Donation Receipt For Specific Purpose In Nevada - Sample Letter for Acknowledgment of Receipt of Gift or Donation - Appreciative

Category:

State:

Multi-State

Control #:

US-0018LR

Format:

Word

Instant download

Description

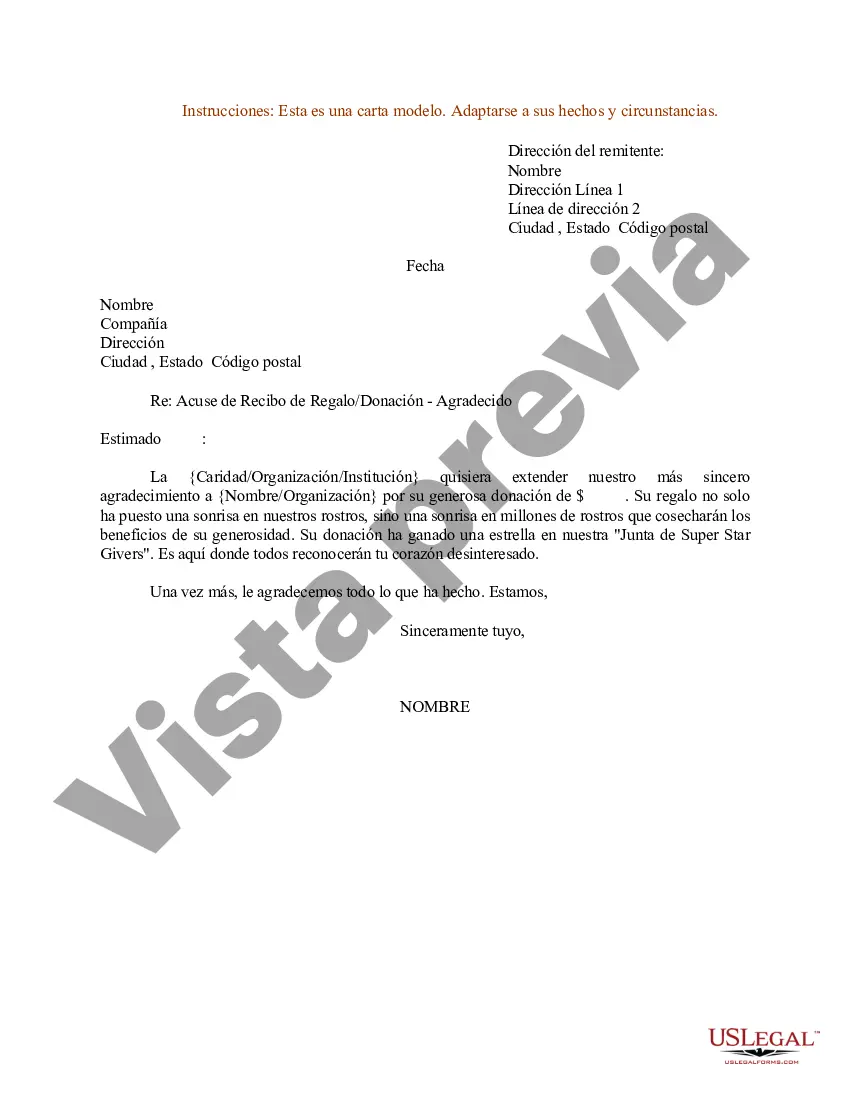

Carta de reconocimiento de obsequio/donación.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés.

For your convenience, the complete English version of this form is attached below the Spanish version.