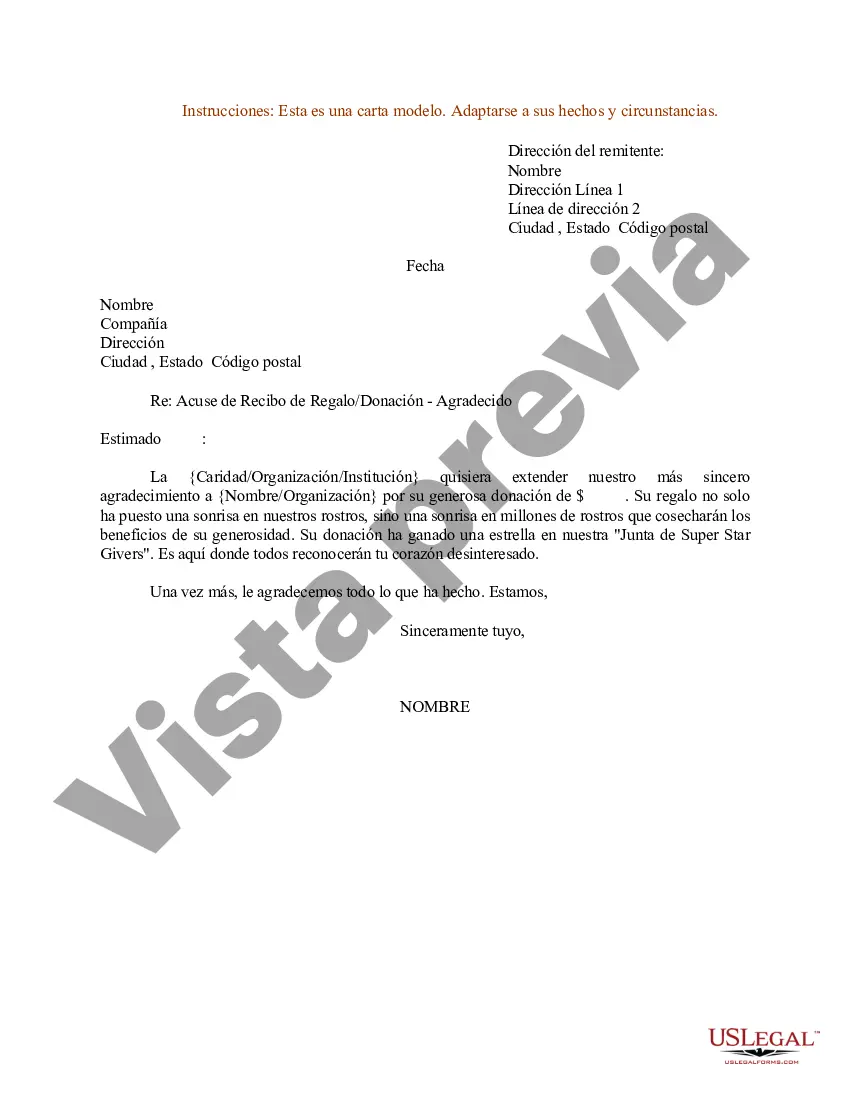

Donation Receipt For Non Profit In Massachusetts - Sample Letter for Acknowledgment of Receipt of Gift or Donation - Appreciative

Description

Form popularity

FAQ

Example 2: Individual Acknowledgment Letter Hi donor name, We're super grateful for your contribution of $250 to nonprofit's name on date received. As a thank you, we sent you a T-shirt with an estimated fair market value of $25 in exchange for your contribution.

Ing to the IRS, nonprofits must recognize any gift over $250 with a receipt.

While we recommend sending donation acknowledgment letters to all of your donors, you are legally obligated to send documentation to donors who have given a gift of $250 or more. The IRS requires nonprofit organizations to provide a formal acknowledgment letter to these donors for tax purposes.

An exempt organization must keep books and records needed to show that it complies with the tax rules. The organization must be able to document the sources of receipts and expenditures reported on its annual return and on any tax returns it must file.

Charities are required to provide donors with receipts for charitable contributions over $250, which donors must have to substantiate their tax deductions.

Ing to the IRS, any kind of donation above $250 should require a donation receipt. The same applies to stock gifts/donations.

Tax-exempt nonprofits are required, upon request, to provide copies of the three most recently filed annual information returns (IRS Form 990) and the organization's application for tax-exemption (which includes correspondence between the organization and the IRS related to the application).

What is the State Charitable Tax Deduction? The State Charitable Deduction is a charitable contributions deduction that applies to all donations made from January 1, 2023—on. It includes all Massachusetts taxpayers, regardless of whether they itemize federally.

Every public charity organized or operating in Massachusetts or soliciting funds in Massachusetts must file a Form PC with the Non-Profit Organizations/Public Charities Division (the “Division”), except organizations that hold property for religious purposes or certain federally chartered organizations.