Accounting For Asset Sale Of Business In Wake - Asset Purchase Agreement - Business Sale

Category:

State:

Multi-State

County:

Wake

Control #:

US-00418

Format:

Word

Instant download

Description

Venta de todos los activos de una empresa.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés.

For your convenience, the complete English version of this form is attached below the Spanish version.

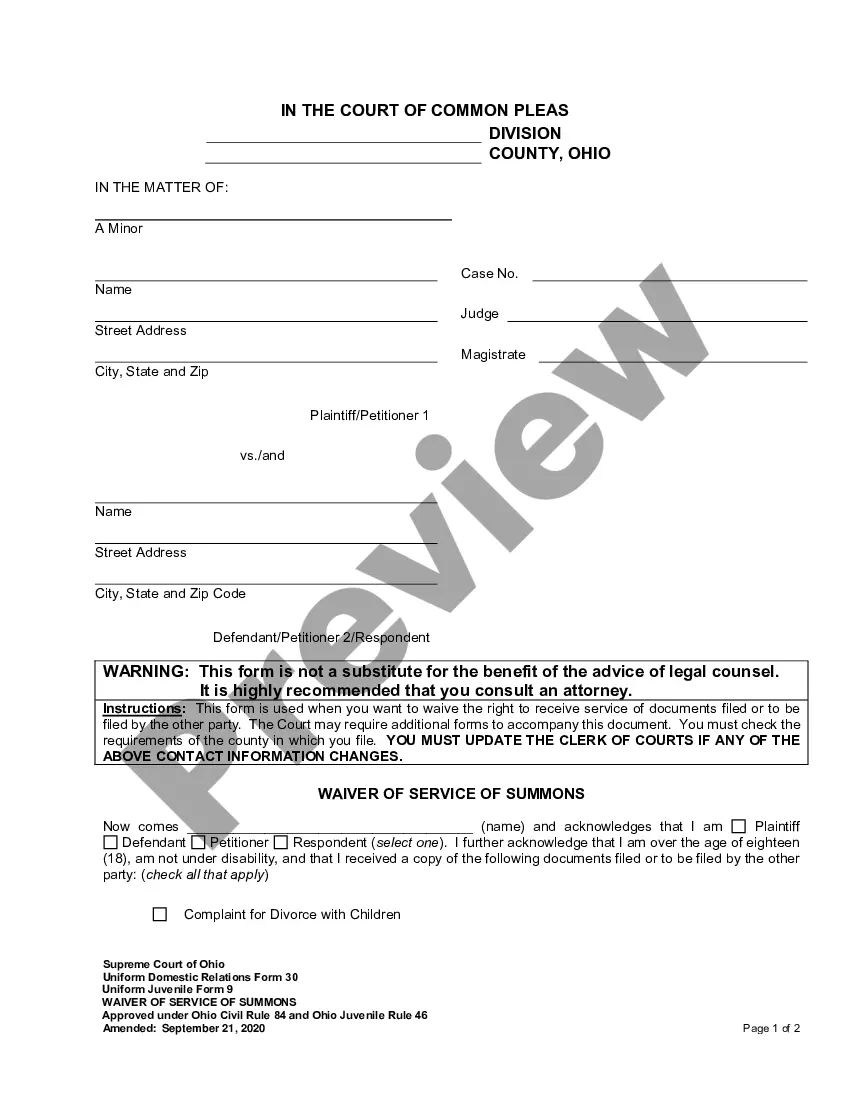

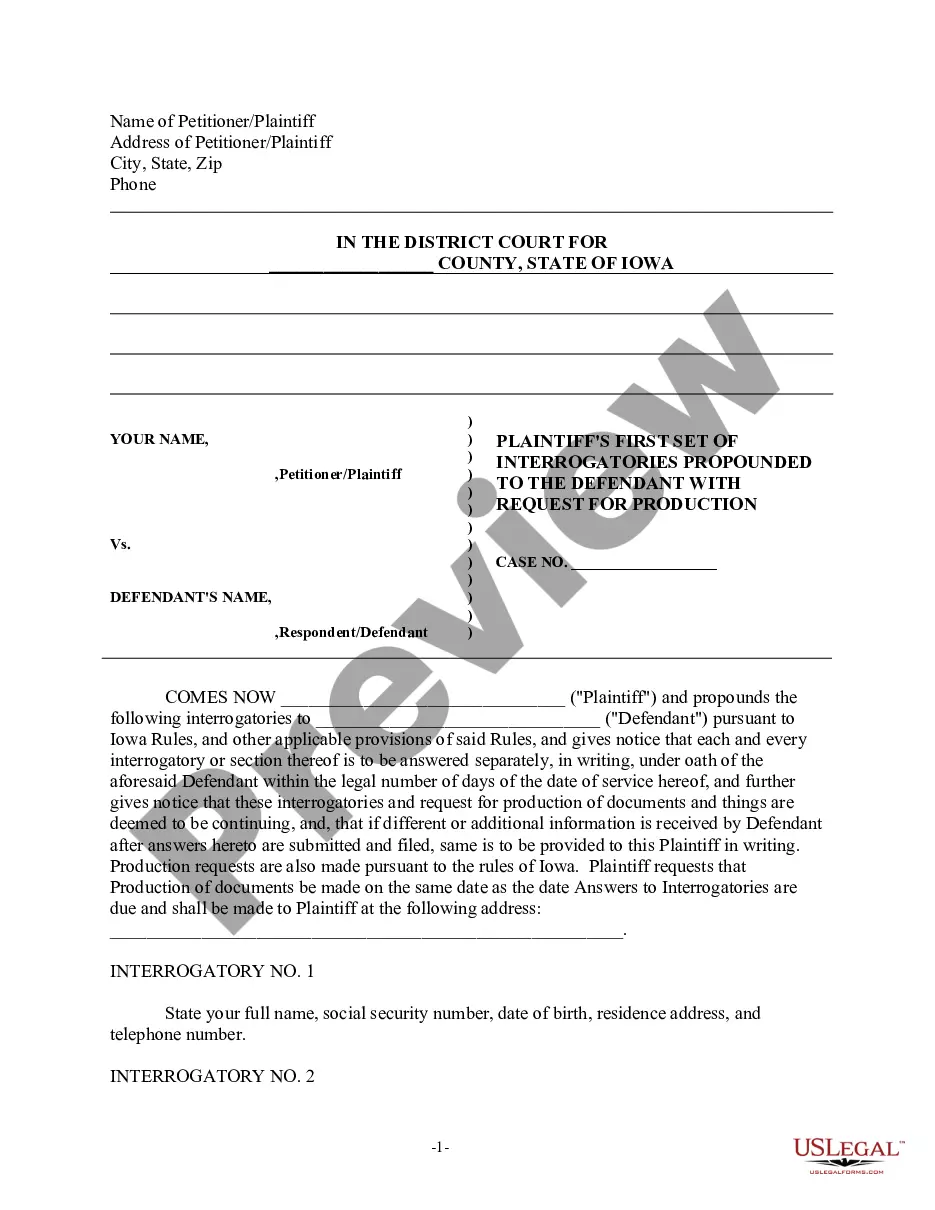

Free preview

Form popularity

More info

When selling or otherwise disposing of a plant asset, a firm must record the depreciation up to the date of sale or disposal. In this article, we discuss what asset sales are, how they work and how to calculate a loss or gain because of an asset sale.In an asset sale, the new owner purchases the business's physical assets. The seller retains all rights to the legal entity. Form 8594 is a tax document required in certain business sales where the buyer acquires assets rather than stock or equity. You will need to allocate the amount reflected on form 8594 among all the assets. A typical method is to allocate the proceeds based on the original cost. When we're talking about the gain or loss of the sale of an asset we need to be looking at net book value at the time of the sale. There are major tax implications for both the buyer and seller based on the classification of each asset in an asset sale. A longlived asset (disposal group) should be classified as held for sale in the period in which all of the held for sale criteria are met.