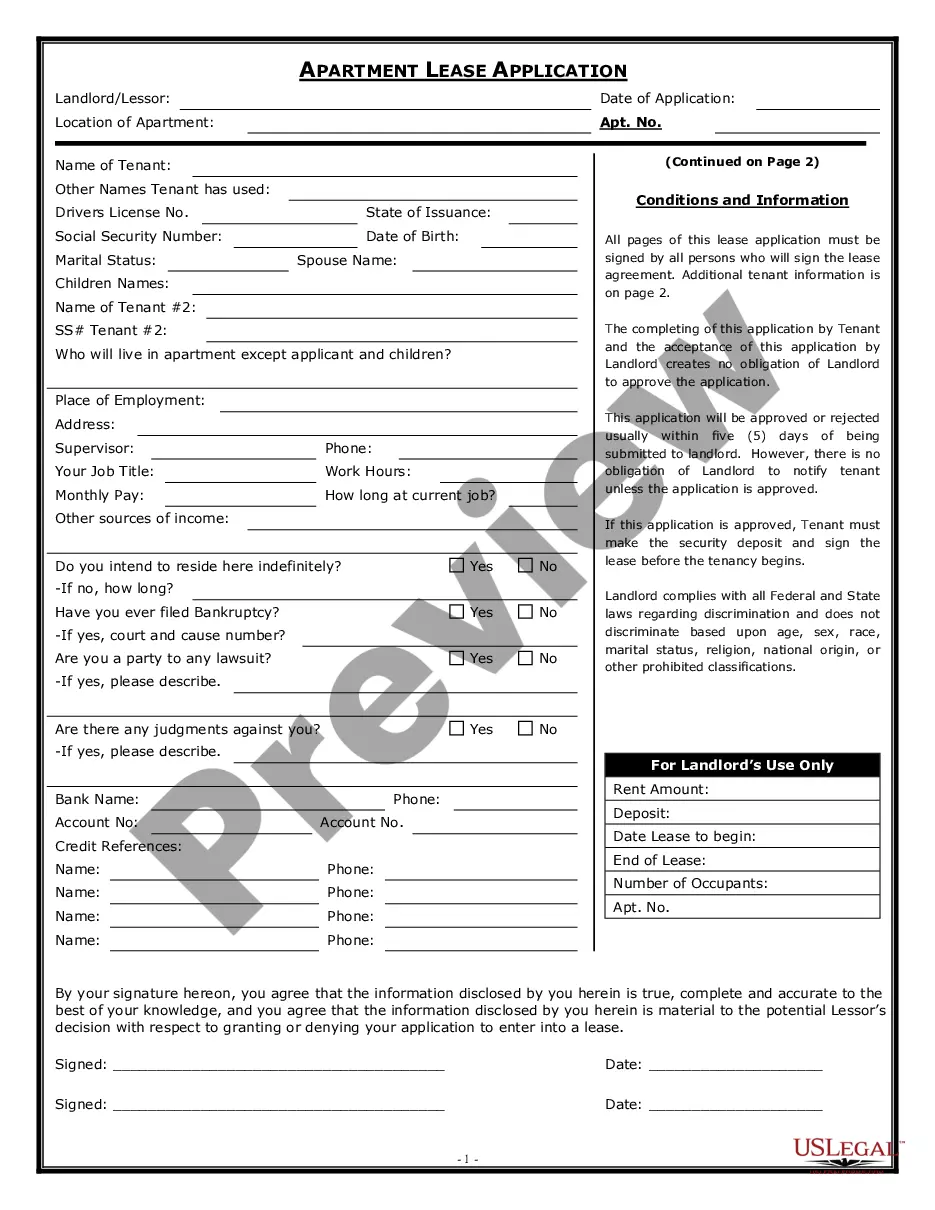

This form is a sample letter in Word format covering the subject matter of the title of the form.

Gift Letter For Money Without Tax In Hillsborough

Description

Form popularity

FAQ

While gifting property is legally permissible in Florida, the process involves specific documentation, including the preparation of a deed—typically a quitclaim deed or warranty deed—outlining the transfer and recording it with the county recorder's office.

The basic gift tax exclusion or exemption is the amount you can give each year to one person and not worry about being taxed. The gift tax exclusion limit for 2023 was $17,000, and for 2024 it's $18,000. That means anything you give under that amount is not taxable and does not have to be reported to the IRS.

A letter from your parents and a copy of the bank statement may be enough. However, if your parents give more than that in a single year, they will be required to file a gift tax return on Form 709, assuming they are American citizens.

Furnishing (POF) proof of funds letter But it is important to remember that a bank statement also includes substantial personal information, which is crucial when you provide a proof of funds for a real estate transaction. Ensure that your personal information is protected if you decide to opt for this route.

The best proof of funds letter is your bank statement.

Your lender may provide you with a gift letter template. If that's the case, you can simply pass it along to the gift giver and have them fill it out. If the lender doesn't provide you with a gift letter template, be sure to verify the gift letter requirements.

Making a gift or leaving your estate to your heirs does not ordinarily affect your federal income tax. You cannot deduct the value of gifts you make (other than gifts that are deductible charitable contributions).

(Date) Dear (Donor): I have received your "Offer of Gift," dated ___________________, by which you, on behalf of the (Name of Company), offered to convey (Description of Property) to the United States of America as a gift. I accept with pleasure your gift and conveyance of the (Property), pursuant to 10 U.S.C. 2601.