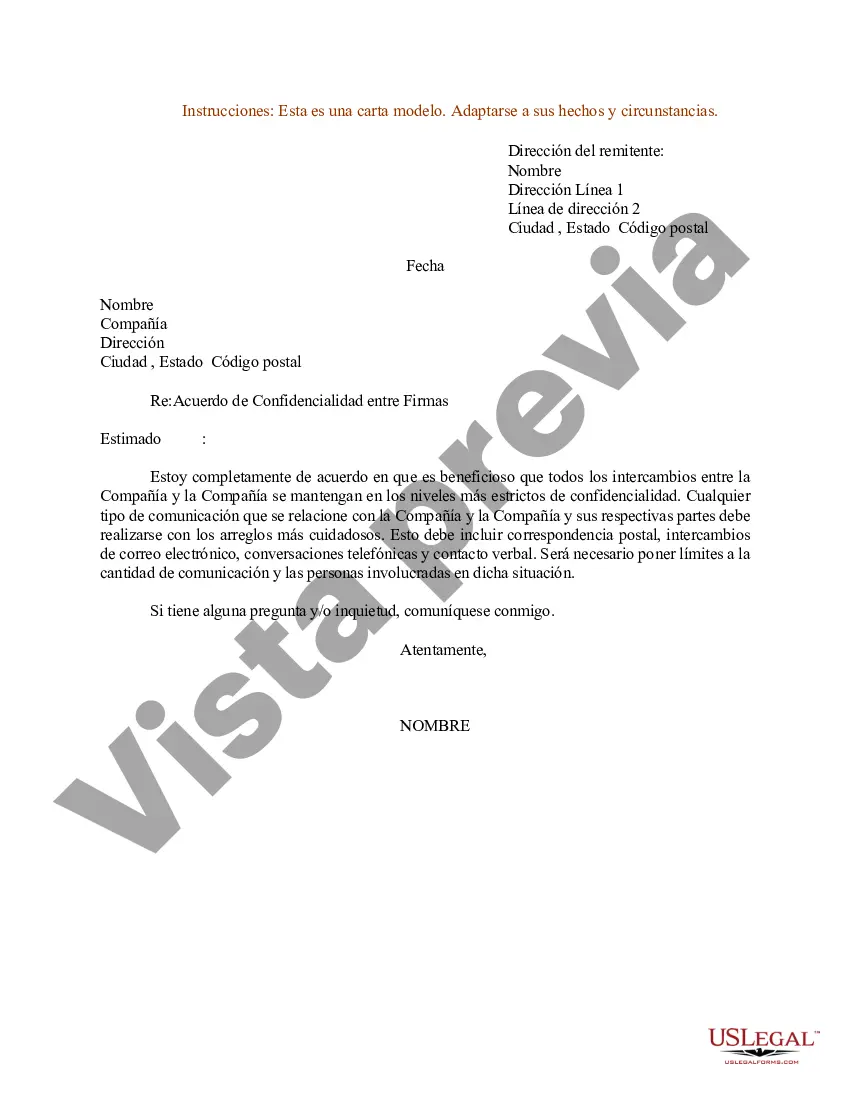

Agreement Confidentiality Between For Nonprofit Board Members In North Carolina - Sample Letter for Agreement of Confidentiality Between Firms

Description

Form popularity

FAQ

The IRS generally requires a minimum of three board members for every nonprofit, but does not dictate board term length. What is important to remember is that board service terms aren't intended to be perpetual, and are typically one to five years.

Nonprofits with annual gross receipts of more than $50,000 or with an average of more than $50,000 over the past three years must file a 990 or 990-EZ. File the form each year by the 15th day of the 5th month after your fiscal year ends (e.g., Nov. 15 if your year ends June 30).

North Carolina nonprofit corporations are required to register with the North Carolina Secretary of State. To maintain their registration, nonprofit corporations must comply with all state licensing and reporting requirements, including, for many nonprofit organizations, maintaining a charitable solicitation license.

If you do not file an annual report on time, the state of North Carolina will send you a “Notice of Grounds for Administrative Dissolution.” If you do not file your report within 60 days, your business will be dissolved.

North Carolina law requires only one board member, but best practices recommend that you have at least five; a minimum of seven is preferable.

I have researched the IRS regulations on 501C3's and the answer is no, your board members do not have to be us citizens. A foreign citizen may be an officer or director for a non-profit organization so long as they do not receive a salary or compensation for the services provided in the United States.

profit company must have at least three incorporators and three directors and may be registered with or without members. profit company is not required to have members.

What Factors Influence the Size of the Board? ing to The Wall Street Journal study, the board should be large enough to carry out the board's fiduciary and other duties effectively and efficiently. For many organizations, that means five to seven board members are ideal.