A property buyout agreement form with mortgage is a legal document that outlines the terms and conditions of a transaction where one party (the buyer) agrees to purchase a property from another party (the seller) by taking over an existing mortgage. In this agreement, the buyer assumes the responsibility of paying off the remaining mortgage balance on the property. The agreement form typically includes the following key details: 1. Parties Involved: The names, addresses, and contact information of both the buyer and the seller. 2. Property Details: A detailed description of the property being sold, including its address, legal description, and any unique features or characteristics. 3. Terms of Sale: This section includes the agreed-upon purchase price, down payment amount, and the schedule for payment installments. 4. Assumption of Mortgage: Here, the buyer agrees to assume responsibility for the existing mortgage loan and continue making payments on the outstanding balance. 5. Mortgage Contingency: This section outlines any conditions or requirements that need to be met for the mortgage assumption to take place, such as creditworthiness or loan approval. 6. Property Condition: The agreement may include a clause that requires the seller to provide the property in a certain condition, free from defects or other issues, at the time of transfer. 7. Closing and Transfer: Details regarding the closing date, the location where the transaction will take place, and the process for transferring ownership of the property. 8. Default and Remedies: In case either party fails to fulfill their obligations under the agreement, this section describes the remedies available to the innocent party, which may include cancellation of the agreement or legal actions. 9. Governing Law and Jurisdiction: The agreement clarifies which state's laws will govern the agreement and any disputes that may arise, as well as which courts have jurisdiction over such matters. Types of property buyout agreement forms with mortgages include: 1. Residential Property Buyout Agreement: Primarily used for the purchase of single-family homes, townhouses, or condominiums. 2. Commercial Property Buyout Agreement: Used for the acquisition of commercial properties such as office buildings, retail spaces, warehouses, or industrial complexes. 3. Multi-unit Property Buyout Agreement: Specifically designed for the purchase of properties with multiple units, such as apartment buildings or duplexes. 4. Vacant Land Buyout Agreement: Used when buying undeveloped land or lots for future development or investment purposes. Overall, a property buyout agreement form with a mortgage serves to protect the rights and obligations of both the buyer and seller during the transfer of a property while considering the existing mortgage.

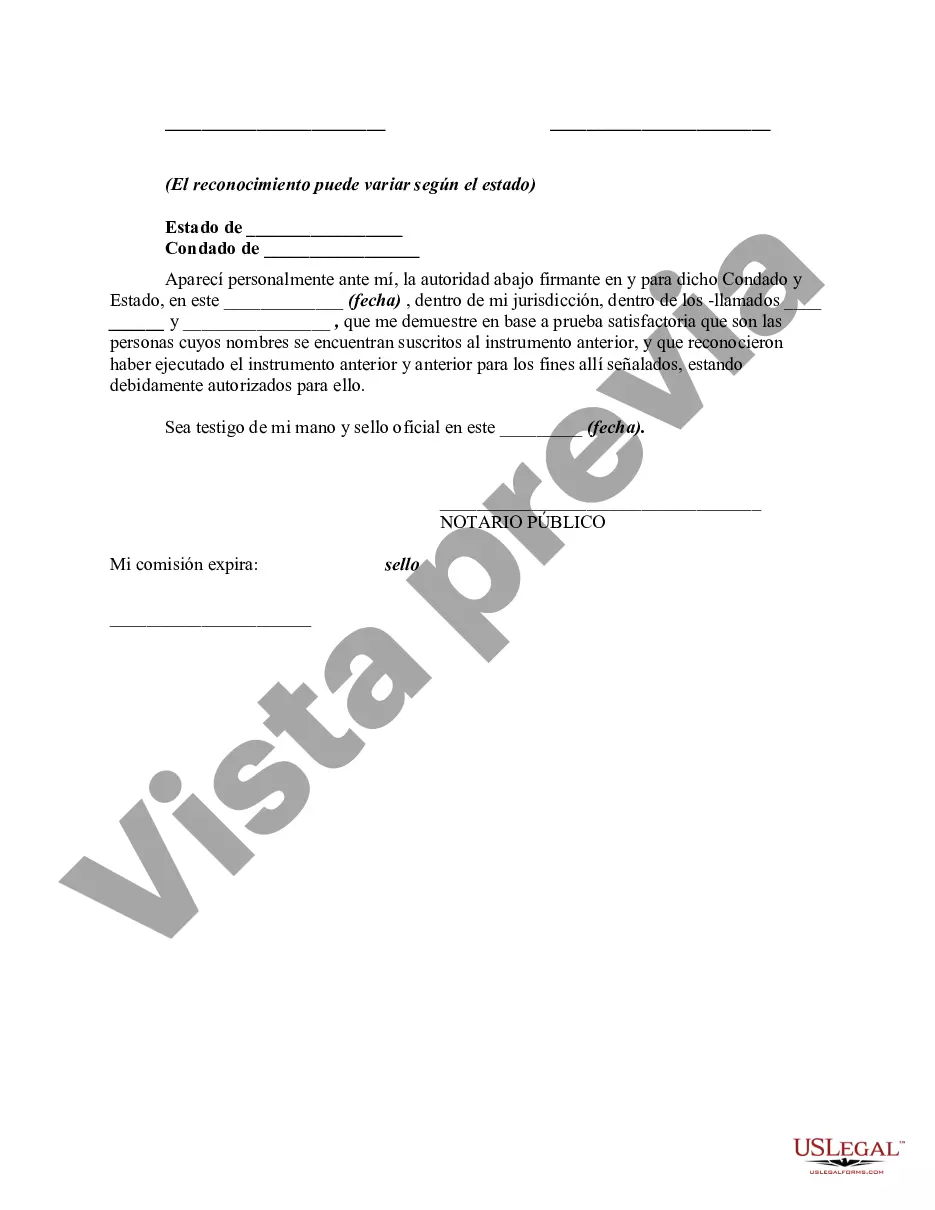

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Property Buyout Agreement Form With Mortgage - Buy Sell Agreement Between Co-Owners of Real Property

Description Compraventa Bienes

How to fill out Acuerdo Compraventa Bienes?

Legal managing might be overwhelming, even for the most skilled professionals. When you are searching for a Property Buyout Agreement Form With Mortgage and do not get the a chance to commit searching for the right and up-to-date version, the operations may be stressful. A robust online form library could be a gamechanger for anybody who wants to take care of these situations effectively. US Legal Forms is a market leader in online legal forms, with more than 85,000 state-specific legal forms available to you whenever you want.

With US Legal Forms, you are able to:

- Gain access to state- or county-specific legal and business forms. US Legal Forms covers any needs you could have, from individual to business papers, in one location.

- Utilize innovative tools to accomplish and deal with your Property Buyout Agreement Form With Mortgage

- Gain access to a resource base of articles, tutorials and handbooks and resources relevant to your situation and needs

Save time and effort searching for the papers you need, and use US Legal Forms’ advanced search and Preview feature to get Property Buyout Agreement Form With Mortgage and get it. In case you have a membership, log in for your US Legal Forms account, look for the form, and get it. Review your My Forms tab to find out the papers you previously downloaded as well as to deal with your folders as you see fit.

Should it be the first time with US Legal Forms, make an account and have unrestricted access to all benefits of the library. Listed below are the steps for taking after getting the form you want:

- Validate this is the proper form by previewing it and looking at its information.

- Be sure that the sample is accepted in your state or county.

- Select Buy Now once you are ready.

- Choose a monthly subscription plan.

- Pick the file format you want, and Download, complete, eSign, print out and deliver your papers.

Take advantage of the US Legal Forms online library, backed with 25 years of experience and stability. Change your everyday papers management in to a smooth and intuitive process today.