Solicitud De Empleo Llena Withholding Tax In Houston

Category:

State:

Multi-State

City:

Houston

Control #:

US-00413-19

Format:

Word;

Rich Text

Instant download

Description

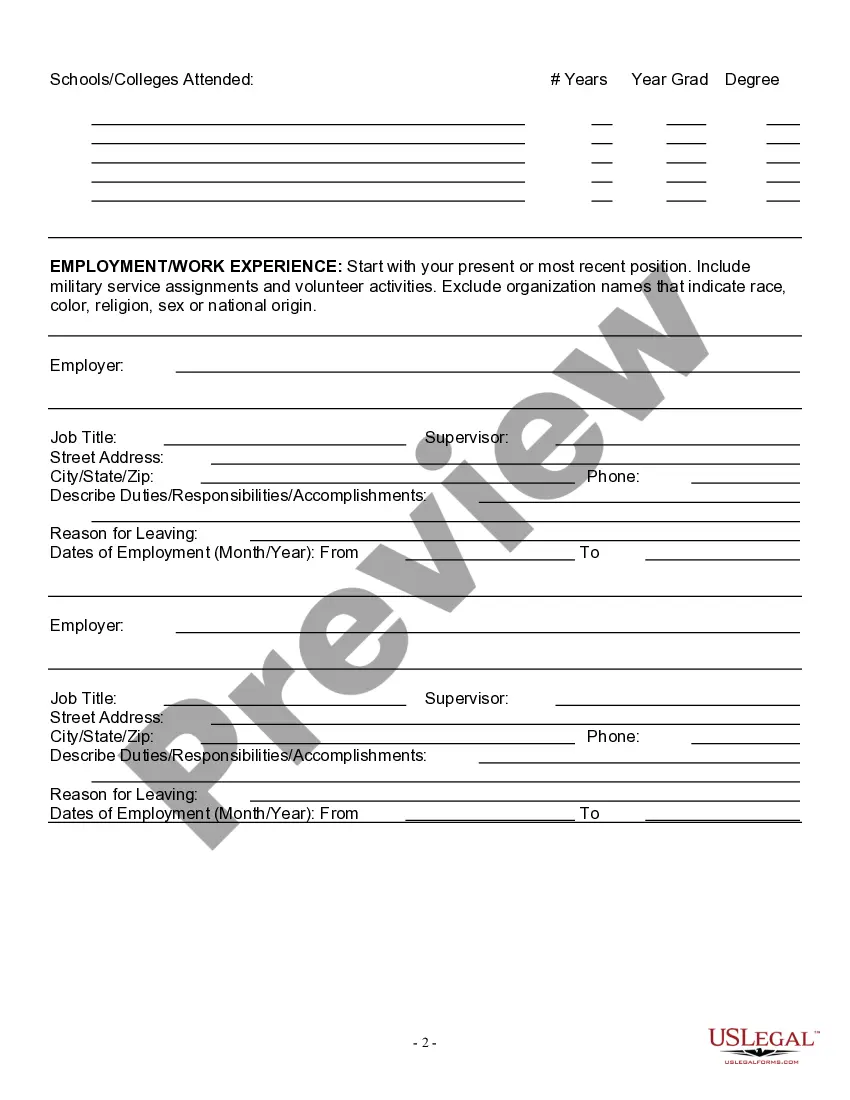

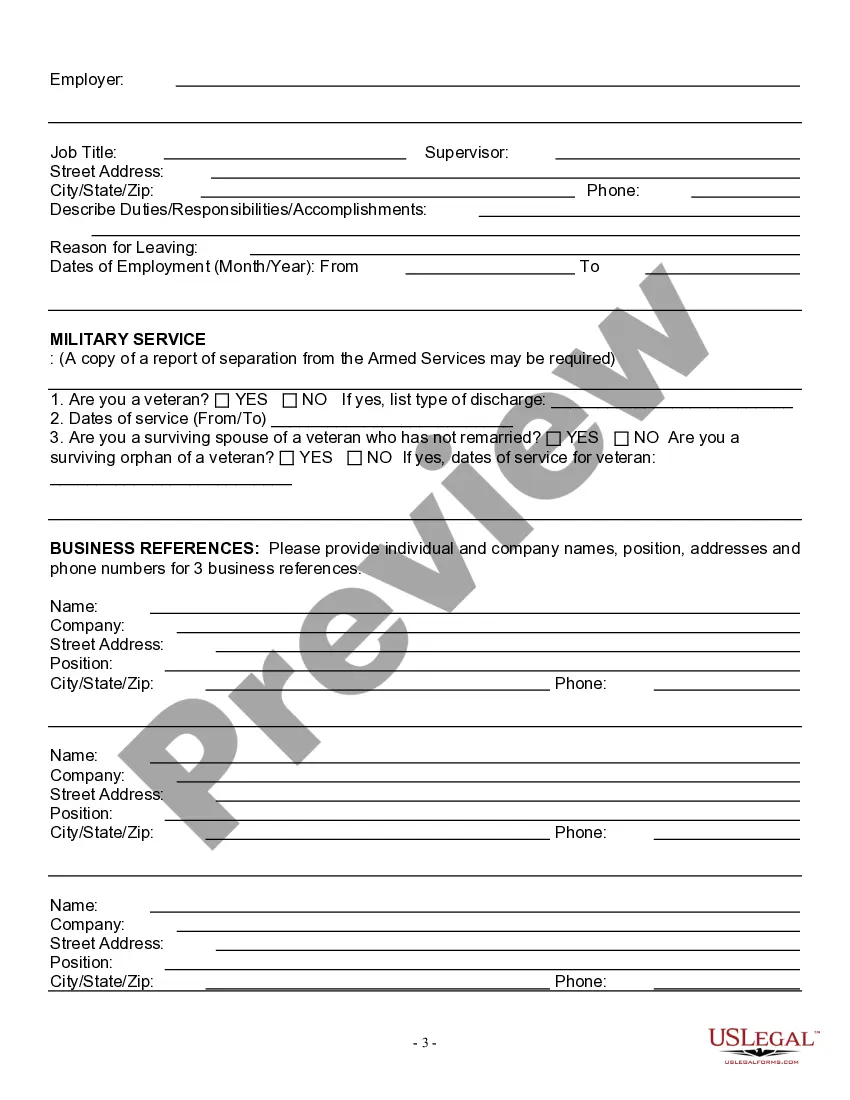

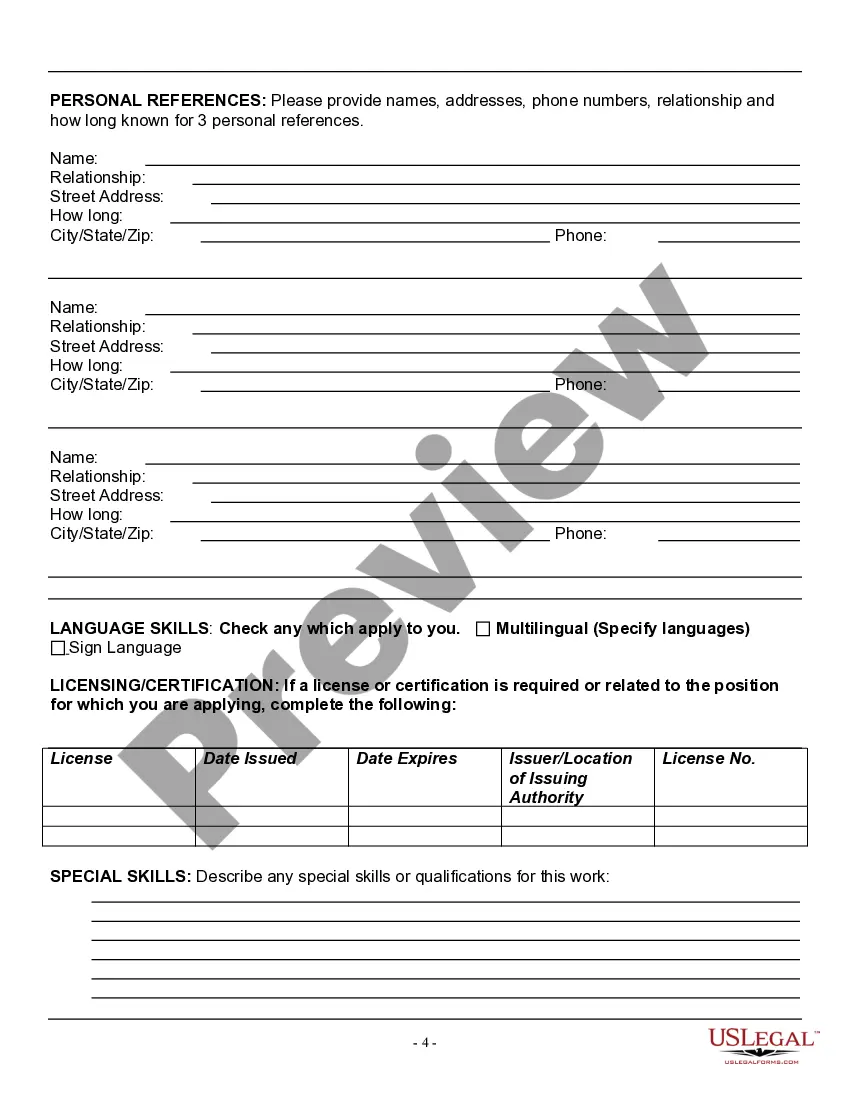

This form is an Employment Application. The form provides that applications are considered without regard to race, color, religion, or veteran status.

Free preview

Form popularity

More info

Complete el Formulario W-4 para que su empleador pueda retener la cantidad correcta del impuesto federal sobre los ingresos de su paga. As employers, state agencies and institutions of higher education must deduct federal income tax (FIT) from the wages of a state officer or employee.Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Give Form W-4 to your employer. Tax withholding is completely voluntary; withholding taxes is not required. A W4 form, or "Employee's Withholding Certificate," is an IRS tax document that employees fill out and submit to their employers. This video goes over how to fill out a 2021 Form W-4 if you are single and the basics behind Form W-4. The new form has five steps. Employees must fill out step 1 and step 5. Complete este formulario para que su empleador pueda retener correctamente de su sueldo el impuesto sobre el ingreso de California.