Independent Contractor Agreement For Sales Associate In Virginia - International Independent Contractor Agreement

Description

Form popularity

FAQ

If you are offered an associateship that engages you as an independent contractor, your compensation and tax status will be dramatically different from an employee's - most significantly, you will not have any taxes or other deductions from your paycheck.

Most states do not require a business license to become an independent contractor within the US. Virginia doesn't require a state-wide business license, except for some certification and licensing requirements for specific occupations.

What Documents Are Needed to Legally Establish Independent Contractor Status? Get a Form W-9. The first step to working with an independent contractor is getting a W-9 form. Agree on the agreement. Request an invoice. Finally, the 1099-NEC.

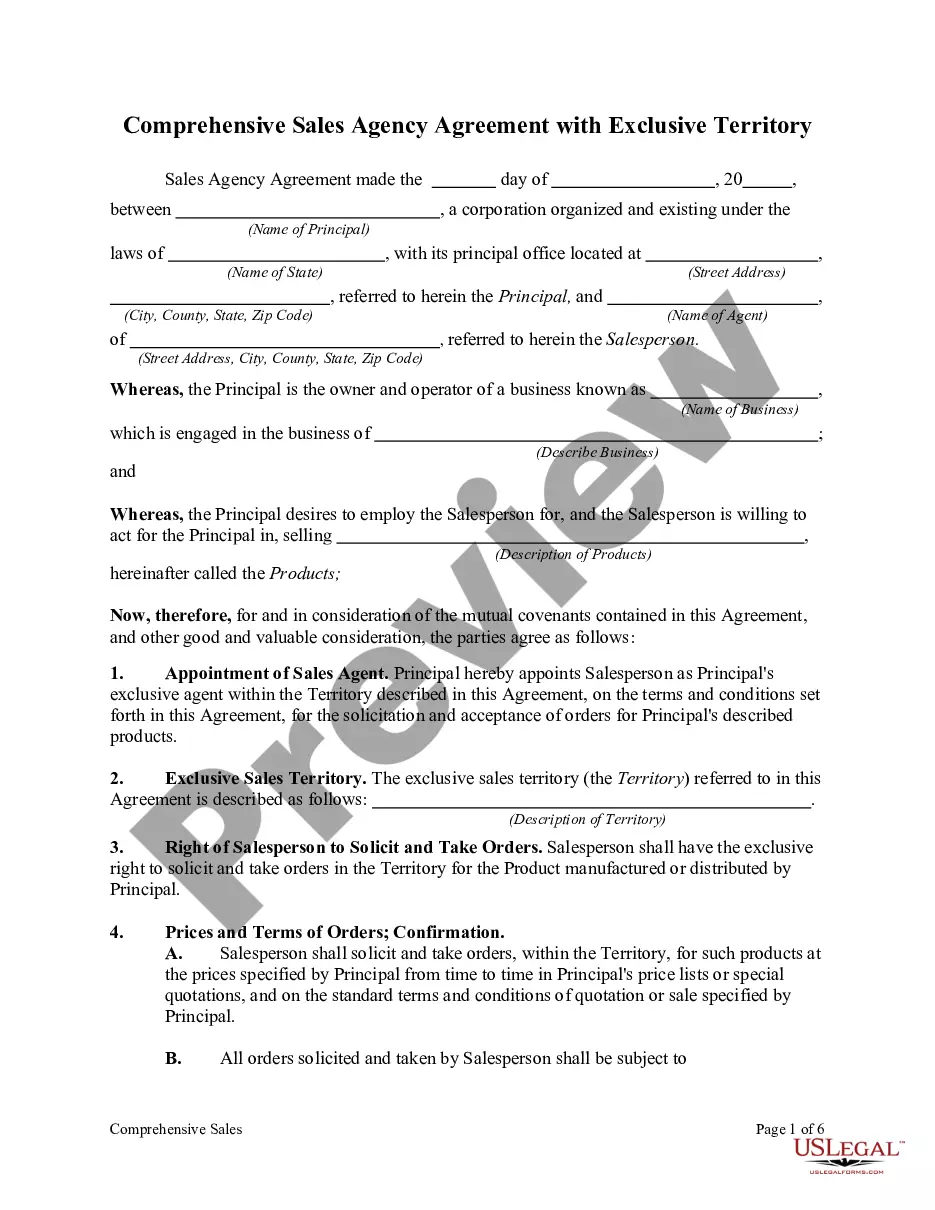

The agreement should have an introductory paragraph outlining who is the client and who is the service provider. It should contain the legal names of both parties, the date, and the physical addresses of each party.

An Independent Contractor Agreement is a contract between a company and an independent contractor to hire the contractor without them becoming an employee. In this agreement, the contractor or freelancer agrees to work for the hiring organization for a specified period of time, on a specific assignment or project.

Factors that show you are an independent contractor include working with multiple clients instead of just one, not receiving detailed instructions from hiring firms, paying your own business expenses such as office and equipment expenses, setting your own schedule, marketing your services to the public, having all ...

California Law states that a worker may be considered an independent contractor if (1) the worker has the right to control the performance of services, (2) the result of the work is the primary factor bargained for, and not the means by which it is accomplished, (3) the worker has an independently established business, ...

Ing to IRS guidelines, it is possible to have a W-2 employee who also performs work as a 1099 independent contractor. For example, it is possible that an individual could work part of the year as an employee and part of the year as an independent contractor due to a layoff or even a resignation.

Generally, dental associates are considered employees if their employer has the right to control how duties are performed. This would mean you are subject to your employer's decisions and direction on: When and where you work. The equipment and supplies you will use.