Letter Donation Form With Tax Id In San Bernardino - Sample Letter for Acknowledgment of Receipt of Gift or Donation - Appreciative

Description

Form popularity

FAQ

Individuals, partnerships, and corporations file Form 8283 to report information about noncash charitable contributions when the amount of their deduction for all noncash gifts is more than $500.

Technically, donors don't need the substantiation until sometime before they file their personal tax returns for the year the gift was made. There are other ways to acknowledge a gift in addition to a written gift acknowledgment that is sent to the donor, whether via email or regular mail.

I'm writing to ask you to support me and my cause/project/etc.. Just a small donation of amount can help me accomplish task/reach a goal/etc.. Your donation will go toward describe exactly what the contribution will be used for. When possible, add a personal connection to tie the donor to the cause.

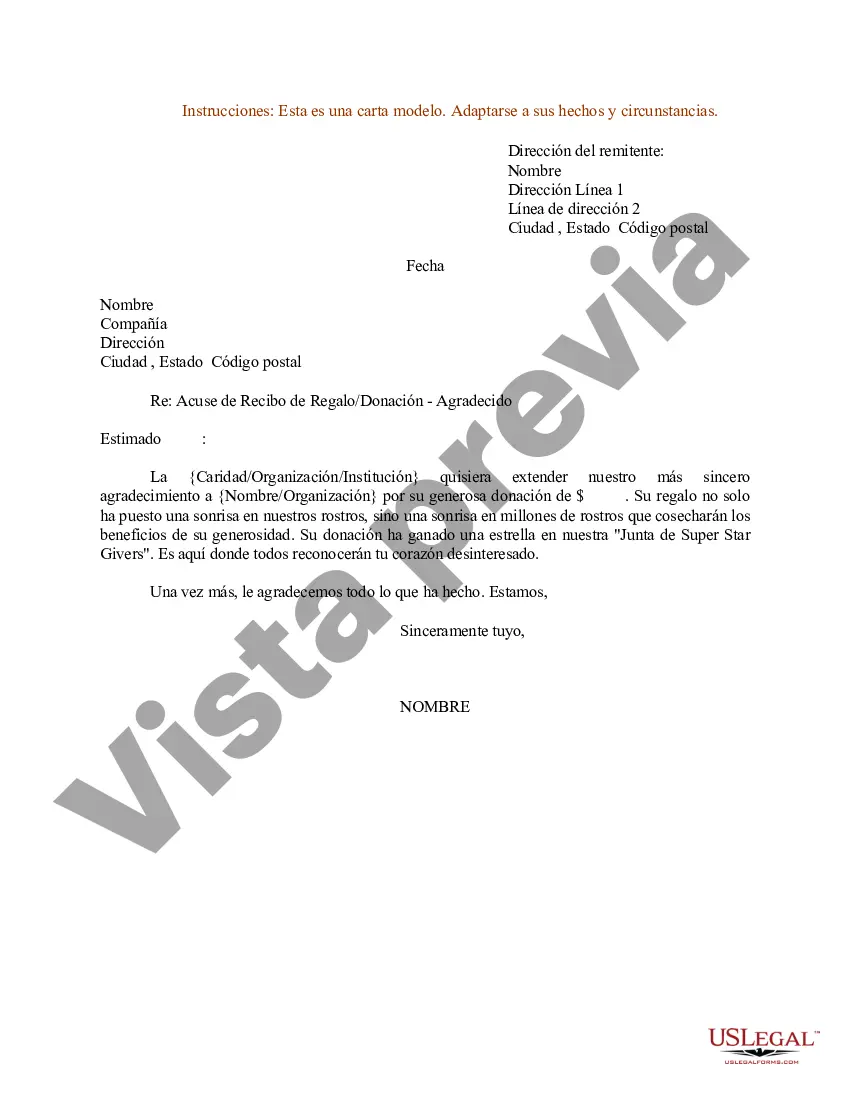

What Your Donation Letter Should Say Header: Include your nonprofit's name and branded logo if you have one. Nonprofit Contact Information: Include your physical address and phone number. Date: Include the date when you plan to mail/email the letter. Donor Salutation: Address your donor by their preferred name.

Ing to the IRS, any kind of donation above $250 should require a donation receipt. The same applies to stock gifts/donations.

Charitable contributions or donations can help taxpayers to lower their taxable income via a tax deduction. To claim a tax-deductible donation, you must itemize on your taxes. The amount of charitable donations you can deduct may range from 20% to 60% of your AGI.

A donation request form can be used to collect donation requests, track donation progress, reach a wider audience, and manage donation campaigns. It helps nonprofit organizations streamline their fundraising efforts and maintain a strong relationship with their donors.

A donation acknowledgment letter is a type of donor letter that you send to donors to document their charitable gifts and donations. Sometimes your donation receipt functions as a donor acknowledgement. However, that's not always the case.