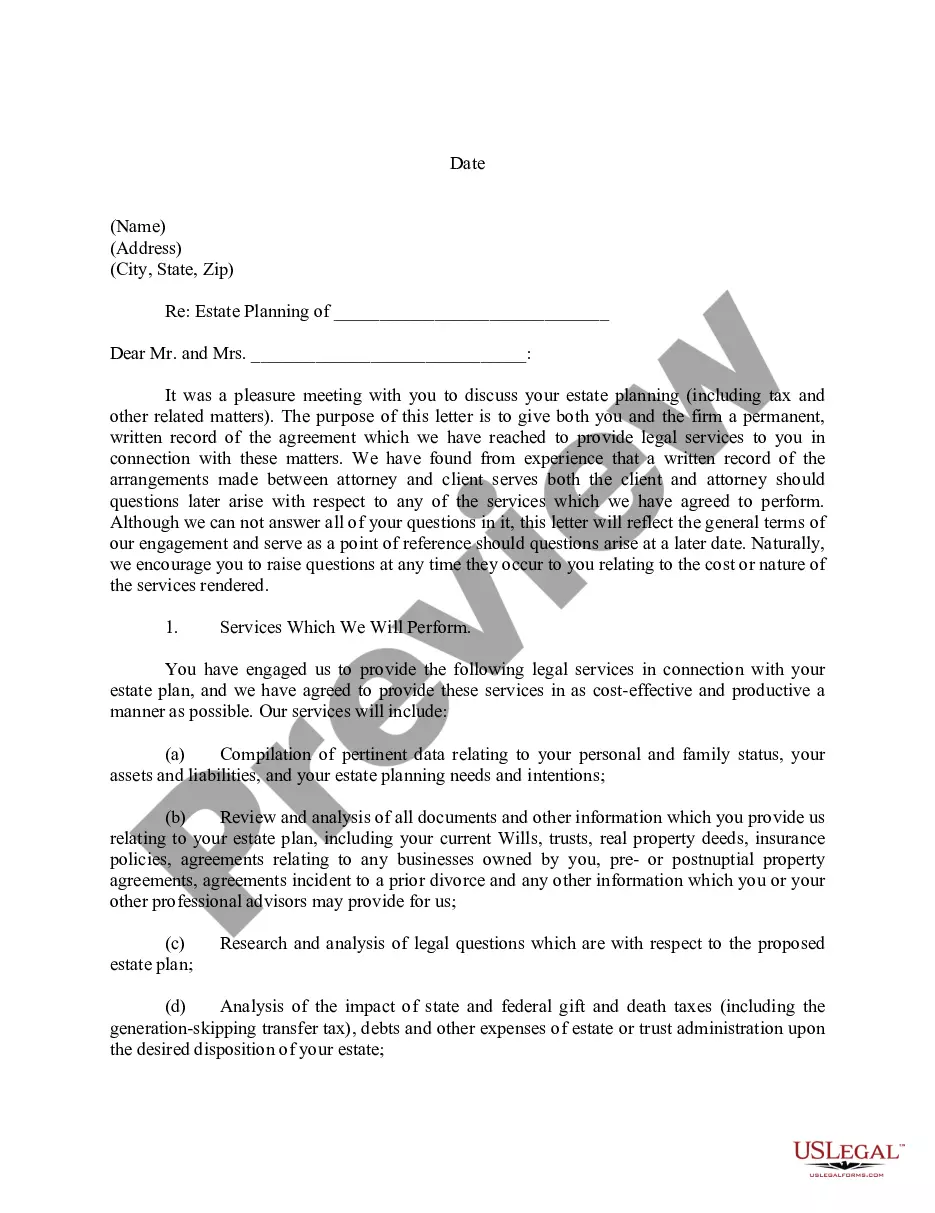

Inheritance Sample Letter To Beneficiary With Distribution

Description

How to fill out Estate And Inheritance Tax Return Engagement Letter - 706?

The Inheritance Sample Letter To Beneficiary With Distribution you see on this page is a reusable formal template drafted by professional lawyers in accordance with federal and state laws. For more than 25 years, US Legal Forms has provided people, organizations, and attorneys with more than 85,000 verified, state-specific forms for any business and personal occasion. It’s the quickest, simplest and most trustworthy way to obtain the documents you need, as the service guarantees the highest level of data security and anti-malware protection.

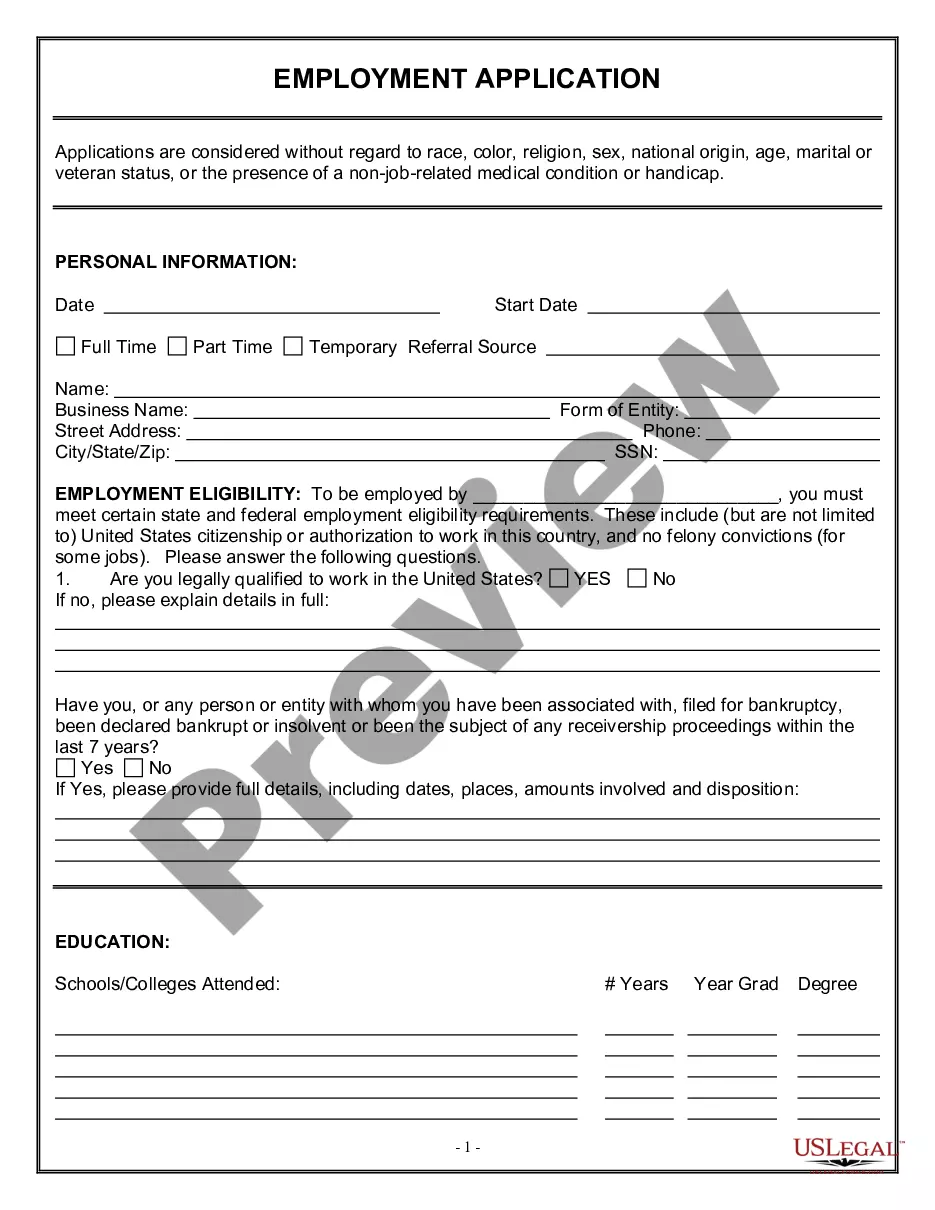

Getting this Inheritance Sample Letter To Beneficiary With Distribution will take you only a few simple steps:

- Browse for the document you need and check it. Look through the sample you searched and preview it or check the form description to verify it suits your requirements. If it does not, make use of the search option to find the correct one. Click Buy Now once you have located the template you need.

- Sign up and log in. Select the pricing plan that suits you and register for an account. Use PayPal or a credit card to make a quick payment. If you already have an account, log in and check your subscription to continue.

- Obtain the fillable template. Choose the format you want for your Inheritance Sample Letter To Beneficiary With Distribution (PDF, DOCX, RTF) and download the sample on your device.

- Fill out and sign the document. Print out the template to complete it manually. Alternatively, utilize an online multi-functional PDF editor to rapidly and precisely fill out and sign your form with a valid.

- Download your paperwork again. Make use of the same document again whenever needed. Open the My Forms tab in your profile to redownload any earlier saved forms.

Sign up for US Legal Forms to have verified legal templates for all of life’s circumstances at your disposal.

Form popularity

FAQ

When writing your letter of instruction, include as much information about your estate and your assets as possible, and provide detailed instruction for how you want any assets not mentioned in your formal will to be dispersed among your heirs. Your letter of intent doesn't supersede the terms of your will.

In terms of content, an Estate distribution letter should include: the deceased's personal details; a detailed and complete list of all assets and liabilities; the Beneficiary names and the details of their respective inheritances; any details on debt settlement and creditor communication;

The grantor can opt to have the beneficiaries receive trust property directly without any restrictions. The trustee can write the beneficiary a check, give them cash, and transfer real estate by drawing up a new deed or selling the house and giving them the proceeds.

How to write a beneficiary letter List important contact information. ... Give specific and clear instructions. ... Address your beneficiary personally. ... Keep multiple copies. ... Check the letter annually and update as needed.

Most assets can be distributed by preparing a new deed, changing the account title, or by giving the person a deed of distribution. For example: To transfer a bank account to a beneficiary, you will need to provide the bank with a death certificate and letters of administration.