Louisiana Deferred Comp Withdrawal In Clark

Category:

State:

Multi-State

County:

Clark

Control #:

US-00418BG

Format:

Word;

Rich Text

Instant download

Description

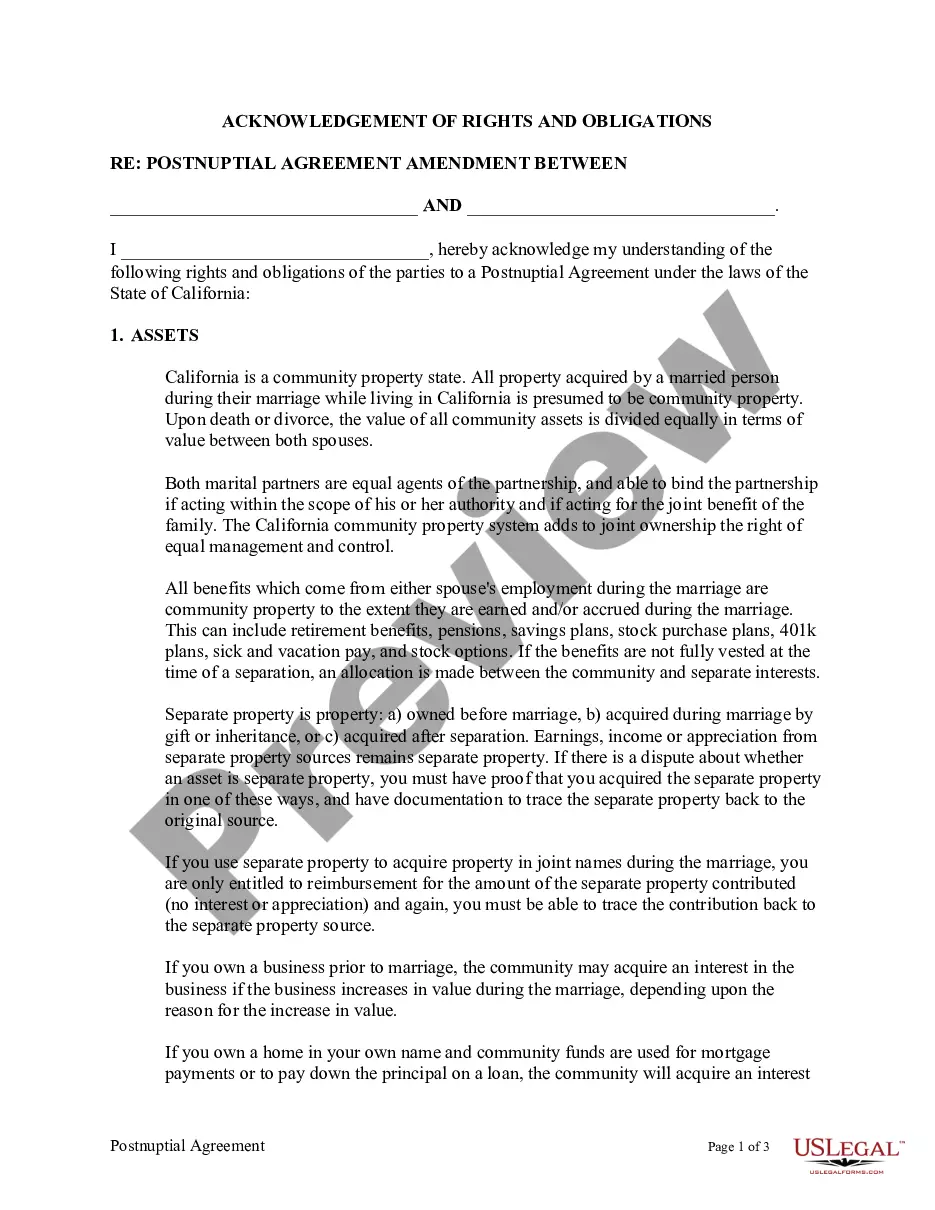

The Louisiana Deferred Comp Withdrawal in Clark is a legal form that outlines the terms of a deferred compensation agreement between an employer and an employee. This agreement is designed to provide employees with additional retirement income or pre-retirement death benefits beyond their regular pension and insurance plans. Key features include provisions for retirement payments based on age and conditions under which benefits can be received, as well as terms regarding benefits upon death before or after retirement. Users must fill in specific details such as names, addresses, payment amounts, and duration of payments, ensuring all parties understand their rights and obligations. This form is particularly useful for attorneys, partners, owners, associates, paralegals, and legal assistants in drafting and executing valid retirement agreements while maintaining compliance with state laws. Properly completing and editing the form is crucial to prevent disputes, especially regarding noncompetition clauses and the terms of entitlement to benefits. Regular updates and compliance with applicable laws are also essential, which this form facilitates. Ultimately, this agreement serves to protect both the corporation and the employee's interests effectively.

Free preview