Escrow Seller Does For Home Insurance In Suffolk - Notice of Satisfaction of Escrow Agreement

Description

Form popularity

FAQ

Typically, the escrow account is most often opened by the seller's real estate agent, but escrow may be opened by anyone involved in the transaction. Escrow may be opened via phone call, email, or in person; or, click here to open an escrow account on Escrow of the West's website.

Escrow Advance means any upfront payment made to cover taxes, insurance premiums or other costs that would otherwise be covered by a borrower's escrow account, if not for a shortfall. Seen in 21 SEC filings. Escrow Advance means the total outstanding amount attributed to an advance.

Steps in the escrow process Opening an escrow account. The first step is to open an escrow account, which is usually done by the seller, but can also be done by the buyer. Appraisal and home inspection. Your mortgage lender will order an appraisal of the home. Obtaining insurance coverage. Final walkthrough. Closing.

Bond deed guarantee insurance pledge security.

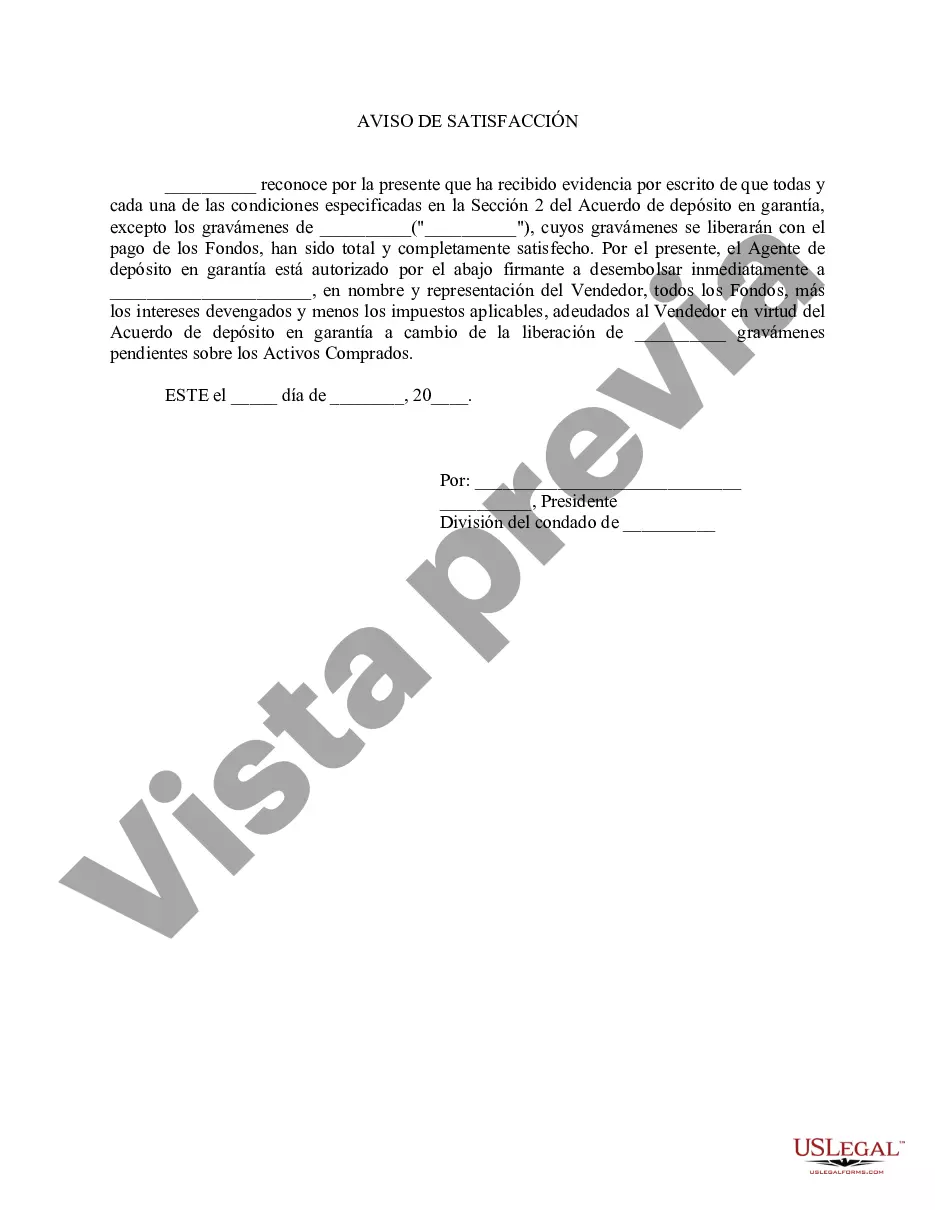

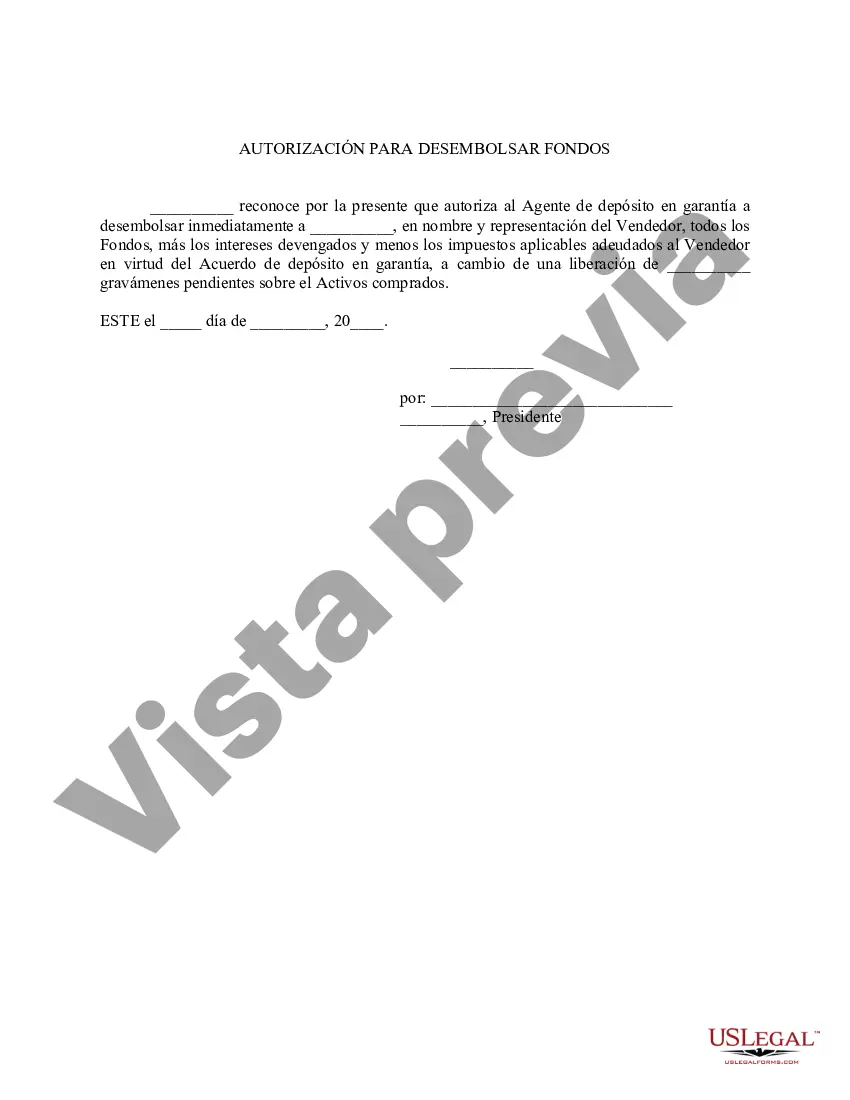

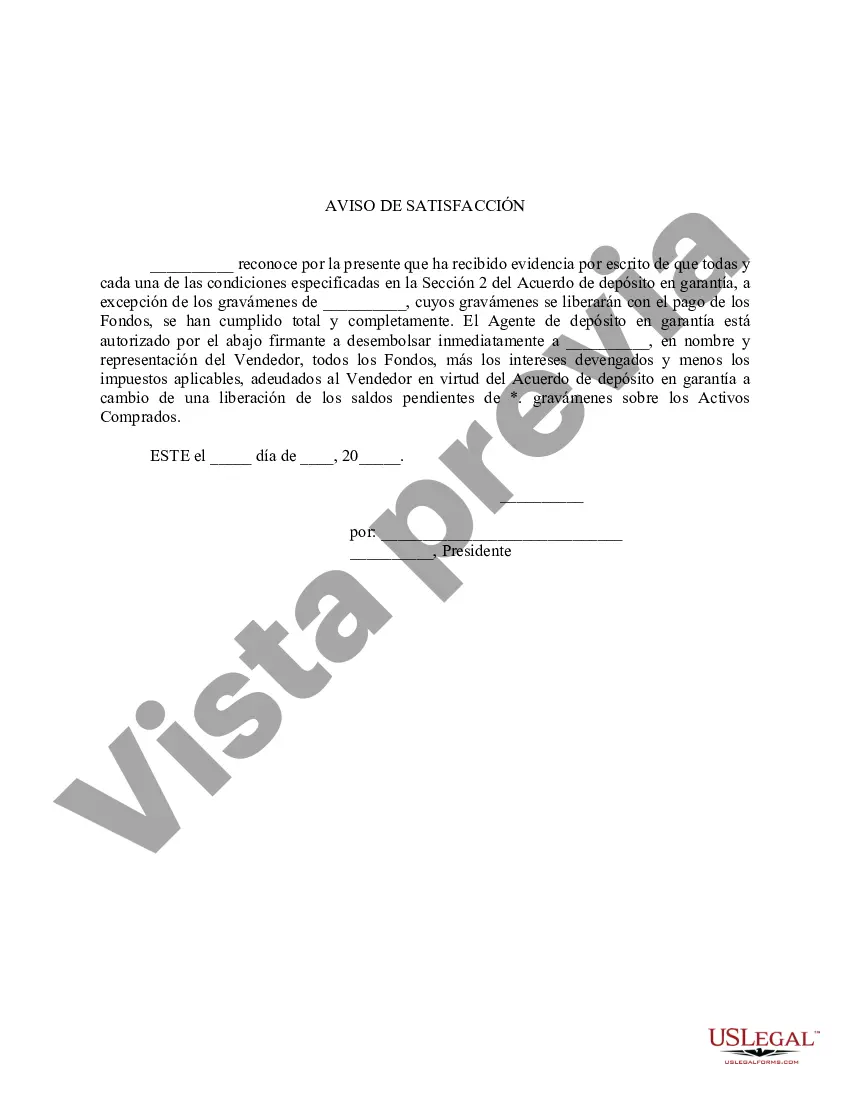

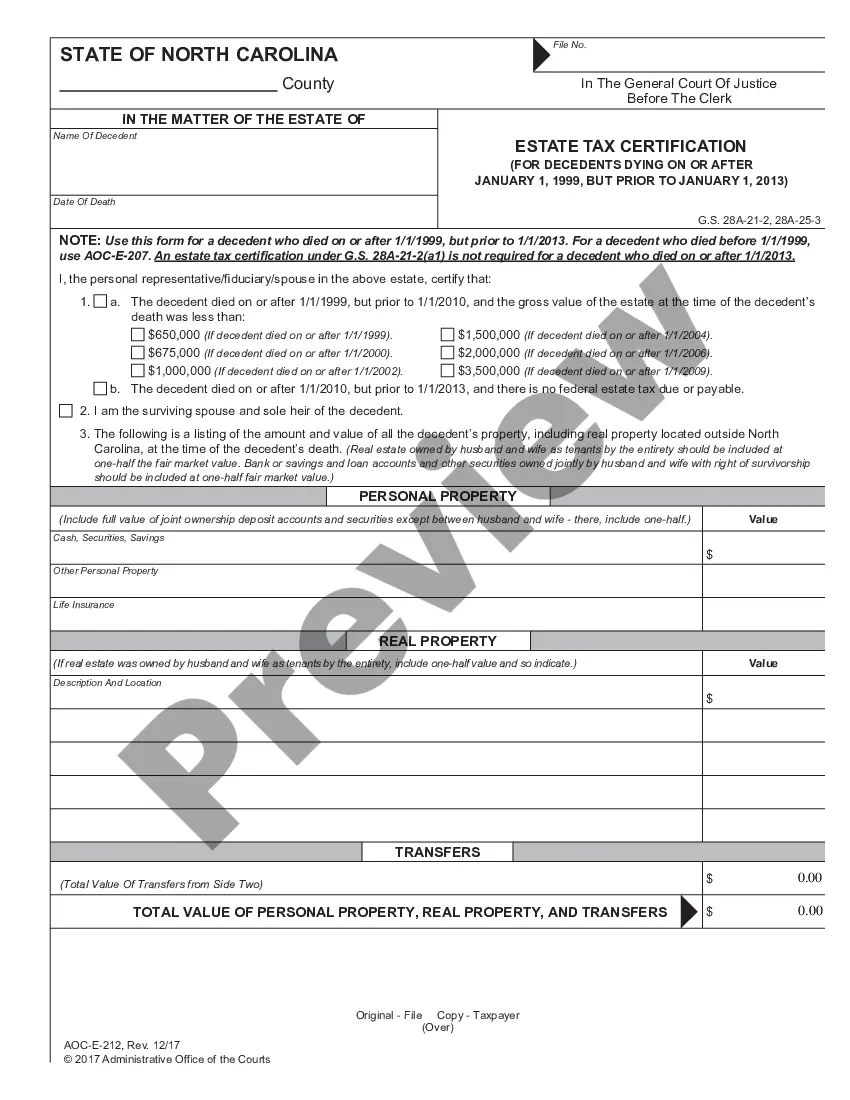

In real estate, the word "Escrow" is used often and may mean different, but similar things. Basically, Escrow refers to a legal arrangement where an escrow agent holds funds, documents, or other assets on behalf of a transacting party during a real estate transaction.

UK escrow accounts can be bank accounts or accounts held with alternative banking institutions. They're commonly used to store funds during real estate transactions, mergers and acquisitions, large purchases and other scenarios where two or more parties need to meet certain obligations before deals can conclude.

Typically you will simply make a single monthly payment to your mortgage lender. Part of that payment will go towards your mortgage principal and interest, while the rest goes into your escrow account to cover your property taxes and insurance premiums.

Steps in the escrow process Opening an escrow account. The first step is to open an escrow account, which is usually done by the seller, but can also be done by the buyer. Appraisal and home inspection. Your mortgage lender will order an appraisal of the home. Obtaining insurance coverage. Final walkthrough. Closing.

Escrow is a financial process used when two parties take part in a transaction where there is uncertainty about the fulfillment of their obligations. Situations that may employ escrow include internet transactions, banking, intellectual property, real estate, mergers and acquisitions, law, and more.