Gift Letter Example In Massachusetts - Sample Letter for Acknowledgment of Receipt of Gift or Donation - Appreciative

Description

Form popularity

FAQ

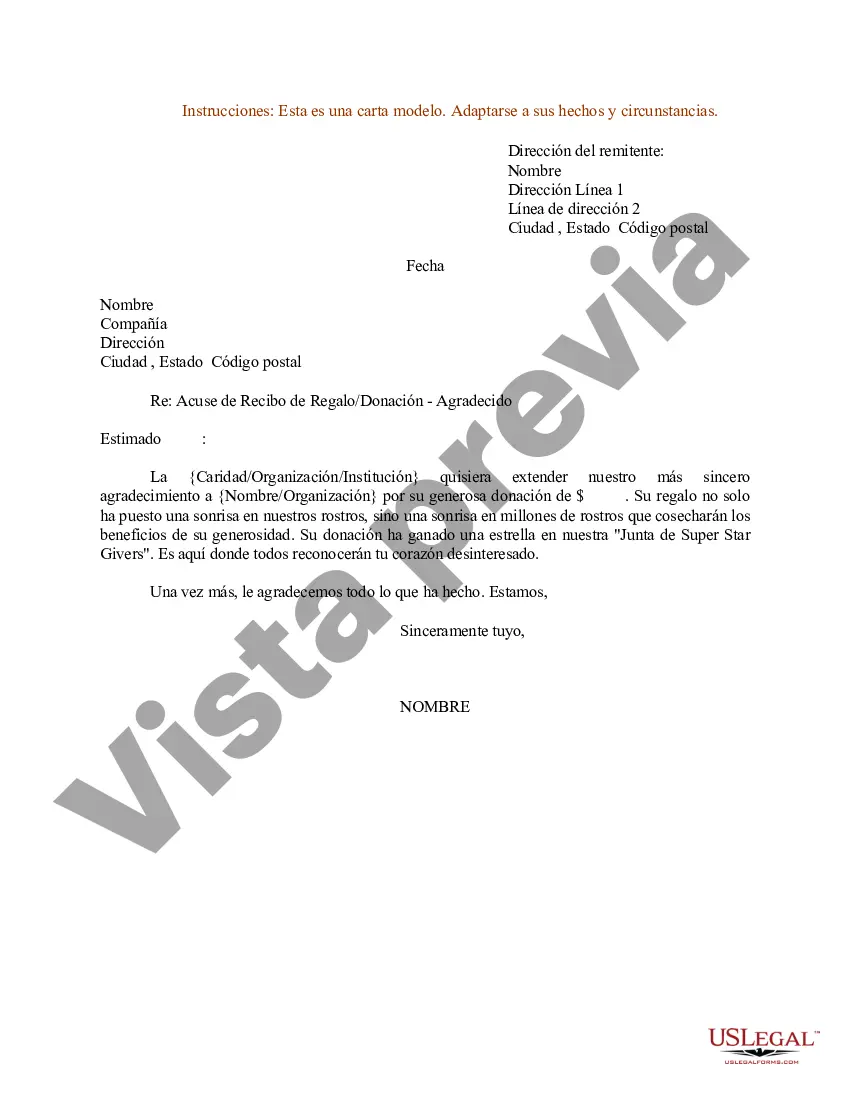

A gift letter must contain the donor's name, the gift's value, confirmation that the gift is not to be repaid, and the donor's signature.

(Date) Dear (Donor): I have received your "Offer of Gift," dated ___________________, by which you, on behalf of the (Name of Company), offered to convey (Description of Property) to the United States of America as a gift. I accept with pleasure your gift and conveyance of the (Property), pursuant to 10 U.S.C.

Short and Simple You're the best. So grateful for you. Yay for you! You're a really great human. You deserve all the nice things. Spend it on something you love! Just a little something from me to you. Get whatever you want!

Express Joy: ``I'm so happy to give you this!'' Share the Thought Behind the Gift: ``I saw this and thought of you because...'' Wish Them Happiness: ``I hope this brings you as much joy as you bring to my life.'' Encourage Enjoyment: ``I hope you enjoy it!'' Keep it Simple: ``Just a little something for you.''

How Do I Write a Gift Letter? The donor's name, address and phone number. The donor's relationship to the client. The dollar amount of the gift. The date when the funds were (or will be) transferred. A statement from the donor that no repayment is expected. The donor's signature.

How Do I Write a Gift Letter? The donor's name, address and phone number. The donor's relationship to the client. The dollar amount of the gift. The date when the funds were (or will be) transferred. A statement from the donor that no repayment is expected. The donor's signature.

Something that is given as a present: Thousands of people bought the book as a Christmas gift. something that you give without getting anything in return: You must convince the tax man that your gift is entirely for charitable purposes.

Express Joy: ``I'm so happy to give you this!'' Share the Thought Behind the Gift: ``I saw this and thought of you because...'' Wish Them Happiness: ``I hope this brings you as much joy as you bring to my life.'' Encourage Enjoyment: ``I hope you enjoy it!'' Keep it Simple: ``Just a little something for you.''