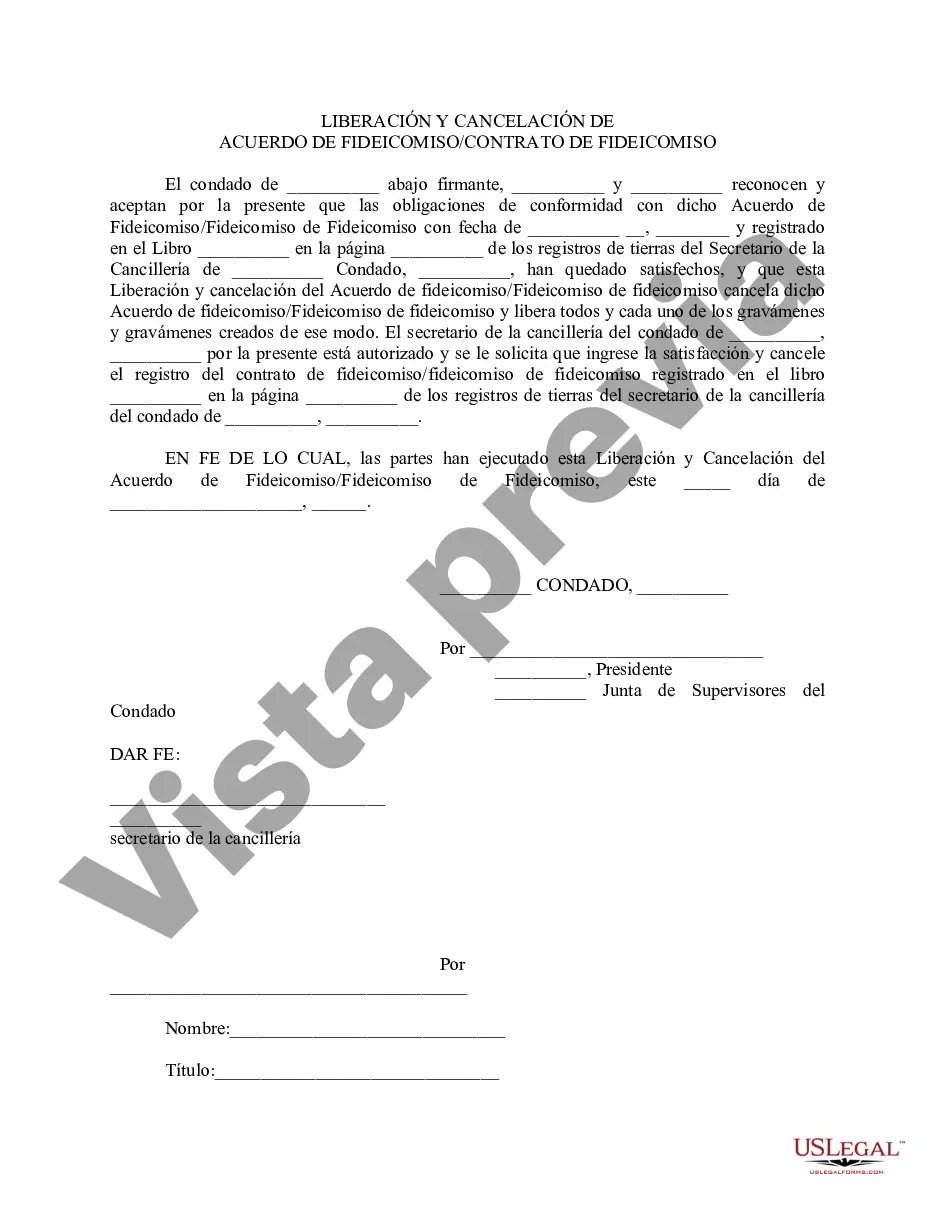

Indenture Meaning With Examples In Palm Beach - Release and Cancellation of Trust Agreement - Trust Indenture

Description

Form popularity

FAQ

An indenture is a particular formal contract or deed made between two or more parties. Beginning in medieval England, an indenture can be defined as a specific agreement within a contract noted with a specific duration or significance.

The Trust Indenture Act requires certain prospectus disclosure about the debt securities in registered offerings. Most offerings of debt securities that are exempt from registration under the Securities Act of 1933 are also exempt from the Trust Indenture Act requirements.

In real estate, an indenture is a deed in which two parties agree to continuing obligations. For example, one party may agree to maintain a property and the other may agree to make payments on it.

The indenture typically: (1) clearly describes and defines the issued debt securities; (2) specifies the rights of the parties, including the duties of the trustee as a third-party administrator; (3) sets forth the borrower's obligation to make payments; and (4) outlines the remedies available to the noteholders if the ...

The Indenture pledges certain revenues as security for repayment of the Bonds. The Trustee agrees to act on behalf of the holders of the Bonds and to represent their interests.

Indenture. n. a type of real property deed in which two parties agree to continuing mutual obligations. One party may agree to maintain the property, while the other agrees to make periodic payments. 2) a contract binding one person to work for another.

The terms of the Indenture are tailored to reflect the specific type of transaction and issuer. Like credit agreements,1 an Indenture contains lending and repayment terms. In contrast to credit agreements, however, the lender is not a party to an Indenture.

Some indentured servants served as cooks, gardeners, housekeepers, field workers, or general laborers, while others learned specific trades such as blacksmithing, plastering, and bricklaying, which they often parlayed into future careers.