Corporate Resolution For Bank Account In Suffolk - General - Resolution Form - Corporate Resolutions

Description

Form popularity

FAQ

“RESOLVED THAT a Current Account in the name of the Company be opened with ____________ Bank, _____________ , for the operations of the activities of the Company and the said Bank be and is hereby authorized to honour all cheques, drafts, bills of exchange, promissory notes and other negotiable instrument, signed drawn ...

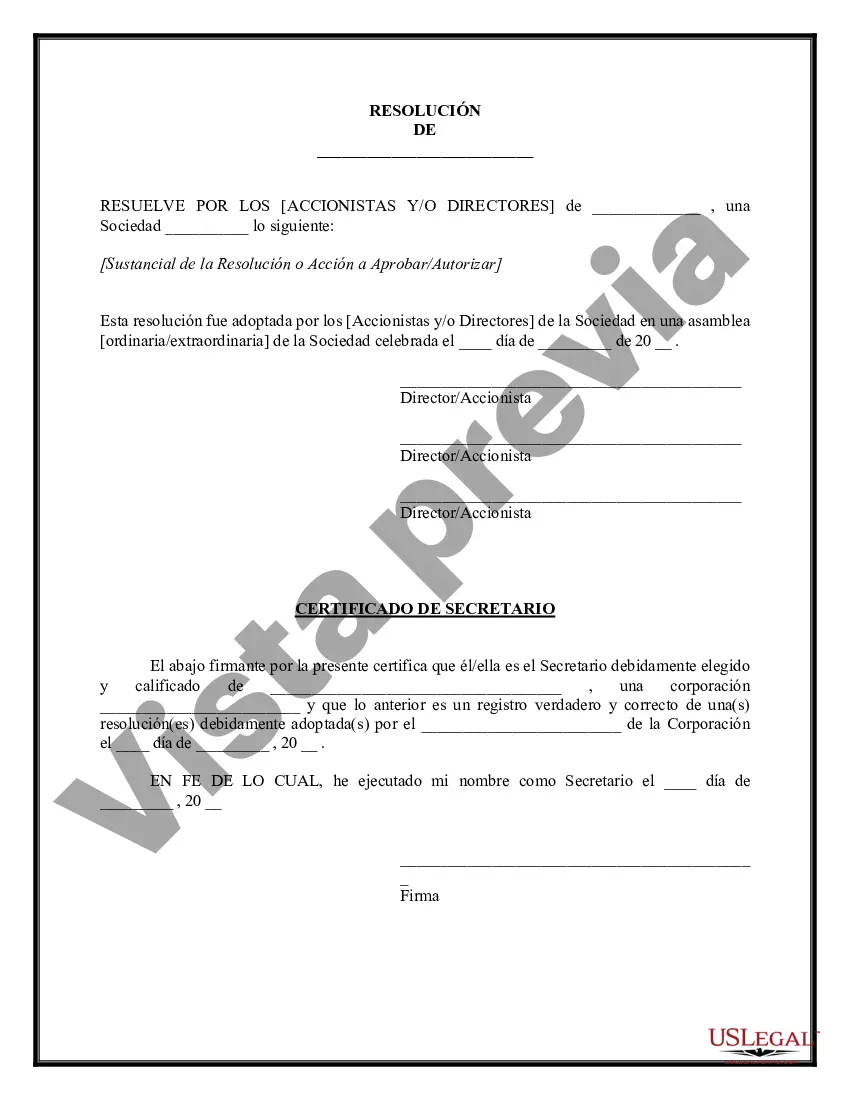

Banks often require banking resolutions from companies. They serve as proof that the person opening a business bank account is authorized to do so. Some banks have a standard form that companies must use for their banking resolution.

Banking resolutions are generally part of the process for opening a bank account for your company. Check with your bank to see what their requirements are. To authenticate it as a stand-alone document, the banking resolution is signed by the corporate secretary and stamped with the corporation's corporate seal.

Board members of a corporation usually draft a banking resolution at their first board meeting. A Limited liability company (LLC) should also have a banking resolution. This simplifies the process of opening a bank account. Banks often require banking resolutions from companies.

Resolution is the restructuring of a bank by a resolution authority through the use of resolution tools in order to safeguard public interests, including the continuity of the bank's critical functions, financial stability and minimal costs to taxpayers.

An LLC banking resolution is often one of the most necessary, as a business cannot generally create a bank account without one. Depending on the rules of the bank, you may be required to fill in an additional proprietary form before creating a business bank account.

Obtain a copy of the corporate resolution form California from the Secretary of State's website or local office. Fill in the necessary information on the form, such as the name of the corporation, its address, and the date of the resolution.

What should a resolution to open a corporate bank account include? Corporation name and address. Bank name and address. Bank account number. Date of resolution. Certifying signatures and dates. Corporate seal.

Corporate Resolution Authorizing Filing Select Bankruptcy menu. Select Other. Enter the case number using correct format and ensure case name and number match the document you are filing. Select Document event: Corp Resolution Auth Filing. Select the party filer. Browse, verify and attach the document (PDF file).

Key Takeaways This simplifies the process of opening a bank account. Banks often require banking resolutions from companies. They serve as proof that the person opening a business bank account is authorized to do so. Some banks have a standard form that companies must use for their banking resolution.