Asset Business Sale Contract For Deed In Dallas - Asset Purchase Agreement - Business Sale

Description

Form popularity

FAQ

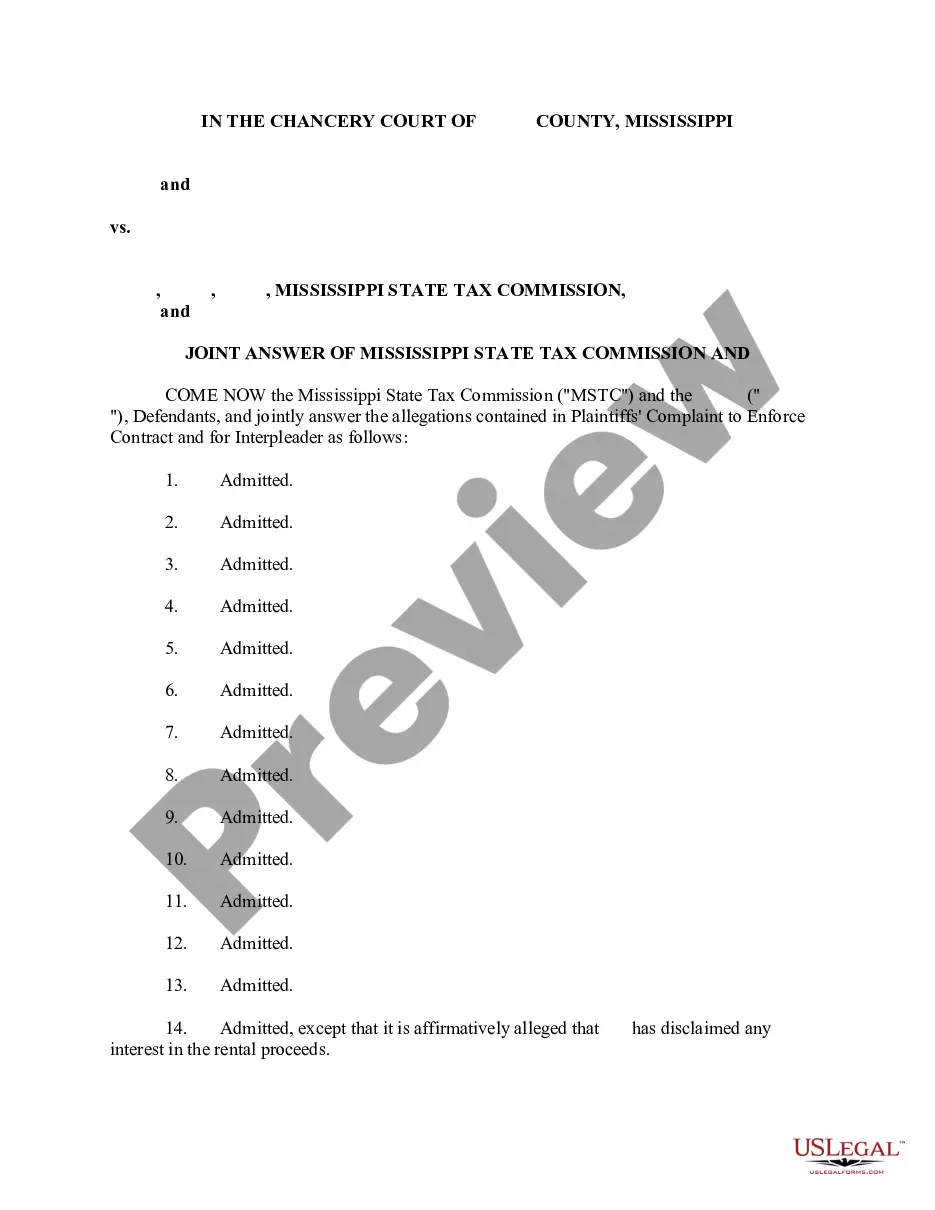

Texas law provides specific protections for buyers under contract for deed arrangements, including: Mandatory Written Agreements – The contract must be in writing, specifying all terms. Right to Cure Default – Buyers generally have a limited time to make up missed payments before forfeiture.

Contracts for deed are governed by Subchapter D, titled "Executory Contract for Conveyance," of the Texas Property Code. The subchapter generally only applies to residential real property to be used as the purchaser's residence where the contract is to be completed after 180 days from execution.

This is because the buyer is considered the owner of the property even though they have not yetMoreThis is because the buyer is considered the owner of the property even though they have not yet obtained a traditional mortgage. The seller may require the buyer to provide proof of insurance.

In Texas, contracts for deed on residential property are considered potentially predatory and subject to strict consumer-protection laws.

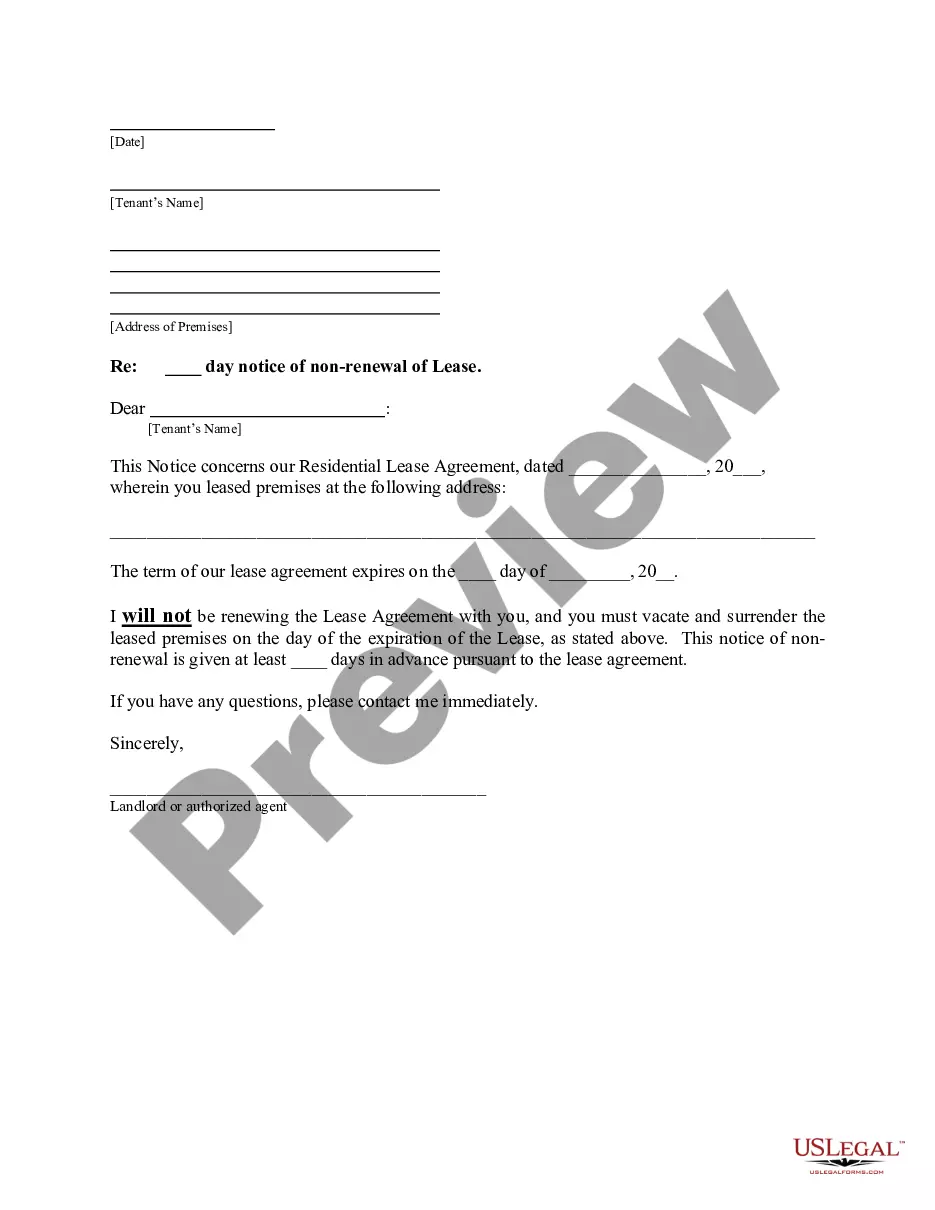

While it's not legally required, hiring a real estate attorney to help draft and review the contract is highly recommended. Can I use a template for my Texas real estate contract? While many templates are available online, it's best to have an attorney review and customize the contract to ensure it meets your needs.

A contract for deed is an agreement to buy property. The buyer makes monthly payments directly to the seller. When the final payment is made, the seller transfers the deed to the buyer, who becomes the new owner.

The property owner, whether residential or business pays taxes and has a reasonable expectation that the taxing authorities administer the taxing process fairly. The property owner is also referred to as the taxpayer.

“Executory Contracts” include contract for deed, lease-purchases, and lease-options. Texas law did not outlaw these methods: contract for deed, lease-purchases, or lease-options, but it has made them perilous for those still interested in trying to use them.

The biggest difference is that an SPA is the sale of all shares, and an APA is the sale of selected assets. Therefore, they are both different transactions and have different procedures. 2. With a SPA, all shareholders in the company must be consulted and agree to sell their shares in the company.