Change For Stocks In Allegheny - Change Amount of Authorized Shares - Resolution Form - Corporate Resolutions

Description

Form popularity

FAQ

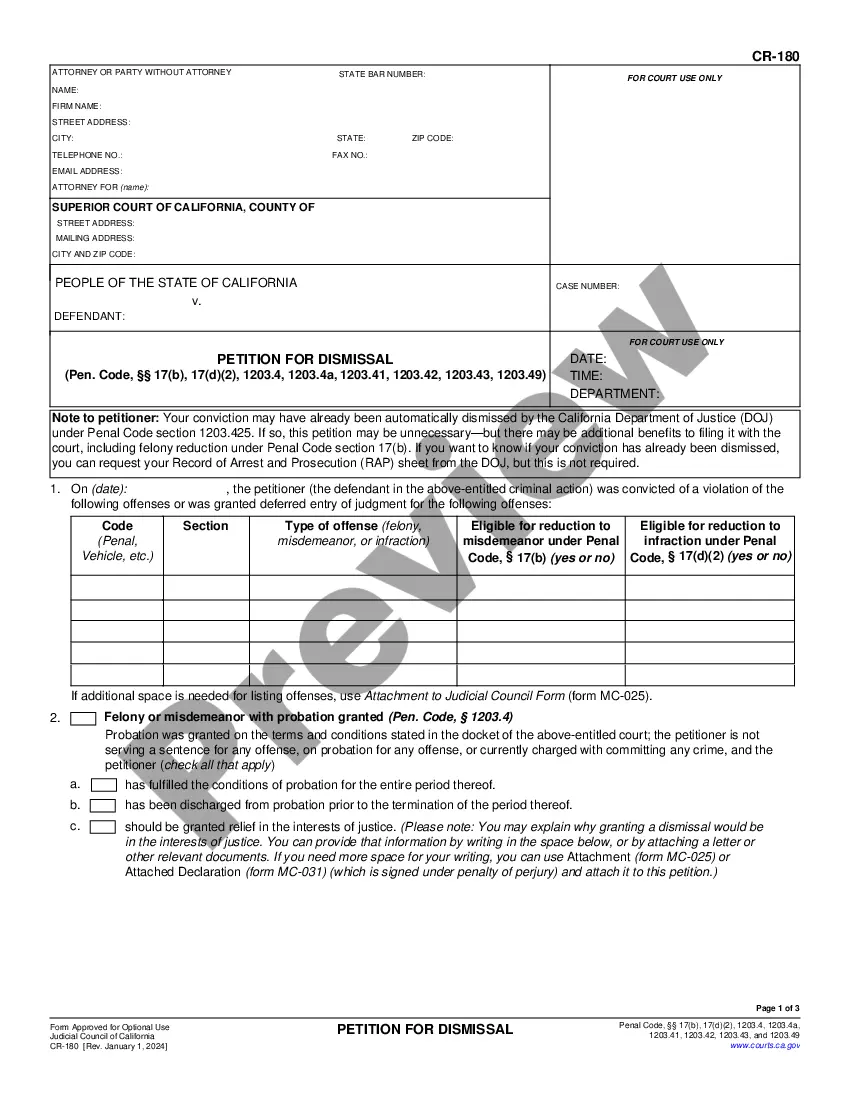

Buyers and sellers meet to trade stocks through an exchange. Exchanges can be physical or electronic. Stocks that can't meet exchange requirements may be traded "over the counter."

More specifically: 3%: risk management (maximum risk per trade) 5%: maximum exposure across all trades (based on the timing of the transaction) 7%: profit target or minimum profit-to-loss ratio.

A stock market correction describes a specific fall in value of at least 10% (but less than 20%) from a recent stock market high. Investors often use "stock market correction" to describe a drop in the market as a whole or within a specific index, like the S&P 500.

The :10 rule helps safeguard SIPs by allocating 70% to low-risk, 20% to medium-risk, and 10% to high-risk investments, ensuring stability, balanced growth, and high returns while managing market fluctuations.

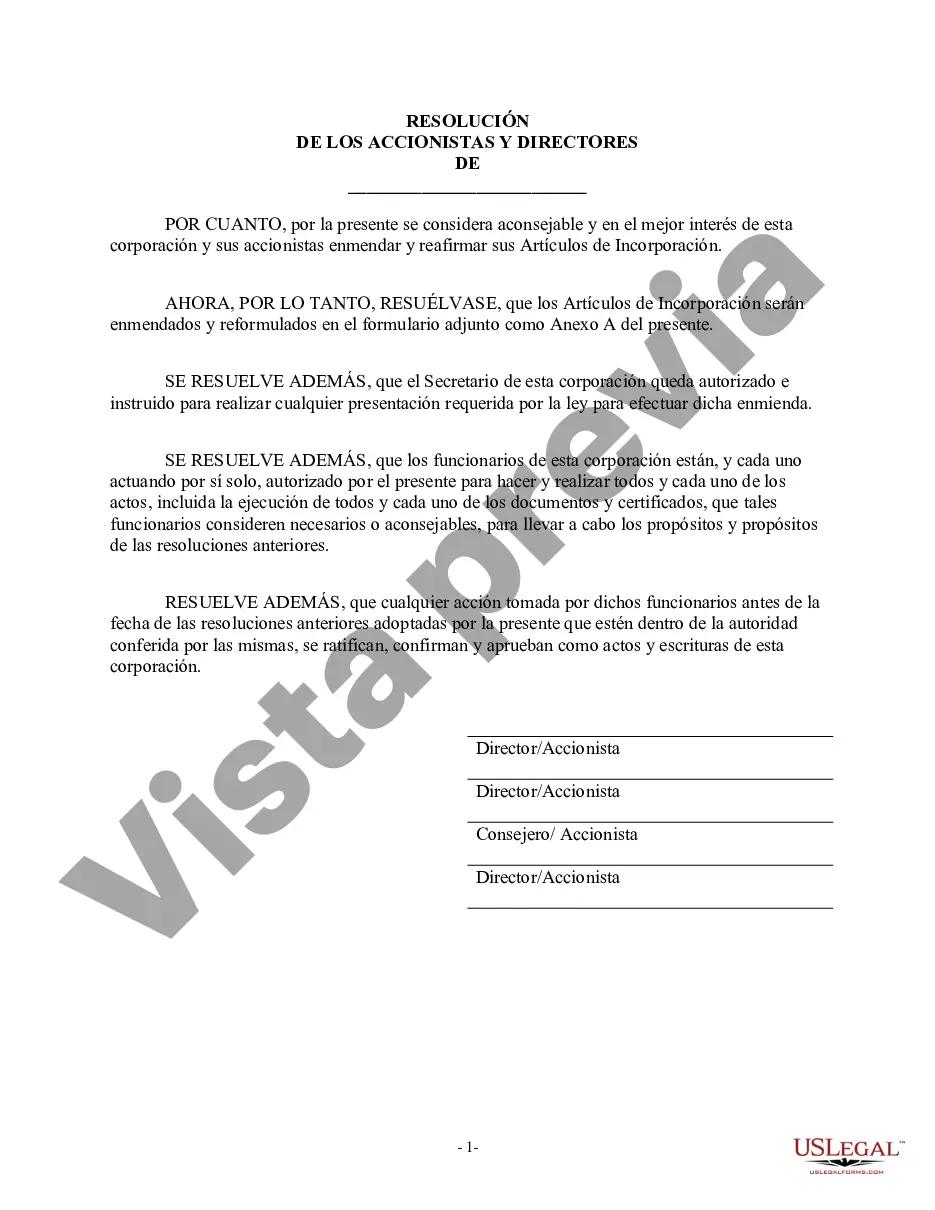

Here are some ways ownership can be transferred within an S-corp: Issuing new stock shares. You can issues new shares of company stock by by creating a bill of sale—BUT make sure you're following the protocols set-out in your Articles of Incorporation. Selling existing stock shares. Through a shareholder's estate.

How to Transfer Ownership of a Corporation Consult your Articles of Incorporation and corporate bylaws. Contact the board of directors or shareholders. Find a buyer. Transfer ownership of stock. Inform the Secretary of State.

To change your commercial registered agent in Pennsylvania, you must complete and file a Change of Registered Office with the Pennsylvania Department of State, Corporations Bureau and Charitable Organizations. The form can be filed online or by mail and costs $5 to file.

How to Transfer Ownership of a Corporation Consult your Articles of Incorporation and corporate bylaws. Contact the board of directors or shareholders. Find a buyer. Transfer ownership of stock. Inform the Secretary of State.

While there is no one correct way to transfer your business, businesses typically change hands through one of the following vehicles: Selling to a Third Party. Selling to Co-Owners. Transferring to Family. Management Buyout. Employee Stock Ownership Plans.