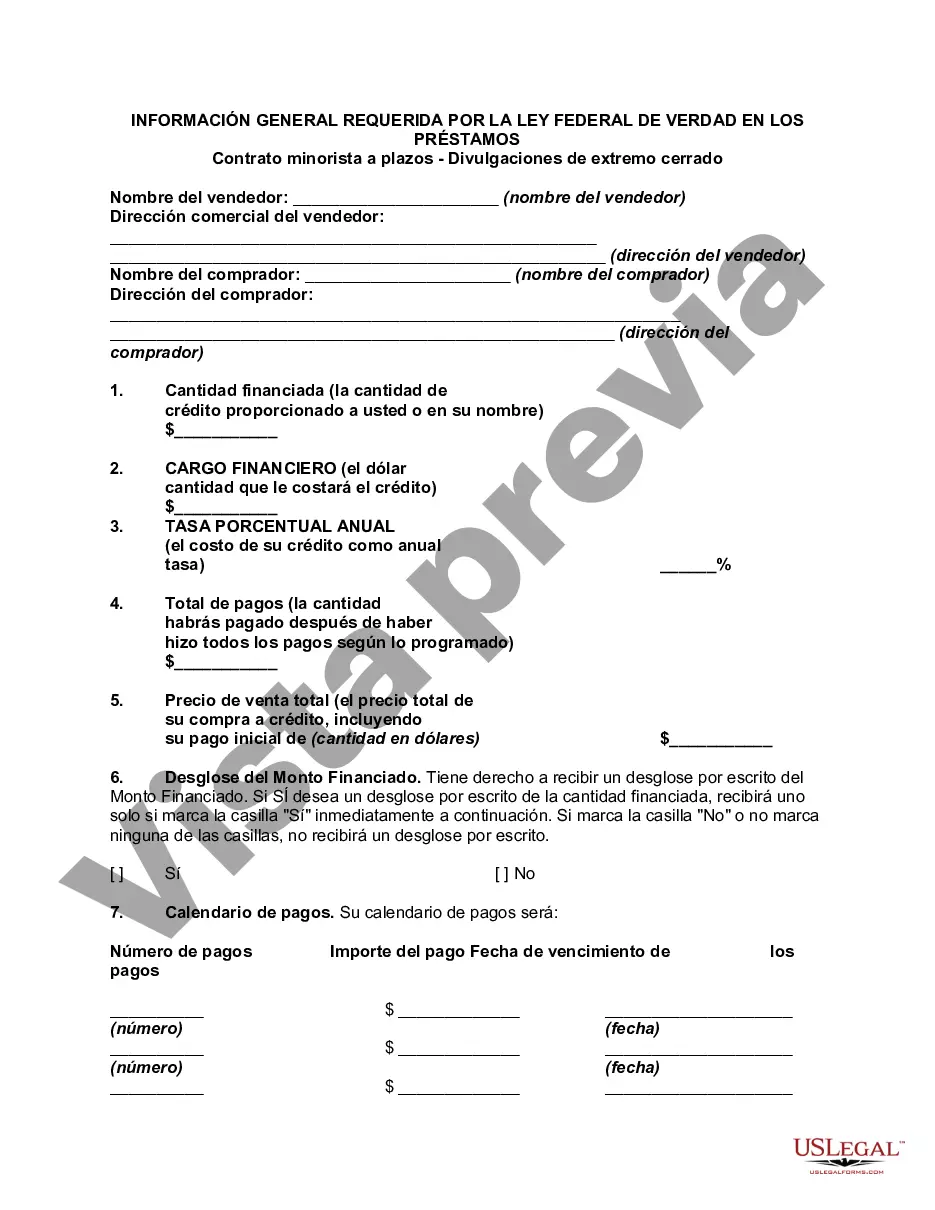

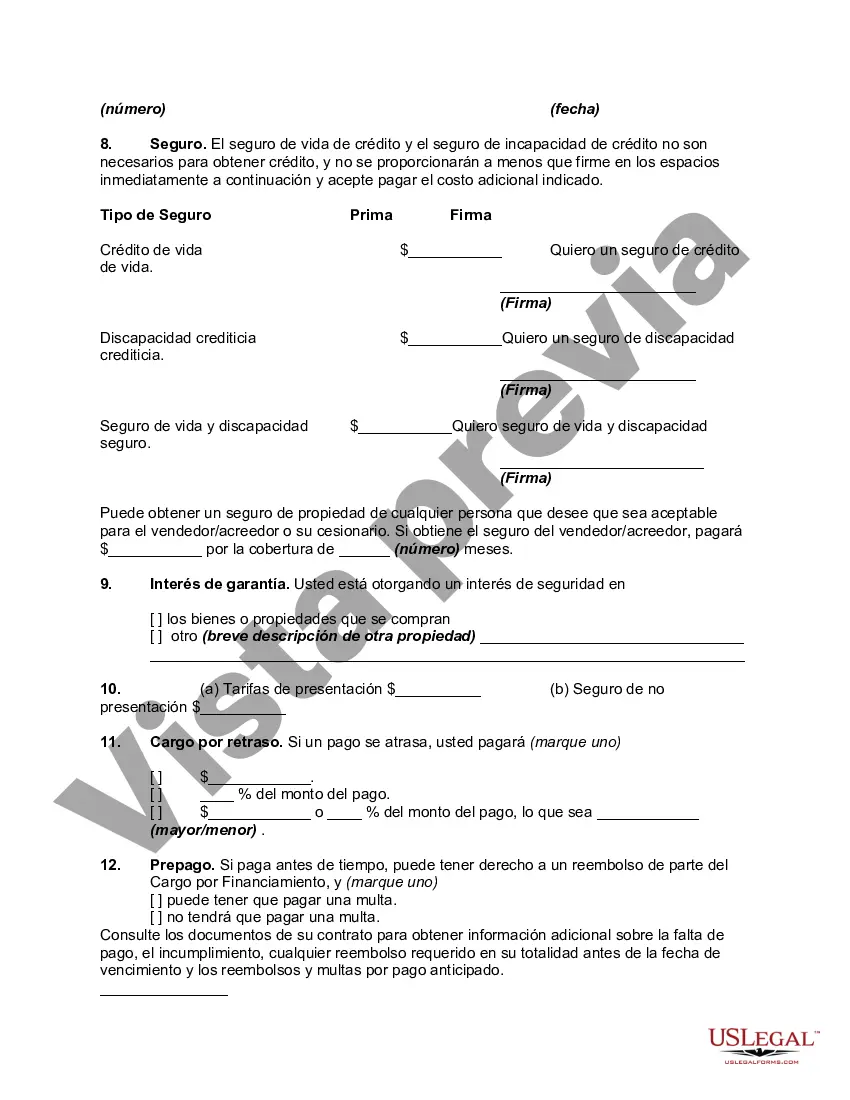

Required Disclosures For Mortgage Loans - General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures

Description

How to fill out Required Disclosures For Mortgage Loans?

People tend to associate legal paperwork with something intricate that only a specialist can deal with. In some way, it's true, as drafting Required Disclosures For Mortgage Loans demands substantial knowledge of subject criteria, including state and county regulations. However, with the US Legal Forms, things have become more accessible: ready-to-use legal forms for any life and business occasion specific to state laws are accumulated in a single online library and are now available for everyone.

US Legal Forms offers more than 85k up-to-date documents arranged by state and field of use, so browsing for Required Disclosures For Mortgage Loans or any other particular sample only takes minutes. Previously registered users with a valid subscription need to log in to their account and click Download to obtain the form. Users that are new to the service will first need to register for an account and subscribe before they can save any paperworkdocumentation.

Here is the step-by-step instruction on how to get the Required Disclosures For Mortgage Loans:

- Check the page content attentively to make sure it satisfies your needs.

- Read the form description or check it through the Preview option.

- Find another sample using the Search field in the header if the previous one doesn't suit you.

- Click Buy Now when you find the correct Required Disclosures For Mortgage Loans.

- Choose a pricing plan that meets your needs and budget.

- Register for an account or sign in to proceed to the payment page.

- Pay for your subscription via PayPal or with your credit card.

- Select the format for your file and click Download.

- Print your document or upload it to an online editor for a quicker fill-out.

All templates in our library are reusable: once purchased, they keep stored in your profile. You can get access to them whenever needed via the My Forms tab. Check all positive aspects of using the US Legal Forms platform. Subscribe now!