Escrow Release Form With Payment In Washington - Escrow Release

Description

Form popularity

FAQ

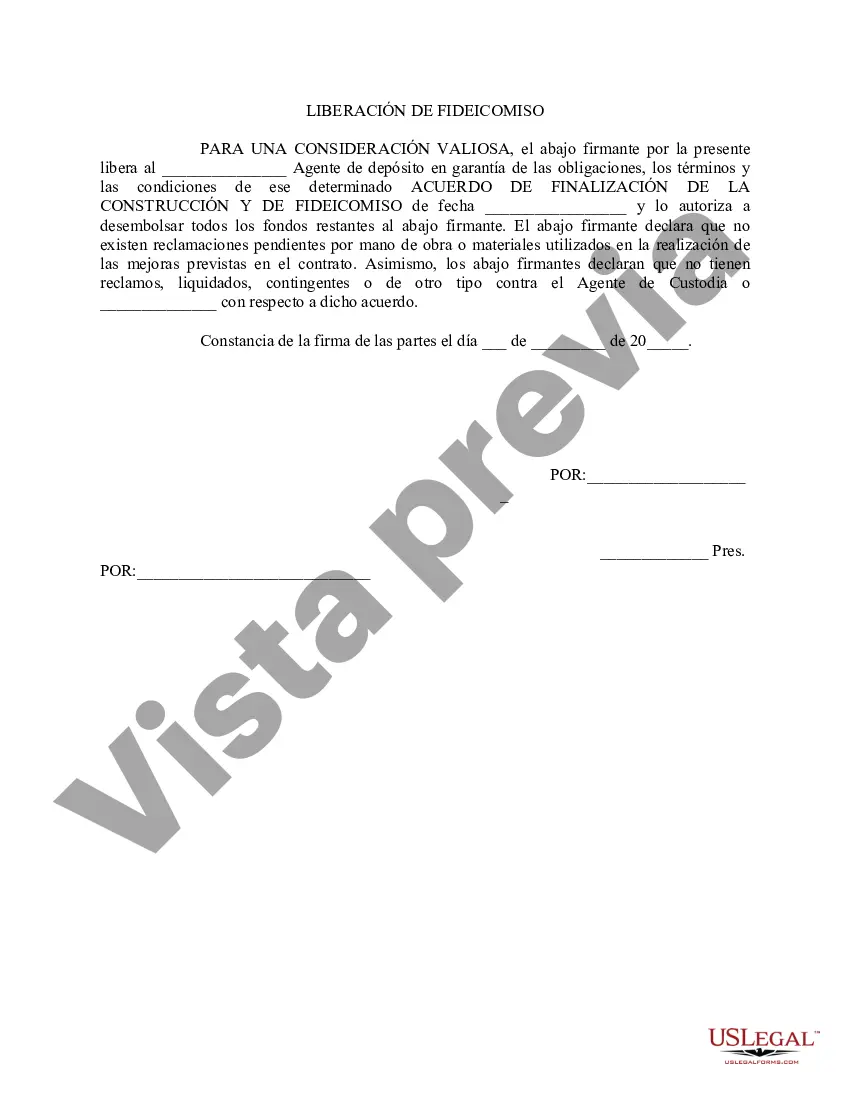

An escrow funds release certificate is a certification of the amount of the escrow funds (all or part) to be released from those funds placed into escrow with an escrow agent pursuant to an escrow holdback agreement. Escrow funds are only disbursed to the applicable party when it satisfies its outstanding obligations.

The California Escrow Process Step 1: Escrow Begins. Step 2: Initial Deposit. Step 3: Disclosures and Inspections. Step 4: Repair Negotiations and Appraisal. Step 5: The Mortgage Process. Step 6: Title Searches and Insurance. Step 7: Final Verification.

An escrow funds release certificate is a certification of the amount of the escrow funds (all or part) to be released from those funds placed into escrow with an escrow agent pursuant to an escrow holdback agreement. Escrow funds are only disbursed to the applicable party when it satisfies its outstanding obligations.

Washington state's escrow process is similar to other states where an escrow agent is used to complete the transaction. The escrow company will notify the seller's agent when the title has recorded, and the seller's agent will usually then deliver the keys to the buyer's agent or the buyer.

In an escrow agreement, one party—usually a depositor—deposits funds or an asset with the escrow agent until the time that the contract is fulfilled. Once the contractual conditions are met, the escrow agent will deliver the funds or other assets to the beneficiary.

All Escrow Agents must first apply and be approved for an Escrow Officer license through DFI, and all Escrow Agents and any employees of an escrow company must comply with the Washington Licensure Requirements.

Questions to ask when choosing an escrow agent Impartial and independent. Is the escrow agent a neutral third-party to all parties involved or are they linked to one of the parties? Expertise. Are escrow services the agent's core business and do they have a dedicated team? ... Knowledge and experience.