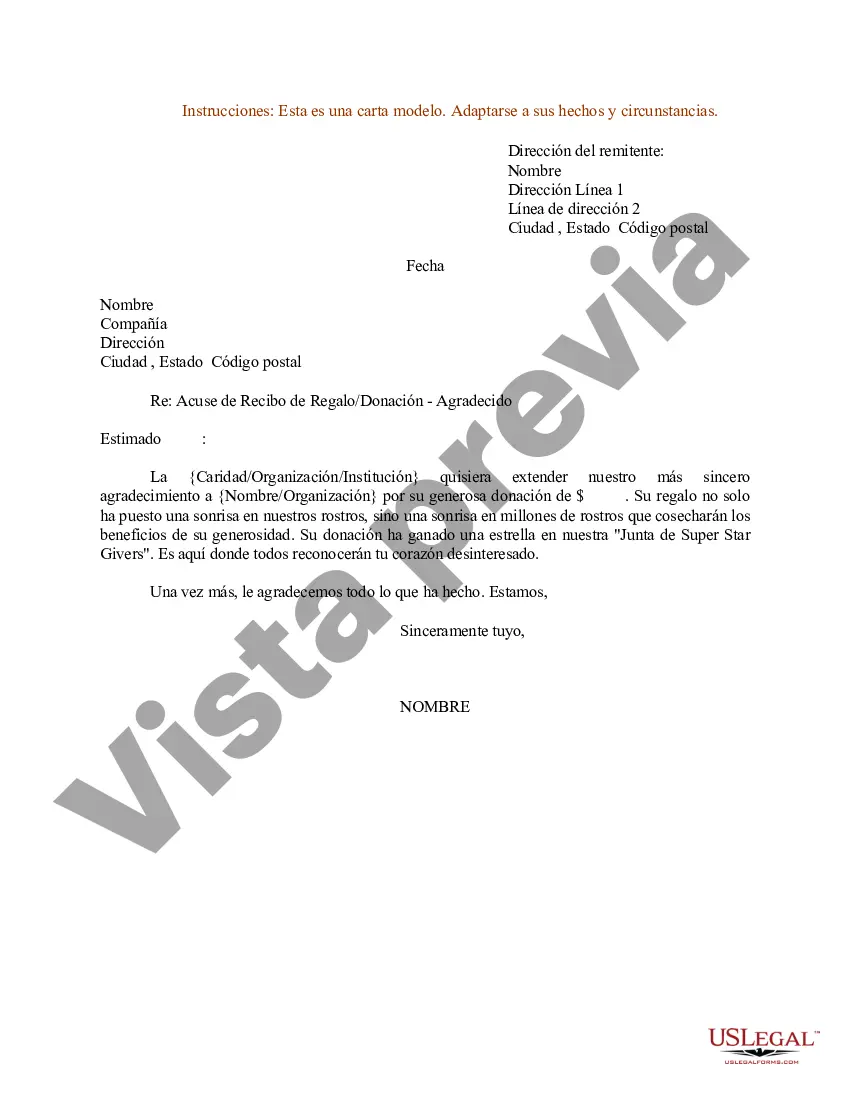

How to Write a Gift Acknowledgment Letter State the purpose of your letter. Start your gift acknowledgment letter with a confirmation of the donation. Make your letter visually engaging. Personalize your note. Explain the impact of the gift. Express heartfelt gratitude. Invite supporters to stay involved.

Some examples of contribution statements are: “wrote entire original draft”; “contributed to methodology design”; “provided animals for experiments”.