Asset Purchase In M\u0026amp;a In Ohio

Category:

State:

Multi-State

Control #:

US-00418

Format:

Word;

Rich Text

Instant download

Description

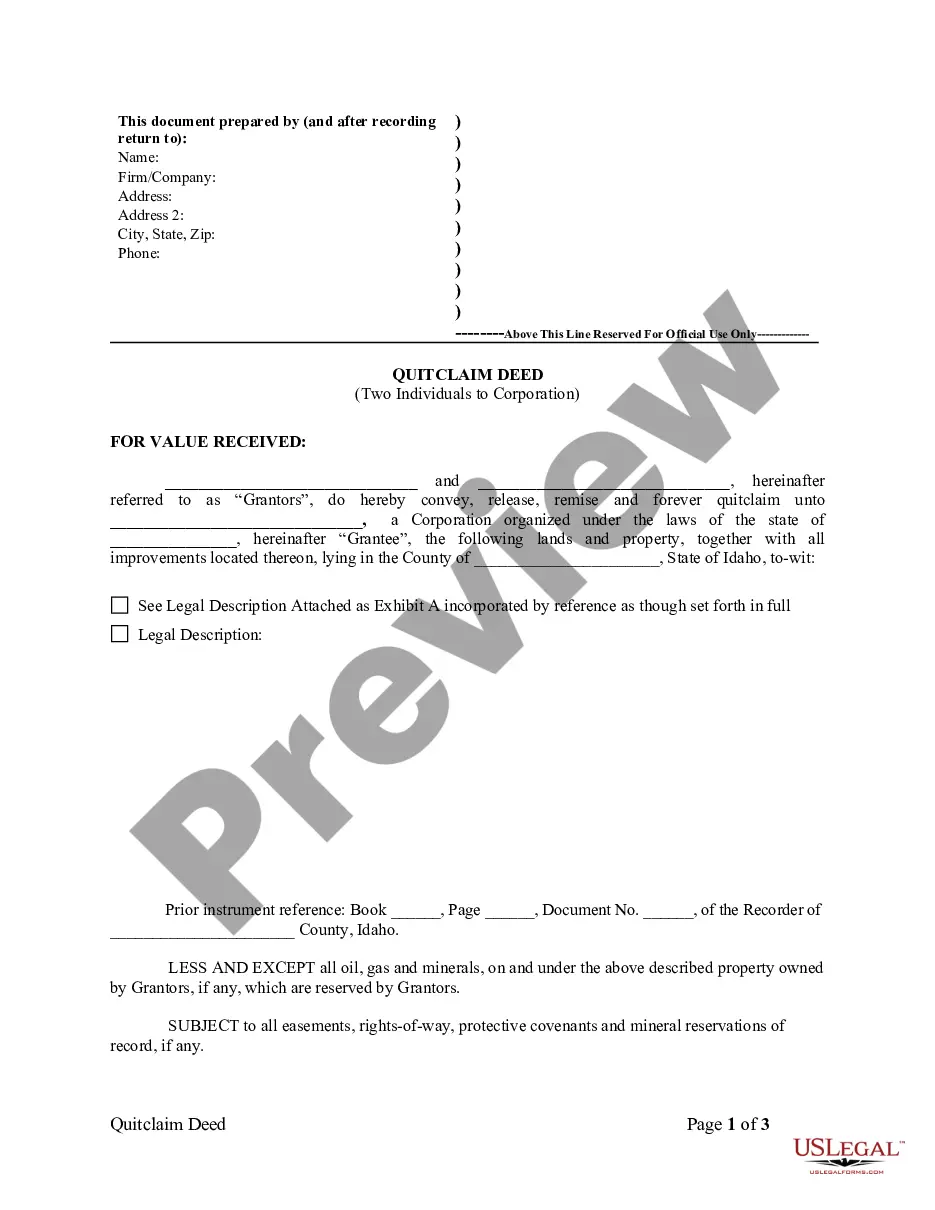

This form is an Asset Purchase Agreement. The buyer agrees to purchase from the seller certain assets which are listed in the agreement. The form also provides a listing of certain assets which will be excluded from the sale. The form must be signed in the presence of a notary public.

Free preview

Form popularity

More info

Is the assignment enforceable in an asset purchase situation in the state of Ohio? In an asset purchase, the buyer agrees to purchase specific assets and liabilities.This means that they only take on the risks of those specific assets. A purchaser of the assets of a business will be liable for any unpaid sales tax of the seller, as well as any accrued interest and penalties related thereto. In an asset sale, the new owner purchases the business's physical assets. The seller retains all rights to the legal entity. Find top rated Ohio asset purchase agreement lawyers. Post your legal needs and get proposals from vetted lawyers in OH for your APA.